RobsonPL

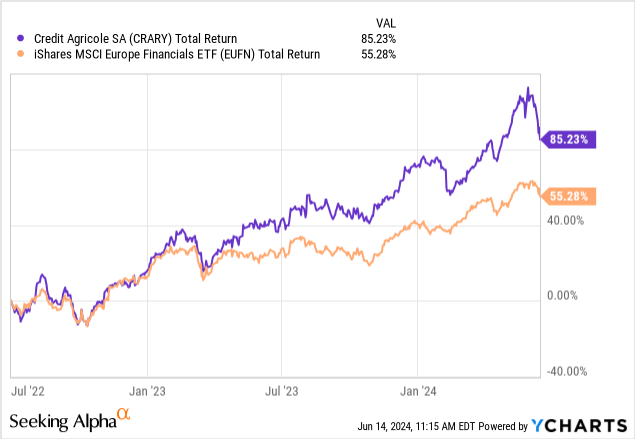

Political developments in France might have despatched French financial institution shares tumbling this week, however Crédit Agricole S.A. (OTCPK:CRARF)(OTCPK:CRARY) has nonetheless been a stable performer lately, outperforming wider European financials (EUFN) by round 30ppt for the reason that European Central Financial institution (“ECB”) started mountain climbing rates of interest again within the second quarter of 2022.

Though it has outperformed its friends on this time, Crédit Agricole is definitely one of many least delicate banks in Europe to rate of interest actions, and this attribute of its enterprise ought to present assist to profitability now that the ECB has begun chopping charges. With the inventory buying and selling at a reduction to tangible e-book worth, resilient earnings suggest a roughly mid-teens earnings yield and excessive single-digit dividend yield, which ought to assist carry the shares over time. I open on the financial institution with a “Purchase” score.

Restricted Sensitivity To Curiosity Charges

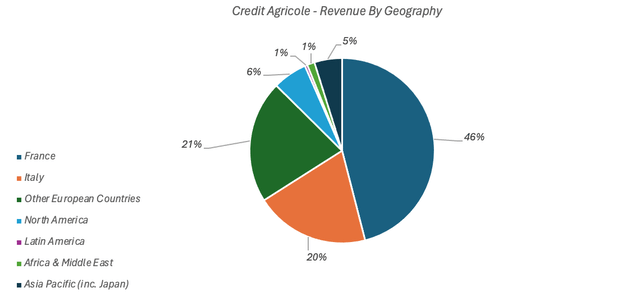

Crédit Agricole is a French common financial institution with €2.2 trillion in property. Round 46% of its income is generated in France, with an extra 41% generated in different European international locations. Its footprint exterior of Europe is comparatively mild, with different geographies accounting for lower than 15% of income and round 21% of internet revenue final 12 months.

Knowledge Supply: Credit score Agricole 2023 Annual Report

Crédit Agricole is among the least delicate banks in Europe to rate of interest modifications. It is a operate of its numerous income combine, country-specific options of the French retail banking market, plus the composition of its home mortgage e-book.

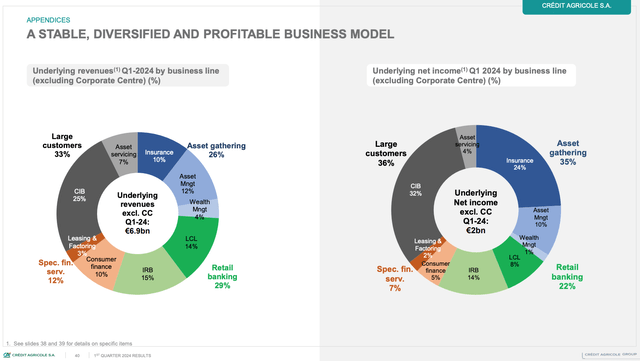

Crédit Agricole’s income combine consists of vital contributions from non-interest-based enterprise strains, together with asset administration, insurance coverage, asset servicing, and funding banking. Under is a breakdown of whole income and internet revenue by enterprise line (as of Q1 2024):

Supply: Credit score Agricole Q1 2024 Outcomes Presentation

Crédit Agricole additionally has vital interest-based companies, together with retail banking, which was slightly below 30% of income final quarter. That is cut up roughly equally between French Retail Banking (“LCL”, ~14% of 1Q24 income) and Worldwide Retail Banking (~15% of 1Q24 income).

