Printed on December twentieth, 2024 by Bob Ciura

On the earth of investing, volatility issues. Buyers are reminded of this each time there’s a downturn within the broader market and particular person shares which can be extra risky than others expertise huge swings in worth.

Volatility is a proxy for threat; extra volatility typically means a riskier portfolio. The volatility of a safety or portfolio in opposition to the imply is named normal deviation.

In brief, normal deviation is an investing metric that calculates the magnitude of a safety’s dispersion from its common worth over a given time interval.

Because of this, we imagine normal deviation is a crucial monetary metric that buyers ought to familiarize themselves with, when buying particular person shares.

To that finish, we created an inventory of low volatility shares. The record consists of the 100 lowest normal deviation shares within the S&P 500 Index.

You possibly can obtain a spreadsheet of the 100 low volatility shares (together with different essential monetary metrics like price-to-earnings ratios and dividend yields) by clicking on the hyperlink under:

This text will talk about normal deviation extra totally, and supply a dialogue of the 5 lowest-volatility dividend shares within the Certain Evaluation Analysis Database.

The desk of contents under permits for simple navigation.

Desk of Contents

Commonplace Deviation Overview

Commonplace deviation is a calculation that includes quite a lot of inputs, comparable to a safety’s closing share costs over a given time period, the imply worth over that point, and the variety of knowledge factors within the knowledge set.

Why this issues is as a result of buyers can make the most of normal deviation to get a greater understanding of a safety’s volatility, and subsequently its threat.

Importantly, low or excessive normal deviation measures the scale of the actions a safety may make from its common efficiency.

In a traditional distribution, a inventory’s worth motion ought to fall inside one normal distribution of its imply worth, roughly 68% of the time.

Moreover, the share worth of the safety in query, needs to be inside two normal deviations of the imply, roughly 95% of the time.

To place this into perspective, assume a inventory has a imply worth of $100, and a regular deviation of $10. In a traditional distribution, the inventory in query ought to shut between $80-$120 per share, roughly 95% of the time.

After all, this nonetheless leaves a 5% probability that the inventory will shut outdoors the vary of $80-$120. On this method, buyers typically use normal deviation as a proxy for threat.

The standard knowledge would recommend that low volatility shares ought to under-perform throughout market uptrends and outperform throughout downturns.

The next part discusses the 5 dividend-paying shares within the S&P 500 with the bottom normal deviation of day by day returns over the previous 5 years.

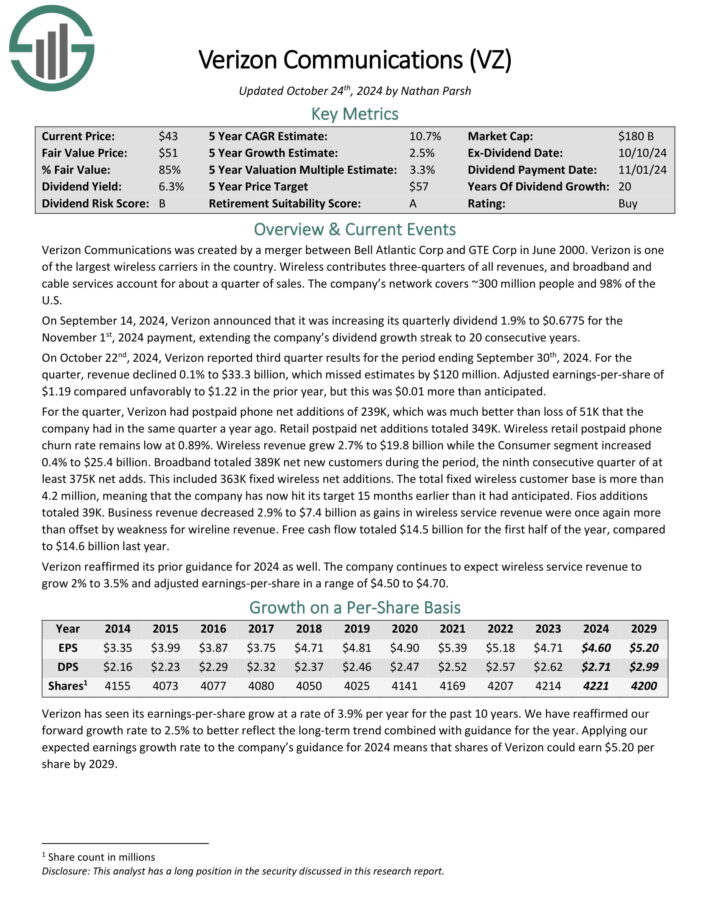

Low Volatility Inventory #5: Verizon Communications (VZ)

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is likely one of the largest wi-fi carriers within the nation.

