Finchat is an funding analysis startup incorporating Massive Language Fashions (assume ChatGPT) into its platform.

This functionality lets you work together with tons of of hundreds of knowledge factors and efficiency metrics throughout hundreds of firms worldwide.

Along with this, additionally they have tons of options for monetary modeling, inventory screening, and evaluation, however with all these instruments, is the platform value your time, or is it simply advertising and marketing hype?

That’s what you could find out under.

Contents

This platform is totally web-based, as is regular now with cloud software program.

It’s extremely straightforward to make use of and navigate, and even the free plan offers you entry to a very powerful companies and instruments.

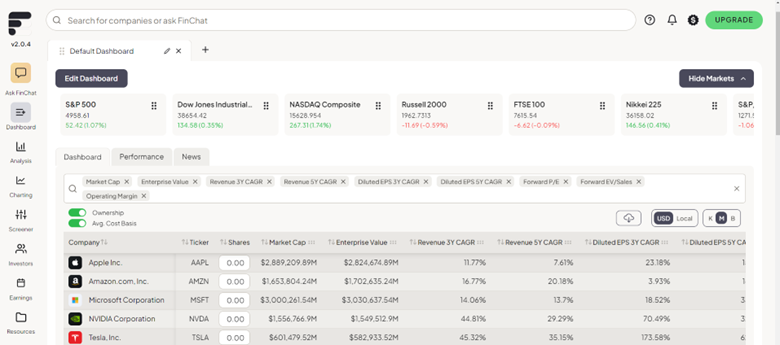

Whenever you open the app for the primary time, it drops you onto a customizable dashboard displaying you details about your favourite traded firms.

One of many paid instruments is integration together with your dealer (if supported), so you possibly can handle your complete portfolio from this dashboard display screen.

The subsequent part is the evaluation part, and that is the place a variety of the magic presently occurs.

In case you can consider a metric, they most likely have it right here.

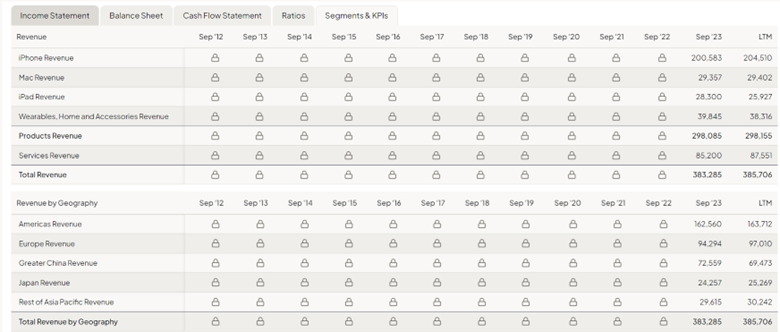

You may have a look at the monetary statements, ratios, filings, possession and dividend metrics, and lots of different Efficiency Indicators.

The screenshot under is one instance of Apple Inventory, the place you possibly can see the breakdown by market section all specified by entrance of you.

For the free model, you might be restricted to the latest quarter, however extra on what every model permits you under.

One of many extra spectacular areas on this tab is the Modeling desk.

This reveals you the current, previous, and future monetary knowledge, nevertheless it additionally enables you to change key metrics like the price of debt, income projections, and market danger premium to see how the numbers will change in real-time.

This fully removes the necessity for lots of handbook forecasting and using Excel for monetary modeling.

Lastly, you are able to do business comparisons from this part as effectively.

Let’s say you need to see how Microsoft matched in opposition to its friends.

You may view the entire knowledge right here.

This system routinely selects what it views as business friends, however if you wish to add or topic firms, you might be free to take action.

This makes business analysis a breeze as all the pieces is interactive.

The charting tab is subsequent on the menu, which fits past regular value charting.

This tab enables you to visualize tons of of metrics and ratios throughout their universe of shares.

You can too chart a number of firms directly so you possibly can visually examine the metrics between them.

You can too plot a number of metrics for single firms, permitting you to create your personal dashboard for firm analysis.

Lastly, you possibly can alter the time scale of the info so you possibly can examine it on a timeframe you need to have a look at, be it quarterly or yearly.

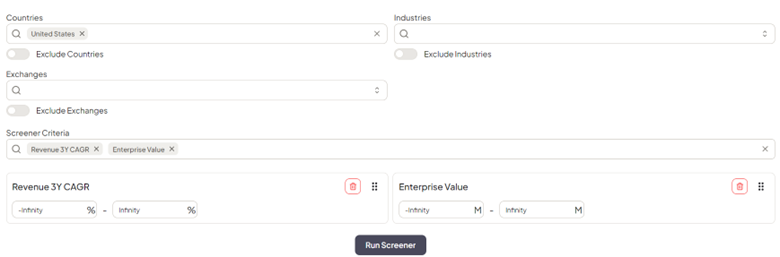

The screener is one other glorious instrument created on the FinChat platform.