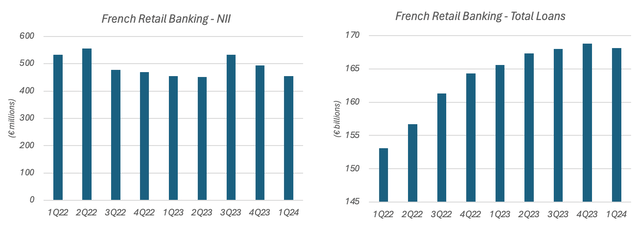

Nation-specific options of the French retail banking market, plus the composition of LCL’s mortgage e-book, have additional restricted Crédit Agricole’s rate of interest sensitivity. These country-specific options embody government-regulated yields on sure buyer deposits, whereas LCL’s mortgage e-book is dominated by long-term fixed-rate residential mortgages, that are naturally gradual to reprice to larger rates of interest. These accounted for round €104 billion, or 62%, of LCL’s mortgage e-book on the finish of 1Q24.

Consequently, French Retail Banking internet curiosity revenue (“NII”) has really been falling whilst Eurozone rates of interest have been rising. This has occurred regardless of a rising mortgage e-book, implying a contraction within the internet curiosity margin.

Knowledge Supply: Credit score Agricole Q1 2024 Outcomes Launch

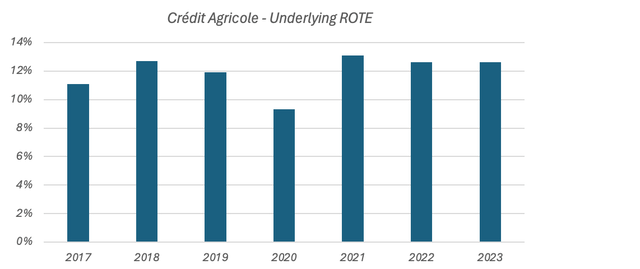

Restricted sensitivity to rates of interest signifies that Crédit Agricole has not loved the tailwind to profitability that sure Eurozone friends have on this mountain climbing cycle. Whereas underlying internet revenue has grown by round 8% since 2021 (the 12 months earlier than rates of interest started rising within the Eurozone), this has occurred on a rising capital base. Profitability has really been pretty steady, with annual underlying ROTE touchdown at 13.1% (2021), 12.6% (2022), and 12.6% (2023) in that point.

Knowledge Supply: Crédit Agricole Annual Experiences

Whereas Crédit Agricole’s lack of rate of interest sensitivity has not led to an growth in underlying profitability, it additionally signifies that profitability is usually steady in several rate of interest environments. This has been the case lately, with the financial institution averaging a circa 11.6% underlying ROTE between 2017 and 2021 (when the ECB deposit facility fee was detrimental), and a 12.6% ROTE between 2022 and 2023 (when the deposit facility fee elevated by 450bps). As such, I anticipate comparatively steady profitability now that the ECB has begun chopping rates of interest.

Valuation

At €12.80 in Paris buying and selling (~$6.80 per ADS), Crédit Agricole shares are at 0.79x tangible e-book worth per share (“TBVPS”), which was €16.19 on the finish of 1Q24 (~€15.14 per share excluding the 2023 dividend, which was paid in Q2). This means a P/E of roughly 6.7x, or an earnings yield of 15%, primarily based on a through-the-cycle ROTE of 12%, which Crédit Agricole has achieved traditionally.

