ryasick

JPMorgan has been a beast with their exchange-traded fund, or ETF, choices, and one of many extra widespread ones designed for traders wanting low volatility earnings is the JPMorgan Extremely-Quick Revenue ETF (NYSEARCA:JPST). This actively managed exchange-traded fund strives to ship earnings whereas sustaining a low volatility of principal, with a beautiful yield in step with most taxable-bond funds. It’s an particularly great tool for traders centered on earnings, reminiscent of retirees, who search stability to assist mitigate the impression of market gyrations on their portfolio withdrawals.

JPST does this with restricted sensitivity to modifications in rates of interest by investing at the very least 80% of its property in a diversified portfolio of short-term, investment-grade company and structured debt securities. The fund is overseen by a group of portfolio managers on the World Fastened Revenue, Forex and Commodities group at J.P. Morgan Asset Administration. The fund’s emphasis on short-term securities signifies that the consequences on the portfolio of rate of interest modifications will probably be minimized.

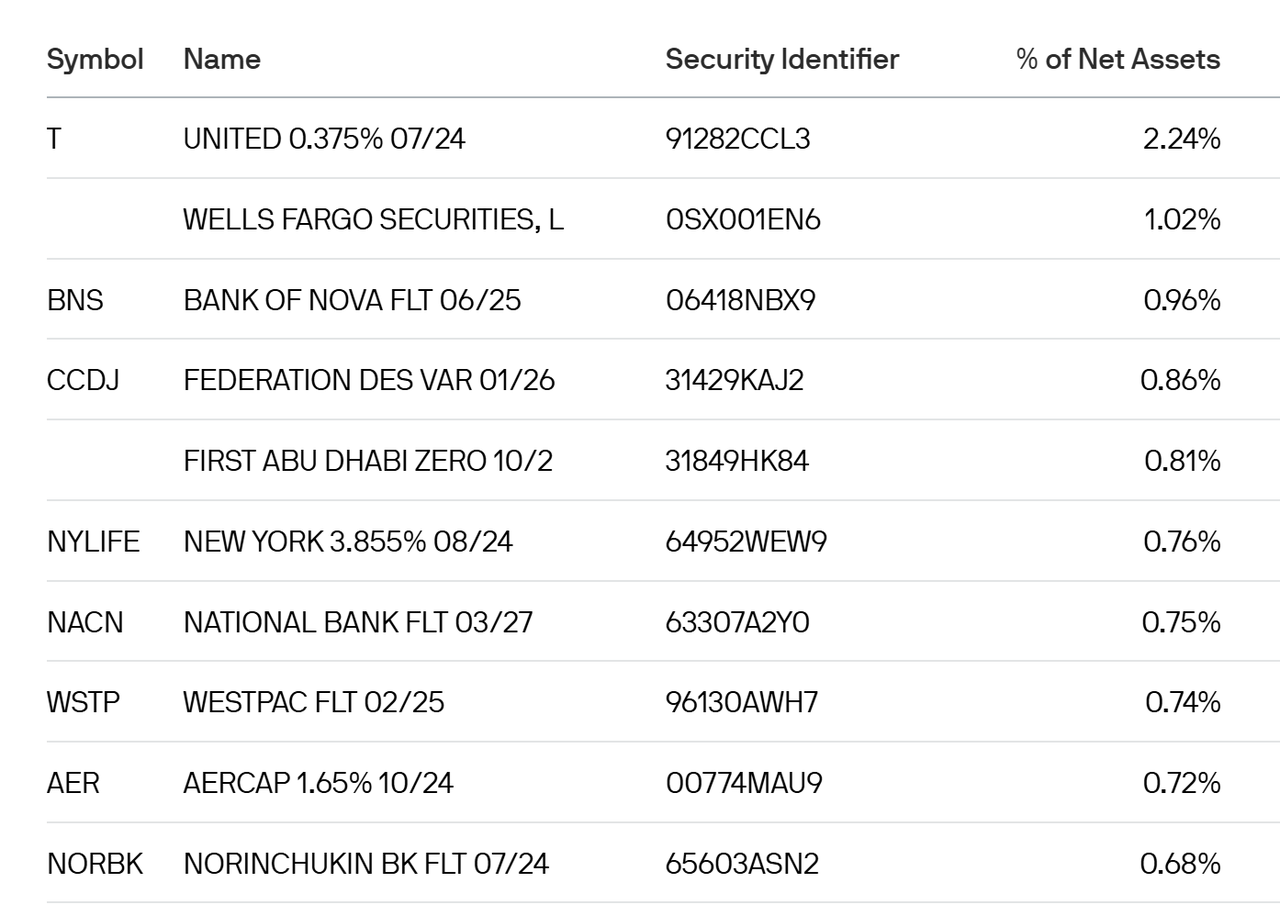

A Look At The Holdings

JPST’s portfolio may be very diversified, investing in a number of sorts of totally different fixed-income devices.

jpmorgan.com

The bulk are funding grade company bonds. These are debt securities issued by companies with a excessive credit standing, reducing the likelihood of default. These investment-grade company bonds, usually pay a better fee of curiosity than authorities bonds whereas sustaining decrease general threat.

