Managing medical claims presents vital challenges for self-insured employers. Whereas self-insurance provides better management over healthcare prices, it calls for subtle oversight of the claims course of. With medical overbilling accounting for $300B yearly, employers face substantial monetary publicity from inaccurate claims. Bluespine addresses this problem by its progressive AI-powered claims price optimization platform. The platform is targeted on self-insured employers and delivers complete claims auditing to fight widespread medical overbilling. Not like conventional approaches that focus solely on high-cost claims, Bluespine’s know-how examines each declare submission utilizing LLMs to combine and analyze well being plan contracts, Abstract Plan Paperwork, Machine-Readable Recordsdata, and billing pointers to make sure accuracy. Constructed by a staff of cybersecurity veterans, Bluespine takes a sophisticated fraud detection method to establish billing anomalies. With an estimated 80% of medical payments containing errors, there’s a major alternative for price restoration. The corporate’s enterprise mannequin aligns with shopper pursuits by a contingency-based price construction, the place compensation is tied on to efficiently recovered overbilled quantities.

AlleyWatch caught up with Bluespine CEO and Cofounder David Talinovsky to study extra concerning the inspiration for the enterprise, the corporate’s strategic plans, current spherical of funding, and far, way more…

Who had been your buyers and the way a lot did you elevate?

$7.2M seed funding led by Team8 and strategic companions.

Inform us concerning the services or products that Bluespine provides.

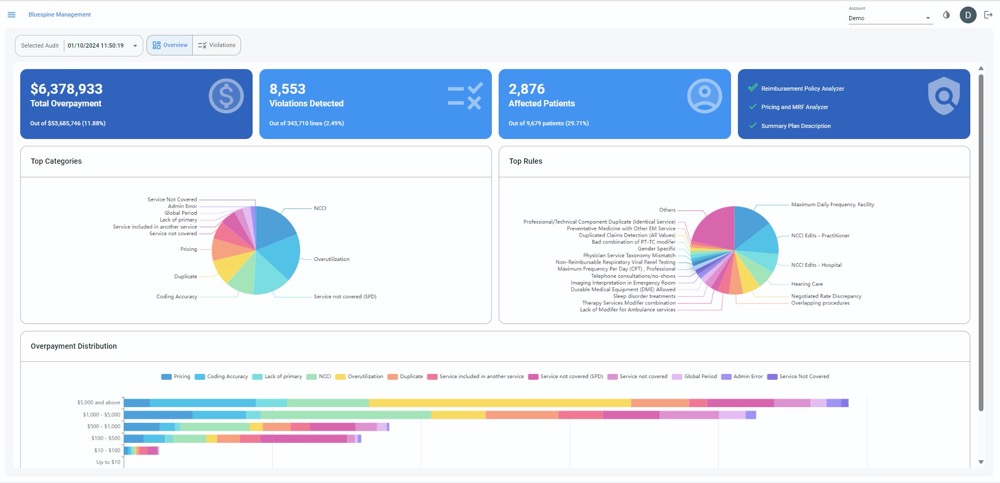

Bluespine is an AI-driven claims price discount resolution that helps self-insured employers uncover, recuperate, and stop medical overbilling. Our platform permits companies to scale back annual healthcare spending by as much as 10% whereas mitigating monetary and authorized dangers related to plan sponsorship.

Along with attracting a number of giant employers, such because the main toy firm Mattel and the DavidShield insurance coverage firm, Bluespine is partnering with main brokers, together with Alliant Insurance coverage Providers, to reinforce their capabilities and repair choices.

What impressed the beginning of Bluespine?

Our staff has a robust background in cybersecurity and stopping monetary fraud. Searching for our subsequent enterprise, we acquired enthusiastic about alternatives on the intersection of FinTech and healthcare. American healthcare is a $4T market, with near 10% going to fraud, waste, and abuse. We noticed a possibility to use our experience in fraud detection to assist clear up this rising drawback.

How is Bluespine completely different?

Not like conventional pattern auditing strategies, which usually evaluation just one% of high-value claims, Bluespine’s evidence-based method leverages proprietary AI to research 100% of claims with pinpoint accuracy. Our platform is the primary of its sort to mix information from well being plan contracts, Abstract Plan Paperwork, Machine-Readable Recordsdata, and plan billing pointers to conduct complete audits which might be uniquely tailor-made to the particular protection phrases of every employer.

What market does Bluespine goal and the way large is it?

We goal self-insured employers, who characterize 91% of firms with greater than 5,000 workers. The issue of medical overbilling – a symptom of fraud, waste, and abuse, prices self-insured employers an estimated $300B yearly.

What’s your enterprise mannequin?

Our enterprise mannequin is totally aligned with the monetary pursuits of our shoppers. We cost a contingency price primarily based on restoration outcomes.

How are you making ready for a possible financial slowdown?

A possible slowdown would incentivize employers to be progressive with their price financial savings methods, and we are able to play an essential function in serving to them scale back their second-largest expense. On the identical time, we’re at all times monitoring our operational prices and are dedicated to constructing a resilient enterprise.

What was the funding course of like?

We’re a bit distinctive in that we had been established inside Team8’s fintech enterprise creation fund, which companions with entrepreneurs to construct category-leading startups. The fund is led by Managing Companions Rakefet Russak Aminoach (former CEO of Financial institution Leumi), Ronen Assia (co-founder of eToro), Alon Huri (co-founder of Subsequent Insurance coverage and Test), and Team8 Associate Galia Beer (former govt at PayPal).

What are the largest challenges that you simply confronted whereas elevating capital?

Team8 actively helped us validate our thesis and resolution early on. This gave them a number of confidence in our market potential throughout the early phases of ideation. By the point we had been prepared to maneuver ahead, their dedication to backing us felt like a pure subsequent step in realizing a shared imaginative and prescient.

What components about your enterprise led your buyers to put in writing the examine?

Team8 noticed that we (the founders) had deep technical data with experience in constructing and scaling tech firms. We’re serial entrepreneurs who perceive that the chance we’re tackling extends past self-insured employers. It is usually extremely related to the broader healthcare fee integrity house. Our buyers are effectively conscious of the excessive prices in healthcare and had been pleased to assist our mission – by leveraging AI to scale back administrative burdens, we’re in the end working towards higher healthcare outcomes for Individuals.

What are the milestones you propose to realize within the subsequent six months?

Within the subsequent six months, we want to broaden our staff to fulfill the demand that we’re seeing available in the market. We additionally wish to lengthen our AI capabilities to research an excellent broader vary of healthcare information sources.

What recommendation are you able to supply firms in New York that should not have a contemporary injection of capital within the financial institution?

Being a founder and elevating capital as of late isn’t straightforward. You want robust conviction in what you’re constructing and a transparent deal with delivering actual worth to your prospects. I additionally consider in sustaining a bootstrapped mindset—even with buyers on board. This method helps you run your enterprise in a extremely environment friendly manner.

The place do you see the corporate going now over the close to time period?

Whereas we’re beginning with self-insured employers, we see demand from brokers, marketing consultant companies, and carriers. We even have requests from authorities companies who want to embrace progressive know-how that may assist them scale back healthcare prices for US residents.

What’s your favourite fall vacation spot in and across the metropolis?

I’m a fan of Central Park, particularly this time of yr.