You may slender your inventory scans utilizing nearly any conceivable metric and filter it by alternate, nation, sector, and extra.

What units this aside from different extra primary inventory screeners is its interface.

As a substitute of choosing pre-set scans or dropdown bins, Finchat lets you simply sort in what you might be on the lookout for, and it’ll populate the closest metric it has.

You may proceed drilling by setting higher and decrease limits on any chosen metric.

These are technically two separate sections, however I’m grouping them merely.

First up is the Traders tab; right here, you possibly can choose a fund or investor and see how they’re investing, which firms they’re in, primary stats of the fund, and any filings they’ve on report.

That is an extremely highly effective instrument in the event you plan to commerce with any of those bigger funds.

In the identical part, additionally they have Hedge Fund Letters.

This assortment of the entire Fund letters as they’re obtainable will permit an investor perception into what a few of these funds are .

Whereas they seldom comprise analysis, you possibly can typically get a really feel for a way they view the economic system, what they’re planning for, and any massive funding thesis they’ve.

Lastly, there’s the earnings tab, which is simply a regular earnings calendar.

You may view by date or seek for a particular firm.

This can then allow you to view estimates for the completely different metrics.

The perfect was undoubtedly saved for final on this evaluate, and that’s the Ask FInchat characteristic.

Set as much as look similar to the ChatGPT interface; this lets you ask questions instantly about Finchat’s knowledge.

This interplay is what units this platform aside from others within the analysis area.

You may ask for particular metrics or bigger firm overviews, and the mannequin will discover the reply and show it for you.

It can additionally present you any associated graphics, create graphs, and present the way it compares to earlier knowledge. It tries to “assume” forward and present you a whole knowledge set for what you is perhaps on the lookout for.

You can too add your PDF paperwork and add them to the dataset the mannequin searches for you.

That is principally coaching the mannequin by yourself dataset; one thing that used to require particular data can now be completed just by importing a PDF.

Entry 9 Free Choice Books

So, now that you’ve seen the entire energy this platform provides, let’s speak about what it prices.

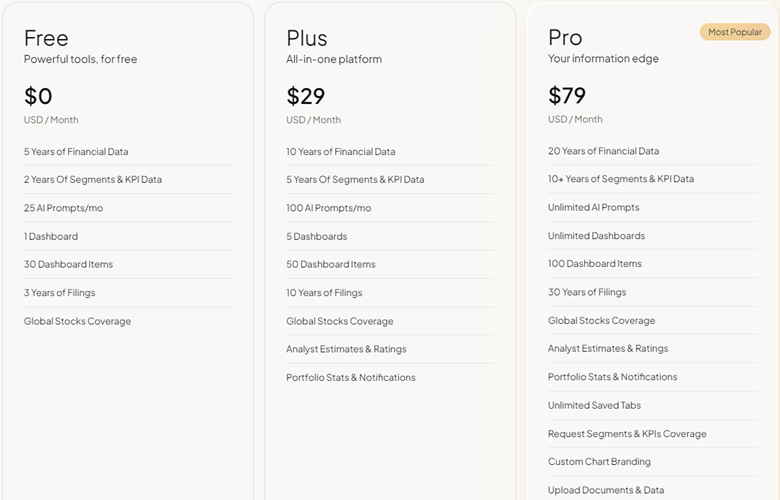

There are three completely different pricing ranges: Free, Plus, and Professional.

The free model offers restricted entry to the Ask FInChat AI, historic knowledge, monetary modeling, and different toolsets.

The Plus, obtainable for $29/month, contains the identical options with extra historic knowledge, analyst estimates, and portfolio info.

Lastly, the Professional is $79/month and comprises the entire earlier options plus considerably extra historic knowledge, much less restricted use of the FinChat AI, and extra customization and branding of charts.

It additionally lets you save layouts and make particular requests for Metrics to be added to the dashboard. For full particulars of the variations, see the picture under.

Having checked out the entire info and potentialities of the Finchat.io platform and the pricing, the query now turns into, is it value it?

For this specific platform, the reply is sure, no matter your investing fashion.

They provide a free model with loads of energy for the informal or retail investor, supplying you with entry to greater than sufficient knowledge on your analysis.

In case you are a severe investor or require extra superior analysis and longer knowledge units, this platform continues to be value $29 or $79 per 30 days, relying in your finances.

The FInchat AI actually makes this a super-powered platform, and with the free tier obtainable, there is no such thing as a motive not to enroll and take a look at it out for your self.

We hope you loved this text on Finchat.io.

You probably have any questions, please ship an e mail or go away a remark under.

Commerce protected!

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for traders who usually are not aware of alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.