Wi-fi contributes three-quarters of all revenues, and broadband and cable companies account for a few quarter of gross sales. The corporate’s community covers ~300 million folks and 98% of the U.S.

On October twenty second, 2024, Verizon reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income declined 0.1% to $33.3 billion, which missed estimates by $120 million.

Supply: Investor Presentation

Adjusted earnings-per-share of $1.19 in contrast unfavorably to $1.22 within the prior yr, however this was $0.01 greater than anticipated.

For the quarter, Verizon had postpaid cellphone internet additions of 239K, which was a lot better than lack of 51K that the corporate had in the identical quarter a yr in the past. Retail postpaid internet additions totaled 349K.

Wi-fi retail postpaid cellphone churn fee stays low at 0.89%. Wi-fi income grew 2.7% to $19.8 billion whereas the Client phase elevated 0.4% to $25.4 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on VZ (preview of web page 1 of three proven under):

Low Volatility Inventory #4: Procter & Gamble (PG)

Procter & Gamble is a shopper merchandise large that sells its merchandise in additional than 180 nations and generates roughly $82 billion in annual gross sales.

Its core manufacturers embody Gillette, Tide, Charmin, Crest, Pampers, Febreze, Head & Shoulders, Bounty, Oral-B, and lots of extra.

P&G has slimmed down to simply 65 manufacturers, from 170 beforehand. And these manufacturers have been gaining international market share at a wholesome fee over the previous few years.

Supply: Investor Presentation

In mid-October, Procter & Gamble reported (10/18/24) monetary outcomes for the primary quarter of fiscal 2025. Its gross sales dipped -1% whereas its natural gross sales grew 2% over final yr’s quarter because of 1% worth hikes and 1% quantity development. Core earnings-per-share grew 5%, from $1.83 to $1.93, beating the analysts’ consensus by $0.03.

Administration reaffirmed its steerage for 3%-5% development of natural gross sales and 5%-7% development of earnings-per-share in fiscal 2025.

Click on right here to obtain our most up-to-date Certain Evaluation report on PG (preview of web page 1 of three proven under):

Low Volatility Inventory #3: The Coca-Cola Firm (KO)

Coca-Cola was based in 1892. Right now, it’s the world’s largest non-alcoholic beverage firm. It owns or licenses greater than 500 non-alcoholic drinks, together with each glowing and nonetheless drinks.

Its manufacturers account for about 2 billion servings of drinks worldwide each day, producing greater than $45 billion in annual income.

The glowing beverage portfolio consists of the flagship Coca-Cola model, in addition to different soda manufacturers like Eating regimen Coke, Sprite, Fanta, and extra.

The nonetheless beverage portfolio consists of water, juices, and ready-to-drink teas, comparable to Dasani, Minute Maid, Vitamin Water, and Trustworthy Tea.

Supply: Investor Presentation

Coca-Cola dominates glowing comfortable drinks, however the firm is making an attempt to take care of and even enhance this dominant place with product extensions of present fashionable manufacturers, together with diminished and zero-sugar variations of manufacturers like Sprite and Fanta.

Coca-Cola posted third quarter earnings on October twenty third, 2024, and outcomes had been higher than anticipated on each income and income. The corporate noticed adjusted earnings-per-share of 77 cents, which was two cents higher than estimates.

Income was off fractionally year-over-year to $11.9 billion, however did beat estimates by $290 million. Natural revenues had been up by 9%. That included 10% development in worth and blend, a 2% decline in focus gross sales, and a 1% achieve in case volumes.

Click on right here to obtain our most up-to-date Certain Evaluation report on KO (preview of web page 1 of three proven under):

Low Volatility Inventory #2: Colgate-Palmolive (CL)

Colgate-Palmolive was based in 1806 and has constructed a powerful and intensive portfolio of shopper manufacturers. It operates globally, promoting in most nations all over the world.

About one-sixth of its income comes from Hill’s pet meals division, which has proven very sturdy development in recent times.

The opposite five-sixths of income comes from a mixture of cleansing and private care merchandise, with the corporate’s most recognizable manufacturers being Colgate (tooth care) and Palmolive (cleaning soap).

The corporate has structured itself into 4 items: Oral Care, Private Care, House Care, and Pet Diet.