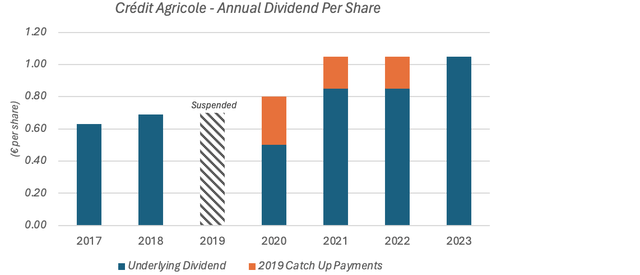

Administration’s acknowledged dividend coverage is to pay out 50% of internet revenue annually. On a ~6.7x P/E (~15% earnings yield), this suggests a dividend yield of roughly 7.5%.

Based mostly on the precise 2023 dividend of €1.05 per share ($0.57 per ADS), the dividend yield is 8.2%. That is larger than the implied yield as Crédit Agricole earned a barely larger ROTE final 12 months (12.6%), whereas the payout ratio was additionally considerably above administration’s goal (~54% in 2023).

Permitting for modest ROTE contraction is prudent, as Crédit Agricole continues to be benefitting from stronger than anticipated asset high quality. Price of threat, for instance, which is unhealthy debt provisioning bills relative to whole loans, was 33bps final 12 months and 29bps in 1Q24, beneath administration’s through-the-cycle goal of 40bps. Normalizing this determine would put downward strain on ROTE, albeit it will stay round 12%.

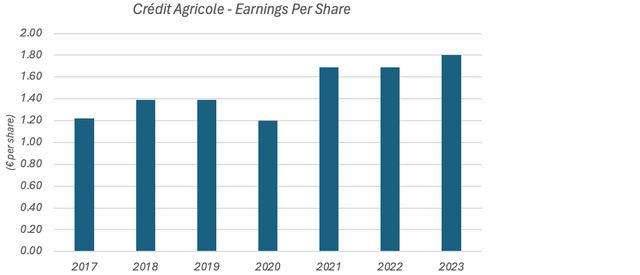

With 50% of internet revenue retained for development, Crédit Agricole ought to theoretically have the ability to obtain round 6% annual earnings development assuming a 12% though-the-cycle ROTE, which all else equal would lead to an analogous degree of annual dividend development.

Word that, whereas the per-share dividend has been flat over the previous three years, the headline figures are considerably deceptive, because the 2021 and 2022 payouts additionally contained “catch up” funds stemming from the 2019-allocated dividend (which was suspended in 2020 as a consequence of COVID). The 2023 per-share dividend was really round 24% larger than the 2021 payout on an underlying foundation, whereas Crédit Agricole has elevated its dividend per share at a circa 8.9% annualized fee over the previous 5 years.

Knowledge Supply: Crédit Agricole Annual Experiences

A 50% payout ratio seems low given the restricted development prospects of its core European footprint, although Crédit Agricole additionally has a historical past of creating acquisitions, most just lately in shopping for the European asset servicing enterprise of Royal Financial institution of Canada (RY) and Belgian financial institution Degroof Petercam. M&A funded out of retained earnings may also assist develop internet revenue over time.

Knowledge Supply: Crédit Agricole Annual Experiences

Word that Crédit Agricole has grown EPS at an roughly 6.6% annualized fee since 2017, roughly according to the 6% annualized fee implied by a 12% ROTE and 50% earnings retention.

Conclusion

On a excessive single-digit dividend yield and ~6% annualized development, Crédit Agricole shares can ship low-teens pre-tax annualized returns for buyers even on a flat valuation a number of. ROTE is comfortably above 10% and is usually resilient whatever the wider rate of interest setting, which might carry shares upwards to 1x TBVPS whereas nonetheless leaving them on a double-digit earnings yield. Though this could supply buyers a further supply of upside, it is not essential to attain acceptable returns, with the present dividend yield and implied development sufficient to generate enticing double-digit annualized returns on their very own. As such, I open on Crédit Agricole with a “Purchase” score.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.