Scott Olson

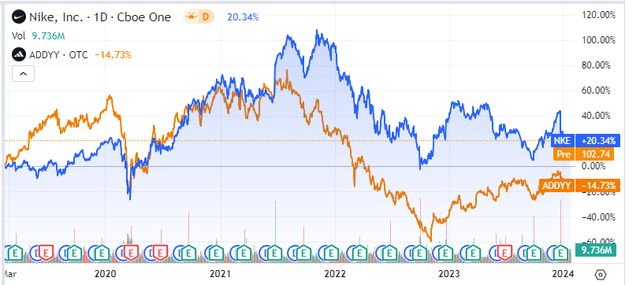

I’ve a previous with adidas (OTCQX:ADDYY) (OTCQX:ADDDF). Again in 2015, I wrote about adidas as a result of the underperformance relative to Nike (NKE) had caught my eye. Right here is the chart from that evaluation.

Google Finance

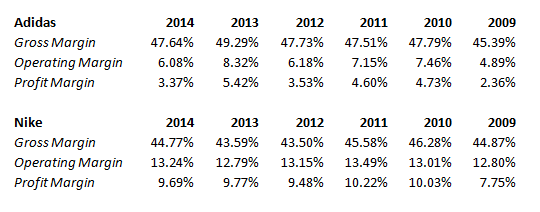

This development was not solely a deviation from its historic averages but additionally reflective of broader market dynamics.

Creator’s computations

A essential issue on this underperformance was the geopolitical stress arising from the Crimea invasion. My speculation posited that the market had preemptively factored within the efficiency dip, anticipating a restoration and eventual market reassessment in favor of adidas. This prediction materialized, resulting in a strategic exit from my adidas place following the onset of the second Ukraine invasion in 2022, a call knowledgeable by the market’s earlier response to comparable geopolitical occasions.

At the moment, a assessment suggests a possible repetition of this sample, albeit compounded by extra challenges, such because the Yeezi collaboration’s shortcomings. This example warrants a nuanced examination of adidas.

Searching for Alpha

Current outcomes

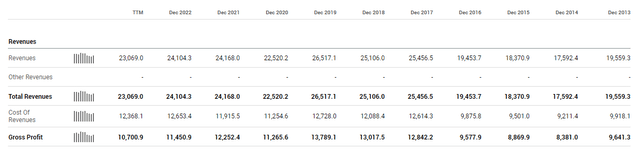

adidas’ monetary efficiency in 2023 introduced a blended but cautiously optimistic image. The corporate’s currency-neutral revenues remained secure year-over-year, outperforming its preliminary projections of a slight decline. This stability is commendable, given the myriad challenges Adidas confronted, together with the termination of the Yeezy line, which was anticipated to negatively influence income. In reported phrases, nonetheless, gross sales noticed a 5% lower to €21,427 million (USD 23,355 million) from €22,511 million (USD 24,537 million) in 2022, illustrating the tangible influence of those challenges.

The discontinuation of the Yeezy partnership was a big drag on Adidas’ income, estimated at round €500 million (USD 545 million). Nonetheless, the discharge of two Yeezy merchandise in 2023 partially offset this loss, contributing €750 million (USD 817 million) to internet gross sales, albeit decrease than the €1,200 million (USD 1,308 million) generated in 2022. Excluding the fluctuating Yeezy revenues, Adidas’ core enterprise exhibited resilience, with a 2% development in currency-neutral revenues, underscoring the underlying energy and flexibility of the model.

Gross margin efficiency barely improved by 0.2 proportion factors to 47.5% in 2023, a testomony to adidas’ strategic price administration and pricing mechanisms, particularly noteworthy amidst substantial foreign money volatility. Working revenue, although considerably diminished to €268 million (USD 292 million) from €669 million (USD 729 million) in 2022, surpassed expectations by avoiding the forecasted working loss, attributed to a sturdy This fall efficiency and a strategic shift in dealing with the Yeezy stock. Opposite to the anticipated write-off of roughly €300 million (USD 327 million), the precise determine was markedly decrease, within the low double-digit million vary. This choice not solely mitigated the monetary influence but additionally laid the groundwork for probably recuperating worth from the Yeezy inventory in 2024 by promoting these merchandise a minimum of at price.