Supply: Investor presentation

Colgate-Palmolive posted third quarter earnings on October twenty fifth, 2024, and outcomes had been higher than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to 91 cents, which was three cents forward of estimates.

Income was up 2.2% year-over-year to $5.03 billion, which was additionally $20 million forward of expectations. North American natural gross sales, that are about 20% of income, fell 1.9% year-over-year. Latin American natural gross sales had been up 14.2%, and up 10.8% in Africa/Eurasia.

Click on right here to obtain our most up-to-date Certain Evaluation report on CL (preview of web page 1 of three proven under):

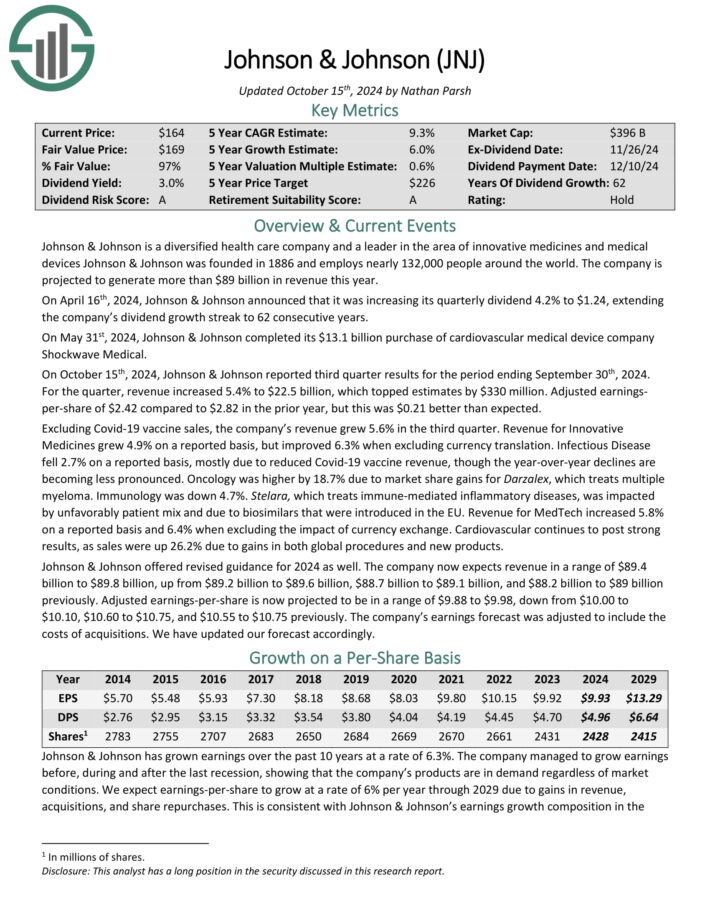

Low Volatility Inventory #1: Johnson & Johnson (JNJ)

Johnson & Johnson was based in 1886 and has reworked into one of many largest firms on this planet. Johnson & Johnson is a mega-cap inventory. The corporate generates annual gross sales above $99 billion.

Johnson & Johnson operates a diversified enterprise mannequin, permitting it to attraction to all kinds of consumers inside the healthcare sector. J&J now operates two segments, prescribed drugs and medical units, after spinning off its shopper well being franchises.

Johnson & Johnson reported third-quarter 2024 gross sales development of 5.2%, reaching $22.5 billion, with operational development of 6.3%.

Supply: Investor Presentation

Nonetheless, earnings per share (EPS) decreased by 34.3%, largely as a consequence of a one-time particular cost and purchased in-process analysis and growth (IPR&D).

Adjusted EPS fell 9.0% to $2.42, pushed by the identical IPR&D impression. The corporate made vital developments, together with approvals for remedies like TREMFYA and RYBREVANT, and the submission of a brand new common surgical procedure robotic system, OTTAVA.

Click on right here to obtain our most up-to-date Certain Evaluation report on JNJ (preview of web page 1 of three proven under):

Ultimate Ideas

Buyers ought to take threat into consideration when buying particular person shares. In spite of everything, if two securities are in any other case related by way of anticipated returns however one affords a decrease normal deviation, the investor would doubtless see stronger returns from the low volatility inventory.

Commonplace deviation can assist buyers decide which securities will produce better deviation from the market common.

The 5 shares within the article not solely have low normal deviation, however additionally they provide enticing dividend yields and whole anticipated returns.

The next databases of dividend development shares may additionally be helpful for earnings buyers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.