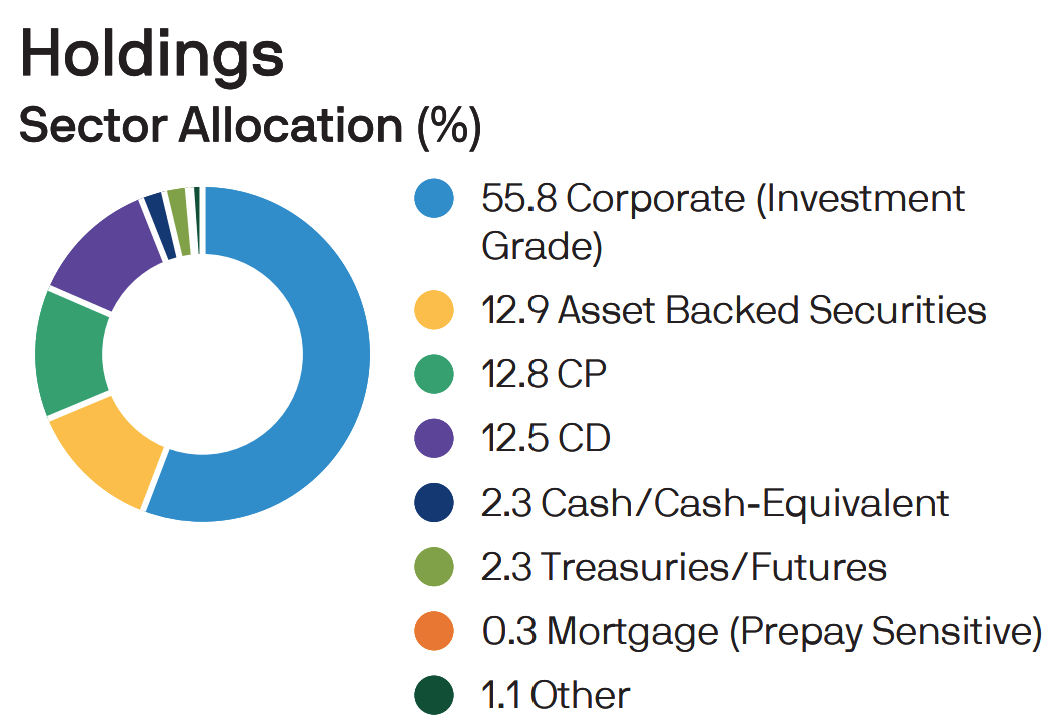

jpmorgan.com

The Asset-Backed Securities within the fund are a type of fixed-income safety backed by a pool of underlying property, together with a group of auto loans, bank card receivables or pupil loans. They’ve roughly the identical weight because the Industrial Paper allocation at 12.8%. Industrial paper consists of short-term unsecured promissory notes issued by companies to fund their short-term liquidity wants. The one different main allocation is nice old style Certificates of Deposits, that are a type of time deposit {that a} financial institution or credit score union will subject, which pays a predetermined fastened fee of return over a set time period.

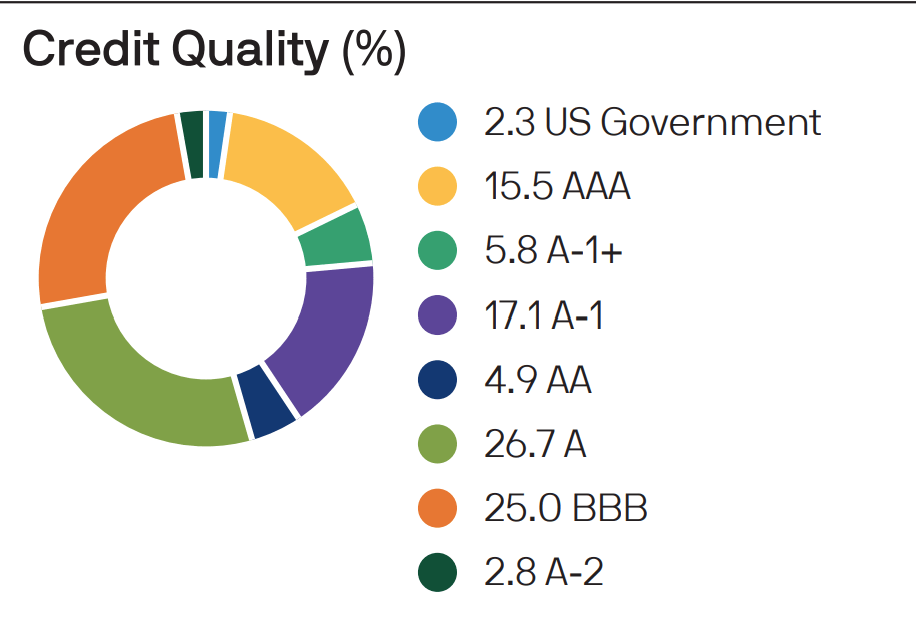

The 690+ holdings are all prime quality with minimal threat, leading to a portfolio that has a length of simply 0.51.