Issues and challenges

The current management transition inside adidas’ North American enterprise, marked by the resignation of the President on the finish of October and the next appointment of a Board member as an interim chief, signifies a essential juncture for the corporate. This variation comes amidst important operational challenges within the American market, notably the difficulty of elevated stock ranges. Each retail and adidas’s personal inventory have been affected, exerting a pronounced destructive influence on gross sales and revenue margins.

A substantial portion of those difficulties may be attributed to the fallout from the Yeezy model discontinuation. The termination of this partnership with Kanye West has not solely led to a substantial income shortfall, but additionally contributed to the stock challenges. The Yeezy line, as soon as a significant income driver for adidas, has left a void that the corporate now struggles to fill, exacerbating present market challenges.

This management change, due to this fact, is just not merely a personnel adjustment however a strategic pivot at a time when adidas wants to deal with and mitigate the compounded results of stock mismanagement and the lack of a high-profile collaboration. The brand new management’s capacity to navigate these points will probably be pivotal in stabilizing adidas’s North American operations and setting a course for restoration. The state of affairs underscores the need for a sturdy technique to handle stock ranges successfully and to seek out new avenues for development and profitability within the wake of the Yeezy discontinuation.

Options: India, China and Saudi Arabia

adidas is at a pivotal juncture, necessitating a strategic overhaul of its advertising and marketing approaches and a complete refresh of its product choices to reinforce its market enchantment globally. The crucial to align extra carefully with American tastes and tendencies has led to the institution of a devoted workplace in Los Angeles, with a give attention to tapping into American road tradition and basketball. This initiative, aimed toward fostering collaborations and tasks resonant with road tradition, signifies adidas’s dedication to embedding itself inside the material of American cultural preferences.

Nevertheless, adidas’s technique extends past the U.S., recognizing the significance of diversifying development avenues. The corporate’s foray into the Indian market, significantly with cricket merchandise, has borne fruit, exemplified by the sale of over half 1,000,000 jerseys of the Indian nationwide cricket crew. This achievement is bolstered by the crew’s efficiency in worldwide tournaments, with gross sales momentum anticipated to surge in anticipation of the World Cup closing.

Enlargement efforts have additionally reached the Center Japanese market, with the opening of an workplace in Saudi Arabia. This transfer displays an understanding of Saudi Arabia’s rising engagement with sports activities, from internet hosting worldwide occasions to enhancing its sports activities leagues. adidas anticipates leveraging the nation’s rising funding in sports activities as a strategic alternative for development.

In China, adidas is recalibrating its focus to satisfy native market calls for, significantly in basketball. By bringing basketball stars to China and reviving grassroots packages, adidas goals to underscore basketball’s cultural significance. The corporate plans to introduce competitively priced basketball merchandise, difficult native manufacturers and catering to numerous client segments. This technique underscores adidas’s imaginative and prescient of turning into a dominant sports activities model in China, supported by important investments and the institution of a state-of-the-art distribution middle.

Valuation & Dangers

adidas’s preliminary outcomes for 2023 depict an organization adeptly navigating the aftermath of discontinuing a big product line, with administration exceeding operational forecasts and making strategic stock selections, significantly in regards to the Yeezy inventory. This demonstrates a possible acceleration in resolving its challenges. The technique to liquidate the remaining Yeezy stock at price in 2024 is pivotal, anticipated to affect monetary metrics considerably.

For 2024, adidas’s forecast suggests a reasonable development trajectory in currency-neutral gross sales, inclusive of a deliberate contribution from promoting the Yeezy stock at price, estimated to spice up gross sales. Excluding this one-off, the corporate’s core enterprise is predicted to exhibit stronger development, with an working revenue projection of round €500 million (USD 545 million). This outlook, juxtaposed with the corporate’s current efficiency, mirrors the resilience adidas demonstrated in 2014 amidst geopolitical tensions and advertising and marketing missteps.

