A “ratio diagonal” is sort of a diagonal choice unfold, besides that the variety of quick and lengthy choices is unequal.

This can make extra sense once we first take a look at a typical diagonal instance on SPY, the S&P 500 ETF.

Afterwards, we’ll take a look at the ratio diagonal.

Contents

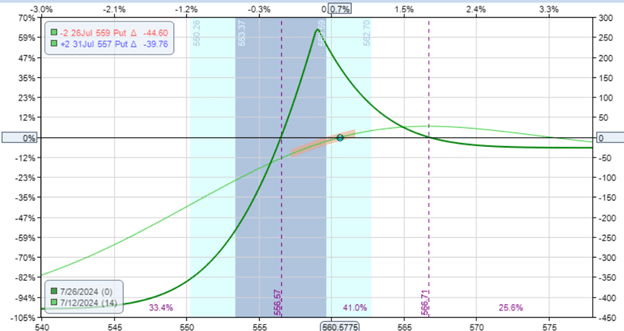

Here’s a typical bullish put diagonal:

Date: July 12, 2024

Worth: SPY @ $560.57

Promote two July 26 SPY $559 put @ $2.91Buy two July 31 SPY $557 put @ $3.05

Web debit: -$27

We’re promoting two contracts, and we’re shopping for two contracts at completely different expirations.

Just like the calendar, the diagonal has the lengthy choices (the choices we purchase) at a later expiration than the quick choices (the choices we promote).

It is a typical diagonal unfold as a result of the variety of choices we purchase is identical because the variety of choices we promote (on this case, it’s two contracts).

This equal variety of lengthy and quick choices makes the commerce a defined-risk commerce.

You’ll be able to see from the expiration threat graph that the dangers taper off to a most lack of about $425 as the value of SPY drops.

The unfold is bullish as a result of the quick choices are nearer to the cash than the lengthy ones, with some constructive deltas.

Listed below are the Greeks:

Delta: 9.79Theta: 2.60Vega: 11.21

Just like the calendar, the diagonal has constructive theta and is constructive vega.

Constructive theta signifies that the unfold will increase in worth as time passes, assuming all different components stay unchanged.

Constructive vega signifies that the commerce, in concept, ought to profit when implied volatility will increase.

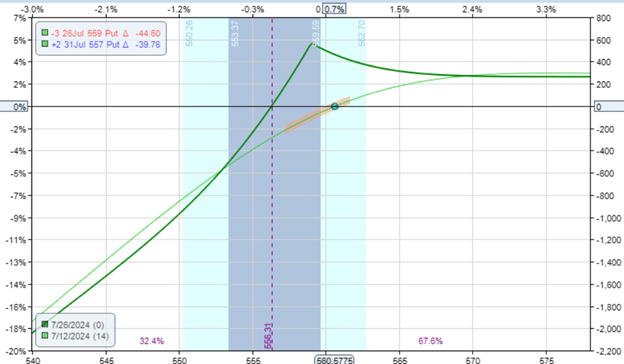

The ratio diagonal is predicated on the diagonal, besides now we have an additional quick contract.

Date: July 12, 2024

Worth: SPY @ $560.57

Promote three July 26 SPY $559 put @ $2.91Buy two July 31 SPY $557 put @ $3.05

Web Credit score: $264

We now have a internet general credit score due to the additional quick contract we’re promoting.

You’ll be able to inform from the expiration graph that by promoting an additional put choice, the commerce is made much more bullish:

Lined Name Calculator Obtain

Whereas the standard diagonal is a defined-risk commerce, this ratio diagonal with the additional quick put makes the commerce an undefined-risk commerce.

It is because there are fewer variety of lengthy choices to cowl the variety of quick choices. There may be one further uncovered short-put choice.

If the account has sufficient money to purchase 100 shares of SPY, if the quick put is assigned at expiration, it might be thought of a “cash-secured put.”

The dealer, if assigned, can resolve to carry these shares and convert the commerce to the Wheel Technique.

Trying on the Greeks, we see this unfold is rather more bullish with 54 deltas.

Delta: 54.36Theta: 16.40Vega: -31.92

Promoting extra choices signifies that it has much more theta.

The unfold is internet quick choices.

Therefore, its vega is adverse.

Brief choices have adverse vegas.

And lengthy choices have constructive vegas.

The Greeks and the present time revenue line have traits just like that of a bull put credit score unfold.

This commerce would behave equally to that of a credit score unfold.

The one distinction is {that a} credit score unfold is an outlined threat commerce, and that is an undefined threat commerce.

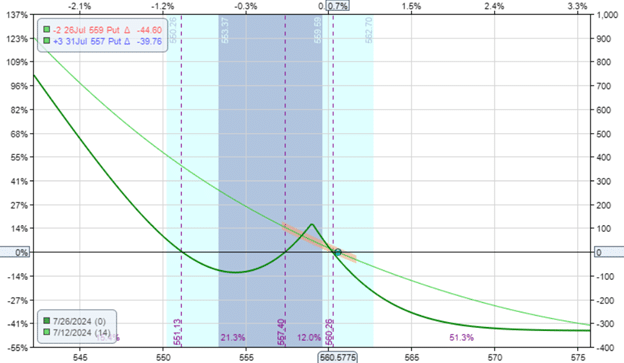

It’s doable to have a ratio diagonal with extra lengthy choices than quick choices, akin to:

Date: July 12, 2024

Worth: SPY @ $560.57

Promote two July 26 SPY $559 put @ $2.91Buy three July 31 SPY $557 put @ $3.05

Web debit: -$332

As a result of we’re shopping for greater than we’re promoting, we pay a internet debit.

This additionally makes it a defined-risk commerce, with the max threat being the debit paid.

We see that this commerce is in a totally completely different course.

As constructed, it’s a bearish commerce with adverse deltas:

Delta: -30Theta: -9.91Vega: 60

It additionally has a adverse theta, which suggests it loses cash as time passes (just like a protracted choice).

As a result of it has extra lengthy places than quick places, the general commerce would have traits of lengthy choices.

The ratio diagonal has an unequal variety of quick and lengthy choices.

Right here, we used the ratio of two by three.

Some ratio diagonal makes use of the ratio of 1 to 2.

We don’t see the ratio diagonal unfold getting used that usually.

That is seemingly as a result of the traits of the ratio diagonal can usually be achieved extra just by utilizing different spreads.

However, it’s at all times attention-grabbing to discover new choice constructions.

We hope you loved this text about ratio diagonal spreads.

In case you have any questions, please ship an e-mail or go away a remark under.

Commerce secure!

Disclaimer: The data above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for traders who aren’t acquainted with trade traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.