jpmorgan.com

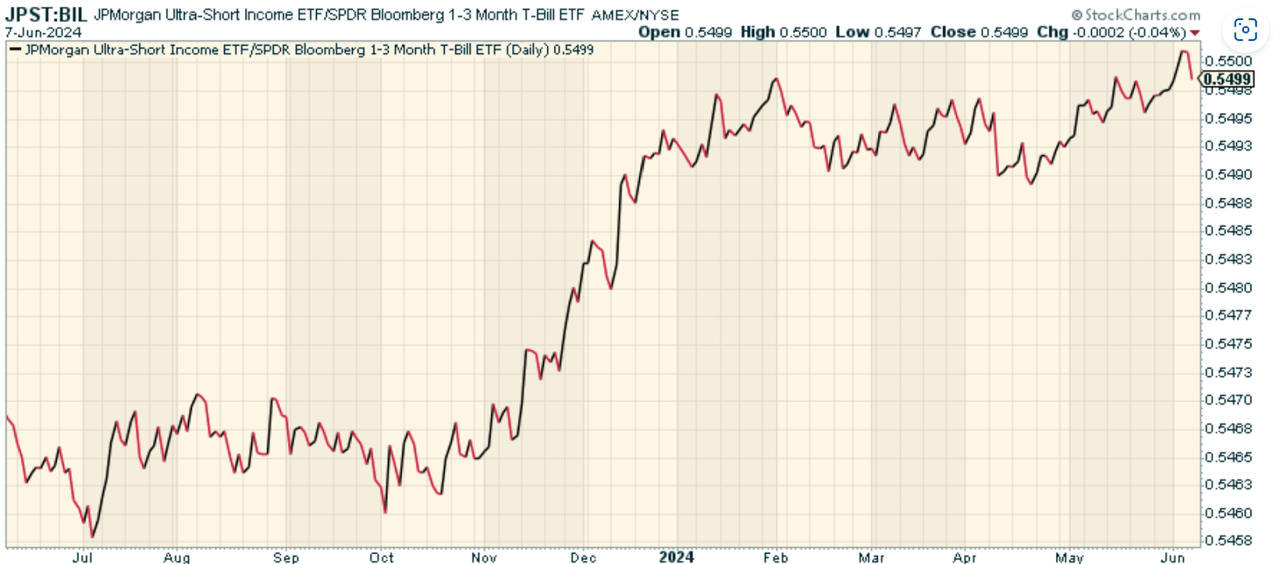

Peer Comparability

Although JPST’s pitch is tough to withstand, different contenders within the ultra-short-term earnings class deserve a glance. One price evaluating it towards is the SPDR® Bloomberg 1-3 Month T-Invoice ETF (BIL). This ETF solely buys US Treasury payments, so it technically has much less threat than JPST (which is negligible). After we have a look at the value ratio of the 2, we discover that JPST has outperformed, significantly in November and December of final 12 months. I want JPST simply given the marginally larger yield profile towards a pleasant diversified combine.

stockcharts.com

Professionals and Cons

On the plus facet? JPST is simple to grasp and has offered respectable returns. It’s low-cost for a fund at simply 0.18%, and is a good money various with out an excessive amount of in danger. The short-term focus helps insulate the fund from rate of interest actions. That, mixed with the lively administration, helps mitigate threat if, for instance, the portfolio managers really feel there’s a have to tactically shift based mostly on altering market circumstances.

On the draw back? For those who’re on the lookout for knockout returns, you gained’t get it with a fund like this. It additionally does have some credit score threat, although it’s clearly minimal. And whereas the short-duration is a optimistic, if the Fed does lower charges, this could not meaningfully profit.

Conclusion

Total, JPMorgan Extremely-Quick Revenue ETF seems to be like an important fund. It clearly has gotten a ton of consideration amongst allocators with over $23 billion in property beneath administration, and a robust yield 30-Day SEC Yield at 5.37%. Does it stand out, although, amongst loads of different funds taking part in in the identical house? I am not so positive. The efficiency metrics are all there, and it is part of the fastened earnings house that’s best to seize by a fund like this, however there are additionally loads of different short-duration bond funds on the market with comparable yield. Total, although, in case you’re a conservative investor or simply have further money and don’t know what to do with it, JPST is price contemplating.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you uninterested in being a passive investor and able to take management of your monetary future? Introducing The Lead-Lag Report, an award-winning analysis instrument designed to offer you a aggressive edge.

The Lead-Lag Report is your every day supply for figuring out threat triggers, uncovering excessive yield concepts, and gaining worthwhile macro observations. Keep forward of the sport with essential insights into leaders, laggards, and the whole lot in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report as we speak.

Click on right here to realize entry and check out the Lead-Lag Report FREE for 14 days.