Filmstax

Funding Thesis

Fiverr Worldwide Ltd.’s (NYSE:FVRR) Q3 2023 outcomes mirror the thesis that I proceed to have on the inventory: that this inventory is just not compelling sufficient for me to reward it with a purchase ranking.

And what I discover ironic is that I am one of many solely voices on In search of Alpha that hasn’t bought a purchase ranking on this inventory. However I imagine that, ultimately, extra analysts will come round to my facet of the boat the place it is lonely and chilly. A minimum of for now.

Finally, the inventory could be very cheaply valued at 8x ahead free money flows. Few traders would argue the opposite. However I contend that an affordable inventory is not ok in and of itself. It wants to have the ability to develop its intrinsic worth sustainably. And it is on that latter facet that I’ve an subject with this firm’s inventory, and I am impartial on this title.

Fast Recap

Again in September, I wrote a impartial evaluation on Fiverr the place I mentioned:

In keeping with my up to date estimates, Fiverr is priced at 11x subsequent 12 months’s EBITDA. The enterprise is clearly so much cheaper than it as soon as was. However on the identical time, it isn’t thriving to the identical extent that it as soon as was.

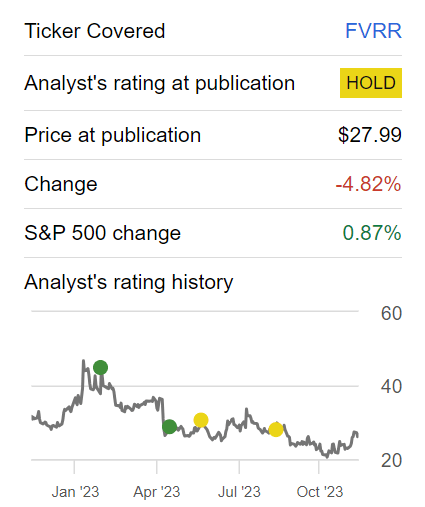

That is the inventory’s efficiency since then.

Writer’s work on FVRR

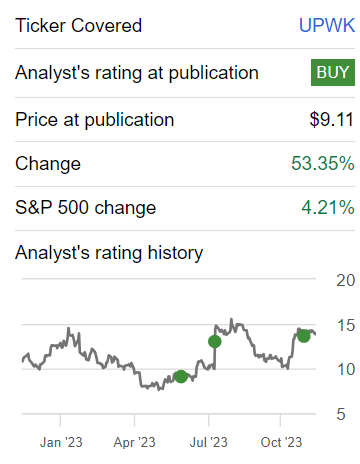

On the identical time, I have been outspoken all through SA that I am bullish on its peer Upwork Inc. (UPWK).

Writer’s work on FVRR

The purpose I am making right here is that in investing, it isn’t sufficient to have a very good story or a rising whole addressable market, or TAM. You’ll want to purchase a mispriced inventory. That’s, the place expectations are decrease than the place the corporate is headed.

Fiverr’s Close to-Time period Prospects

Fiverr is a web based market that connects freelancers with purchasers searching for numerous digital companies. The platform affords a various vary of companies, from graphic design and writing to programming and advertising.

Fiverr’s distinctive proposition lies in its gig-based construction, the place freelancers, known as sellers, showcase their abilities by providing companies, or “gigs,” at completely different worth factors. Purchasers, or consumers, can browse these companies, interact freelancers, and collaborate on initiatives starting from small duties to extra in depth undertakings.

Fiverr’s user-friendly interface and international attain have positioned it as a preferred hub for companies and people searching for cost-effective and specialised freelance experience.

Within the close to time period, Fiverr confronts challenges associated to the continuing evolution of its enterprise mannequin and the dynamics of the freelancing market.

One notable problem revolves across the scalability and optimization of its not too long ago launched product, Fiverr Neo. Whereas Fiverr Neo envisions serving as a customized recruiting knowledgeable, serving to purchasers precisely scope their initiatives and join with freelance expertise effectively, the platform is in its early phases. The corporate acknowledges that the know-how, together with leveraging present Giant Language Mannequin engines, continues to be present process optimization for large-scale and high-performance utilization. Enhancing the algorithm and processing pace whereas guaranteeing a seamless buyer expertise poses a problem as Fiverr seeks to broaden the person base and enhance the affect on match high quality and supply.

