Contents

The YieldMax ETFs makes use of an artificial coated name choices technique to generate earnings from underlying equities symbols.

For instance, the YieldMax ETF with the ticker image MSFO is predicated on the underlying asset of Microsoft inventory (MSFT).

Equally, for the next YieldMax EFTs:

ABNY – underlying inventory ABNB (Airbnb)

AMDY – underlying inventory AMD (Superior Micro Units)

MRNY – underlying inventory MRNA (Moderna)

PYPY – underlying inventory PYPL (Paypal)

DISO – underlying inventory DIS (Disney)

JPMO – underlying inventory JPM (JP Morgan)

XOMO – underlying inventory XOM (Exxon Mobil)

TSLY – underlying inventory TSLA (Tesla)

OARK – underlying inventory ARKK (ARK Innovation ETF)

APLY – underlying inventory AAPL (Apple)

NVDY – underlying inventory NVDA (Nvidia)

AMZY – underlying inventory AMZN (Amazon)

GOOY – underlying inventory GOOGL (Alphabet)

NFLY – underlying inventory NFLX (Netflix)

And plenty of extra. You’ll be able to see the total checklist at yieldmaxetfs.com

An artificial coated name is a coated name on an artificial inventory place.

An artificial inventory place is constructed by promoting an at-the-money put and shopping for an at-the-money name.

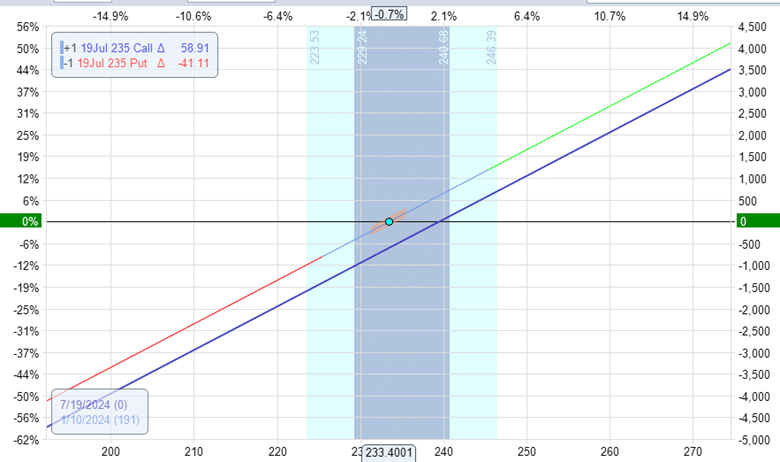

Let’s assemble a hypothetical place in OptionNet Explorer as a way to see what the revenue/loss graph appears to be like like.

Date: January 10, 2024

Worth: TSLA at $233

Promote one July 19, 2024, TSLA 235 put @ $29.08Buy one July 19, 2024 TSLA 235 name @ $33.60

Debit: -$453

This creates the artificial inventory place:

The T+0 line just isn’t precisely on the expiration graph.

It is because this place has detrimental theta time decay.

If the inventory didn’t transfer, the place would lose cash at expiration.

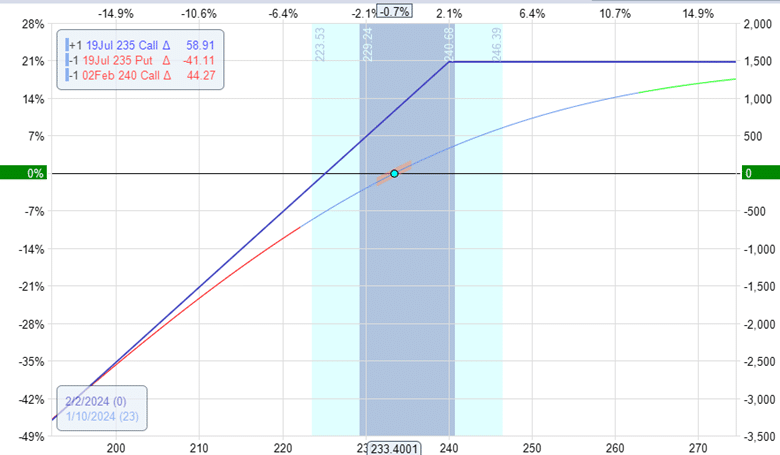

The YieldMax ETF would apply a shorter-term name possibility on this technique…

Promote one February 2, 2024 TSLA 240 name @ $8.95

Credit score: $895

The mixed graph of the artificial coated name will appear like:

The upside is capped.

However the draw back danger is limitless.

In fact, I’d assume that the fund supervisor will apply obligatory danger administration to forestall that from taking place.

Nonetheless, there can be drawbacks to this technique.

You’ll be able to see the efficiency of their numerous funds on the web site.

When you learn their prospectus, you’ll find particulars of the technique.

Their artificial inventory positions have expiration six months to a 12 months out with the strikes of the decision and put possibility near-the-money.

They promote coated calls 0 to fifteen% out-of-the-money with a short-term expiration of 1 month or much less.

Their major goal is to generate month-to-month earnings.

Their secondary goal is to realize publicity to the underlying inventory worth appreciation.

The technique doesn’t contain proudly owning the underlying shares of inventory. Therefore, you don’t get dividends.

Nevertheless, the artificial inventory place makes use of much less capital than a typical buy-and-hold inventory place, so the additional capital is invested in risk-free US.

Treasury Payments.

Can there be an ETF of an ETF?

Sure. An instance is the OARK YieldMax ETF, which is predicated on the ARKK ETF.

Are YieldMax ETFs a good suggestion?

I like to recommend studying the 100+ web page prospectus that’s publicly obtainable on their web site to find out if these exchange-traded funds are best for you.

I can’t reply that query.

That’s like asking a physician, “Are statins good for me?”

To some folks, sure. To different folks, no – relying on their specific well being situation.

Any monetary technique or car might be good for one particular person and never for an additional, relying on their monetary state of affairs, danger tolerance, and funding goal.

These are questions extra fitted to a monetary advisor.

I’m not a monetary advisor and can’t present particular person monetary recommendation.

Can I implement an artificial coated name technique by myself?

Maybe. It depends upon your stage of expertise with choices.

There are nuances to the technique that must be managed correctly.

How the place is managed makes a giant distinction in whether or not the technique is worthwhile.

For instance,

How far out of the cash to promote the decision?

What’s the worth technical sample figuring out the timing to enter and exit?

When do you have to exit the commerce if the commerce is dropping cash?

When to exit and roll the place?

Or maintain to expiration?

In any case, it’s higher to paper commerce it first earlier than attempting to commerce an artificial coated name reside.

Entry 9 Free Choice Books

ETFs are very fashionable as a result of you should purchase and promote shares of ETFs identical to shares of inventory.

At the moment, we seemed on the YieldMax ETFs, which use an artificial coated name choices technique to generate earnings.

We now have ETFs on nearly the whole lot.

We hope you loved this text on the YieldMax ETFs.

When you’ve got any questions, please ship an electronic mail or depart a remark beneath.

Commerce secure!

Disclaimer: The data above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for traders who should not accustomed to change traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.