Katrina Wittkamp

Funding motion

Based mostly on my present outlook and evaluation of Burlington Shops (NYSE:BURL) 2Q23 earnings, I like to recommend a maintain ranking. I anticipate the inventory value to be rangebound within the close to time period, as I don’t see any optimistic catalysts that may drive the valuation a number of upwards. BURL wants to indicate the market that it’s performing in keeping with friends (or higher) over the following few quarters.

Primary recap

BURL is an American nationwide off-price division retailer retailer. They primarily promote items which might be deemed as worth buys for shoppers. BURL primarily serves the US market, with some presence in Puerto Rico. The corporate is without doubt one of the few largest off-price division retailer retailers, competing towards TJX (TJX) and Ross Shops (ROST).

Assessment

The rise in retail gross sales for 2Q23 was 9.4%, which was barely increased than the consensus estimate of 9.2% and was pushed by comp progress of 4.0%. EBIT margin elevated by round 100 foundation factors to three.1%, which was increased than the consensus estimate of two.4%, and gross margin got here in at 41.7%, which was higher than the anticipated 40.4%. On account of strong comps progress and gross margins. EPS for BURL have been $0.60, beating expectations of $0.44. Though the outcomes have been passable on their very own, they lagged behind friends. Essentially the most notable distinction is that ROST and TJX each confirmed stronger sequential comp enhancements in 2Q23, whereas BURL’s comps progress remained flattish from the earlier quarter. Equally, whereas most of BURL’s opponents elevated their 2H23 steerage, BURL lowered theirs. When requested about their future plans, BURL maintained their cautious stance towards their core buyer, the middle- and lower-class people who’re nonetheless feeling the consequences of the continuing financial downturn. To make issues worse, FY23 trade-down visitors advantages have lagged behind each administration’s expectations and shoppers’ previous habits. As such, administration revised their comp steerage for 2H23 and the FY23 to 2-4% and 3-4%, respectively, from 3-6% and 3-5% beforehand, reflecting the slower YTD pattern and macro pressures on the patron.

Whereas I’m conscious of those relative headwinds, I imagine the market is ignoring the truth that BURL execution is enhancing. The excessive merchandise margin achieved in 2Q23 is indicative of this enchancment in buying and availability of fascinating name-brand items. The rise in BURL’s quarterly gross margin of 275 foundation factors was pushed partially by the 150 foundation factors enhance in merchandise margin. Particularly, administration talked about will increase in merchandise margin as a consequence of a positive off-price buying local weather, in addition to decreases in markdowns and lack prices. This demonstrates BURL’s methodical implementation of enhanced merchandising instruments, which, if profitable, ought to enhance the corporate’s potential to supply worth to its prospects. BURL additionally has a clearer view of upcoming retailer openings, as they’re optimistic in regards to the retailer enlargement as a complete, citing the acquisition of 62 previously leased Mattress Bathtub & Past places for instance of the strengthening pipeline of recent retailer progress. In my view, the brand new leases are a internet optimistic, as they supply better readability concerning future retailer enlargement and will enhance buyers’ optimism concerning BURL’s potential for elevated income and earnings per share.

That mentioned, I do acknowledge that the headline comparability definitely doesn’t work nicely for the inventory. Any buyers or capital seeking to reap the benefits of the trade-down scenario are prone to place their bets in TJX or ROST given the efficiency to this point. Within the present scenario, though I’m bullish on BURL’s working efficiency, it’s unhappy to say that the inventory is prone to be rangebound till it exhibits the market (over a few quarters) that 2Q23’s weak efficiency was a blip.

Valuation

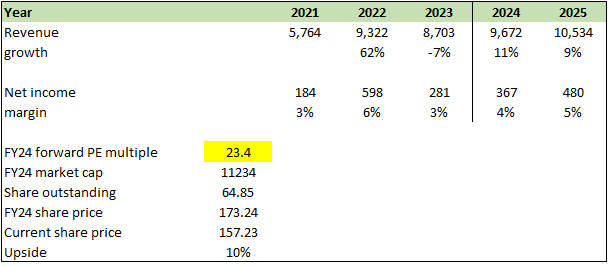

Creator’s work

I imagine BURL can develop as administration guides it in FY24 and proceed to develop equally to the way it has completed so traditionally. My optimistic view is especially pushed by the improved execution and retailer enlargement plans. I don’t see any structural change within the trade; in reality, the present macro scenario is in favor of BURL’s trade. Based mostly on my mannequin, buyers can nonetheless get a ten% return if multiples keep on the present degree, which I anticipate they may, as I don’t see any catalyst to drive them up. Relying on every investor’s funding necessities, for me, 10% is nice sufficient, however due to the bearish causes I acknowledged above, I’m recommending a maintain ranking till BURL exhibits that it’s at the least performing in keeping with friends.

Danger and last ideas

I imagine the chance with investing in BURL in the present day is that the comparative underperformance vs. friends would possibly worsen within the close to time period, which can additional solidify the bearish narrative that BURL is dropping market share. This is not going to be nice for the inventory, particularly with BURL buying and selling on the similar valuation a number of.

In conclusion, my advice for BURL is a maintain as a consequence of uncertainties in near-term progress and efficiency relative to friends. Regardless of reaching a better merchandise margin, BURL’s comps progress remained flat from the earlier quarter, and the corporate lowered its steerage for the remainder of the yr as a consequence of ongoing macro pressures on shoppers. Whereas my mannequin suggests potential for a ten% return at present multiples, I like to recommend holding off till BURL exhibits efficiency on par with its friends, as its relative underperformance may hinder market notion.