Searching for Alpha

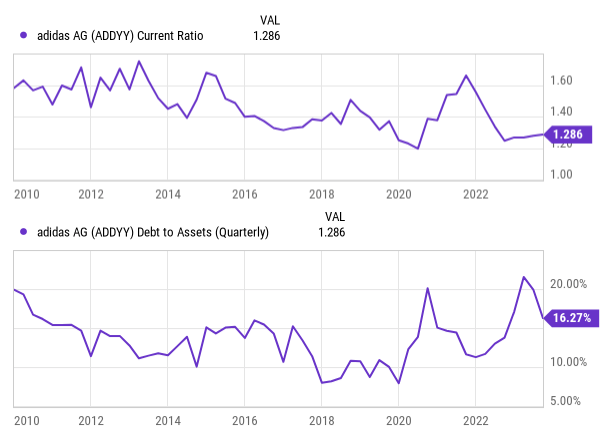

The monetary construction of adidas, characterised by strong liquidity and manageable debt ranges, stays secure, presenting a strong basis for operational flexibility and strategic initiatives.

YCharts

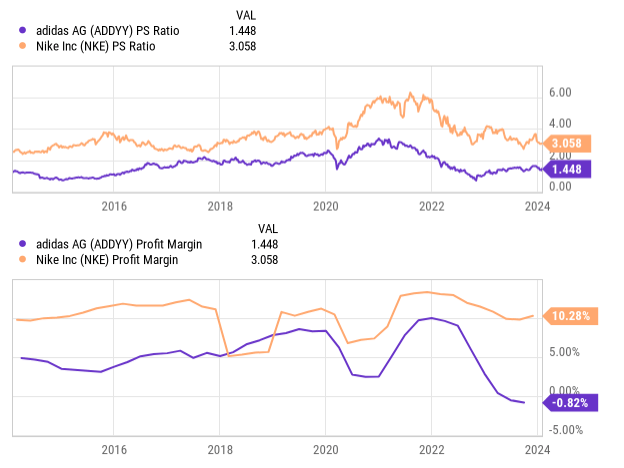

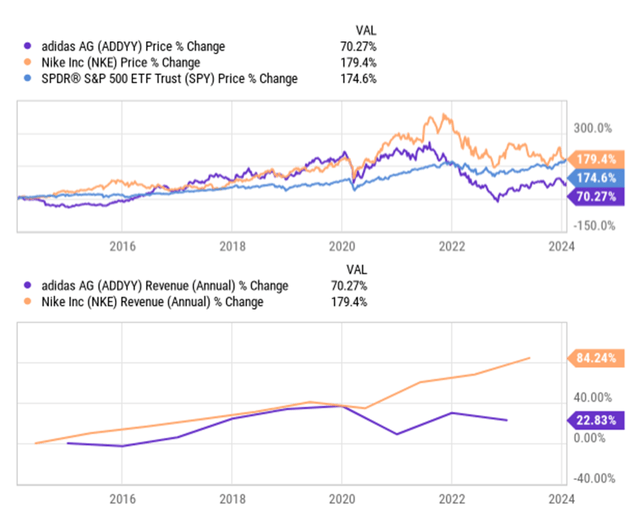

After we take a look at valuation, the comparability with Nike highlights a historic undervaluation of adidas, attributed to Nike’s superior revenue margins. Regardless of this, a imply reversion to adidas’ historic gross sales a number of suggests potential for a valuation uplift, contingent on operational enhancements.

YCharts

Advertising methods reliant on superstar endorsements current inherent dangers, significantly in an period of heightened public scrutiny and the amplification of controversies by way of social media. The problem for adidas and comparable manufacturers lies in navigating these dangers whereas sustaining the attract and relevance of their endorsements. This necessitates a strategic reevaluation of superstar partnerships to mitigate potential model injury.

The enduring enchantment of adidas, absent a big market disruptor, suggests a resilient model place. Nevertheless, the historic comparability with Nike underscores a persistent efficiency hole, underscoring the significance of strategic readability for adidas to reinforce its market standing and monetary efficiency.

In abstract, whereas adidas reveals promise for a valuation rebound and operational normalization, warning is warranted given the aggressive panorama and the intricacies of celebrity-driven advertising and marketing methods. The potential for development and a return to type exists, however the want for a coherent development technique is paramount. Due to this fact, regardless of the attractiveness of adidas’ present valuation and its prospects for restoration, a watchful stance is suggested till clearer development indicators emerge, significantly in distinction to options like Nike, which can provide extra fast readability and development potential.

YCharts

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.