Many merchants stay and die by the symptoms they see on their charts.

One quite common and probably highly effective indicator are Donchian Channels.

These channels look and performance equally to each regression channels and Bollinger bands.

On this information, we are going to look to know the place Donchian Channels come from, how they’re calculated, and the way you need to use them in your buying and selling.

We are going to have a look at some examples of the right way to commerce them and a few potential shortcomings this highly effective indicator has.

Contents

Donchian Channels are a technical indicator developed by Richard Donchian, a futures dealer, within the Seventies.

These channels are designed to research and visualize the market traits and whether or not a safety is trending or range-bound.

The indicator consists of the next strains: the Higher Channel, The Decrease Channel, and the Midline Channel.

The Higher and Decrease Channels are calculated primarily based on the best excessive and lowest low of a specified interval.

The Center Channel is the common of the Higher and Decrease Channels over the past N intervals.

That is additionally referred to as the reversion line as a result of it’s thought-about the imply reversion worth for the given interval.

Donchian Channels are an excellent software to assist a dealer determine a prevailing pattern or lack thereof.

As the worth continues to pattern in a particular path, the bands will maintain adjusting in that path.

A neater option to determine the pattern utilizing the Donchian channels is to observe the Midline.

Since that is a median of each the excessive and low worth of the interval, that provides you with the common path of the size of the bands.

Under, we are going to go into a number of of the totally different buying and selling methods which can be used with the channels.

Now that we’ve got defined the fundamentals of Donchian Channels, it’s time to discover the right way to use them in buying and selling.

Under, we are going to go over 3 of the extra widespread buying and selling methods.

That is removed from an exhaustive record, although; much like any indicator, one of the best ways to make use of it’s the manner that makes you essentially the most risk-adjusted revenue.

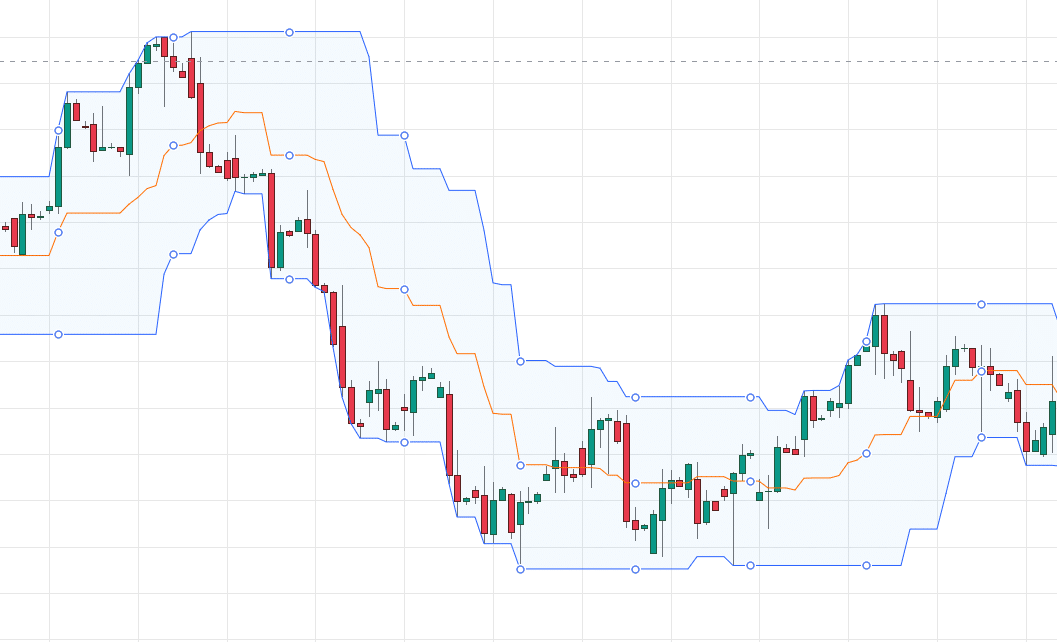

The Midline Bounce/Pullback Commerce

One of many extra frequent trades with the Donchian Channels is the Midline Bounce commerce. This can be a fairly easy commerce, because it doesn’t matter what the prevailing pattern is.

It’s going to work with each rising and falling traits.

Step one is figuring out the path the inventory/market is transferring.

As soon as the general path has been recognized, the dealer will await the worth to return up/down and contact the Midline within the channels.

That is referred to as the sign bar as a result of it alerts that the commerce is establishing.

The following step is to attend for the following candle to open and keep above/beneath the Midline, relying on path.

The ultimate step is to position the commerce within the path of the bounce.

