On-chain information reveals rising promoting exercise amongst long-term Bitcoin holders, whose collective holdings have hit their lowest ranges this 12 months.

Distinguished crypto analyst James Test, also called Checkmate, emphasised the dimensions of this development, noting that the promoting stress from these holders far outweighs the demand from ETFs and institutional gamers like MicroStrategy.

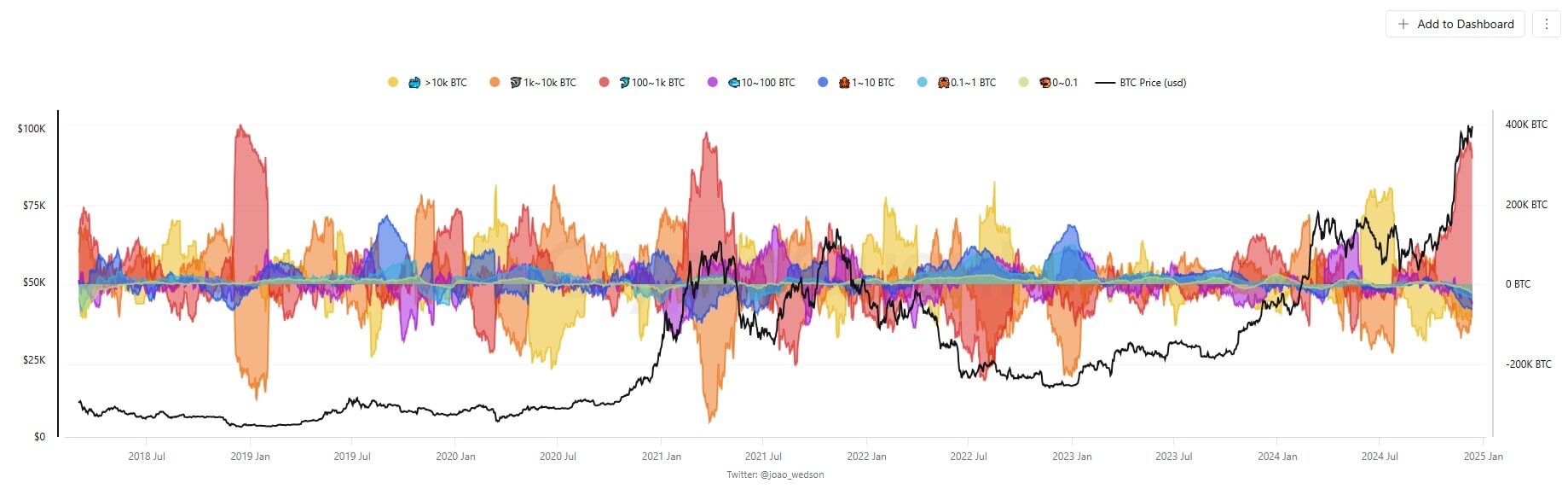

Information from CryptoQuant reveals that long-term holders (LTHs) — traders who retain Bitcoin for over 155 days — have offloaded round 800,000 BTC over the previous month.

In the meantime, institutional entities resembling MicroStrategy added 149,880 BTC, and Bitcoin ETFs acquired 84,193 BTC. This nonetheless left 487,000 BTC to be absorbed by short-term holders, primarily retail traders.

Apparently, dolphins — wallets holding between 100 and 500 BTC — have emerged as vital consumers throughout this era, accumulating over 350,000 BTC. This shift highlights a notable change in provide developments and market sentiment.

Whereas institutional and ETF-driven demand has not instantly translated into sharp value actions, it alerts evolving participant profiles and their rising affect on Bitcoin’s market developments.