One other problem lies within the efficient implementation and adoption of Fiverr Enterprise Options, notably the Fiverr Enterprise providing. Focusing on higher-end prospects with extra complicated venture necessities, Fiverr Enterprise goals to offer ongoing engagement with a pool of freelance expertise, steady job and venture administration, and funds instruments.

The problem right here is twofold: first, convincing bigger companies to embrace the platform for prolonged engagements, and second, guaranteeing that the platform’s options adequately handle the nuanced wants of companies with evolving venture scopes. Attaining widespread adoption and demonstrating tangible worth to bigger enterprises is usually a gradual course of, and Fiverr must navigate these challenges to ascertain Fiverr Enterprise as a go-to resolution for companies searching for prolonged freelancing help.

Income Development Charges Are Uninspiring

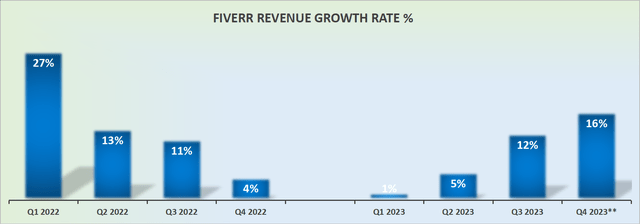

FVRR income progress charges

The issue with investing is that traders demand certainty. Traders by no means like dangerous information, that is apparent. However the second factor that traders dislike is uncertainty. What do I imply by that?

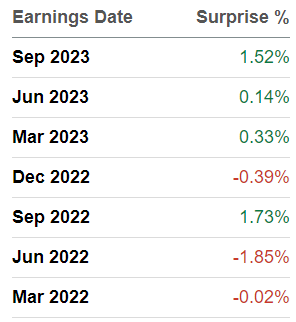

Beforehand, Fiverr could possibly be counted on to ship strong mid-20s% CAGR. Right now, regardless of its very simple comparables with the prior 12 months, its progress is categorically beneath 20% CAGR. What’s extra, I am going to underscore that Fiverr will not be the type of firm that under-promises and overdelivers, as you possibly can see beneath.

SA Premium

As you possibly can see right here, Fiverr is simply as prone to beat analysts estimates as it’s to overlook analysts’ estimates. Put extra concretely, Fiverr is now not classed as a high-growth enterprise. It is a enterprise that now operates within the shadow of its former self.

FVRR Inventory Valuation — 8x Ahead Free Money Circulation

To be clear, there are good facets to Fiverr’s funding thesis. In spite of everything, the enterprise is clearly extremely free money move generative. Working example, I can simply see a path over the subsequent twelve months the place Fiverr delivers $130 million of free money move.

This places Fiverr priced at simply 8x ahead free money move. No rational traders would make the case that this can be a wealthy valuation. What’s extra, the enterprise could be very properly capitalized, with greater than $130 million of web money on its steadiness sheet.

So, not solely is the enterprise producing about $130 million of free money move over the subsequent twelve months and rising, but it surely additionally has greater than 10% of its market cap made up of money.

So, once more, the valuation will not be the difficulty with this inventory. The difficulty, quite, is that its progress prospects have fizzled out. And it is troublesome to get a big a number of on a inventory when this as soon as robustly rising enterprise has sputtered and stalled.

The Backside Line

In abstract, my examination of Fiverr’s prospects solidifies my reservations concerning the inventory, main me to withhold a purchase ranking.

Whereas the present valuation at 8x ahead free money move seems engaging and underscores Fiverr’s robust free money move era, the pivotal concern lies within the firm’s faltering progress charges.

Previously, Fiverr was a stalwart. It could possibly be counted on for a strong mid-20s% CAGR. However now, Fiverr Worldwide Ltd.’s progress has now dipped properly beneath 20%, and maybe it’ll stabilize round 15% CAGR, signaling a departure from its high-growth trajectory.

The problem lies not within the valuation, which is seemingly affordable, however within the firm’s potential to reignite its progress engine. Regardless of the interesting free money move metrics, the stagnant progress prospects are a major hurdle, prompting me to stay cautious and impartial on Fiverr till a extra convincing progress story emerges.