Administration for this commerce is pretty easy: a cease loss is positioned above/beneath the Midline following the danger administration ideas you commerce with.

The goal would be the higher/decrease band, relying on path.

You will need to point out that since it is a pullback-type technique, it really works greatest in trending markets. Under are a number of examples from TSLA from earlier this yr.

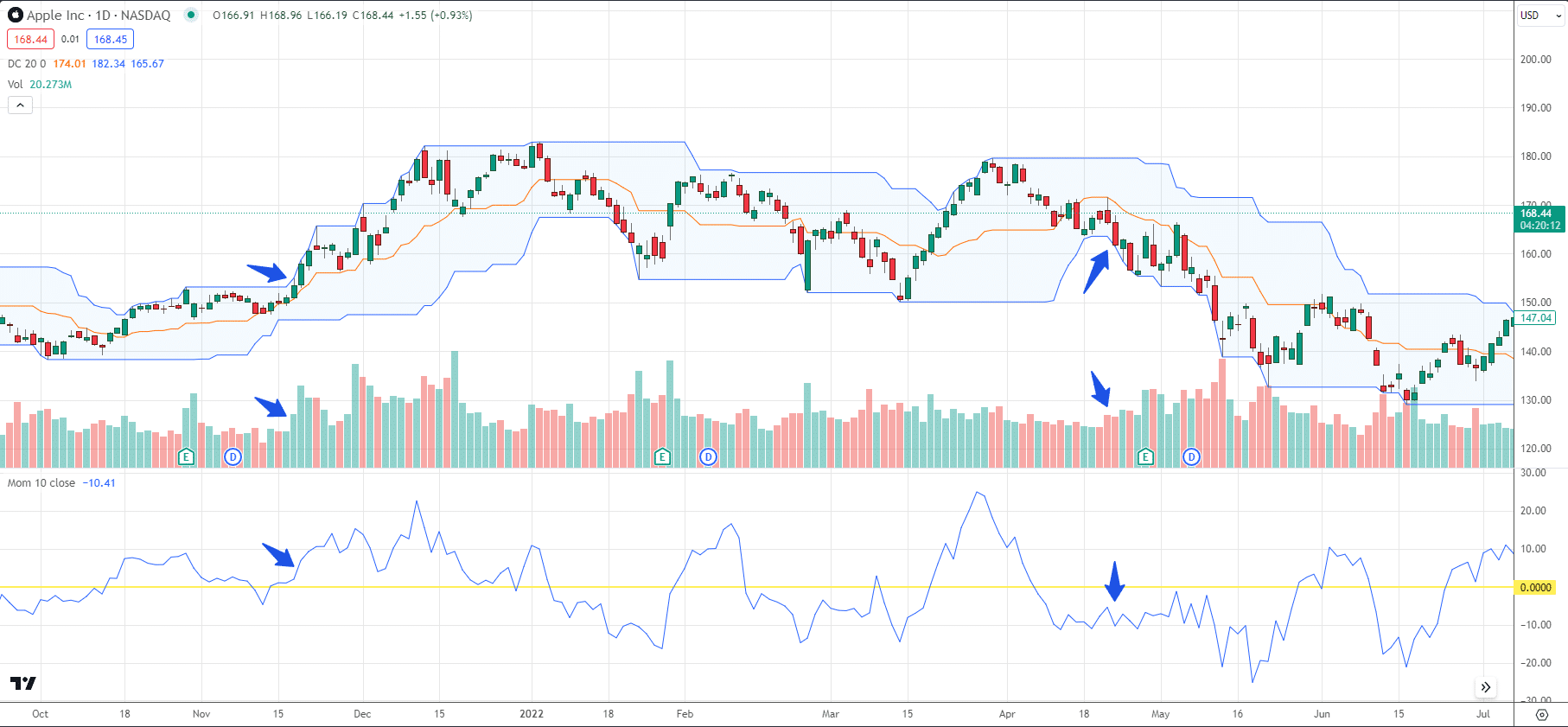

The Vary Growth/Breakout Commerce

The vary growth commerce, or “turtle commerce,” is when a dealer buys or sells a inventory when it breaks the higher or decrease channel.

Resulting from the truth that the bands adapt as the worth strikes, a dealer is searching for a worth to shut above or beneath the prior intervals, excessive or low.

As with all breakout trades, a affirmation sign is often one of the best motion earlier than inserting the commerce.

Whether or not it’s quantity or one other indicator, merely shopping for or promoting primarily based on the break of a channel might not yield one of the best outcomes.

Let’s check out a few examples beneath on AAPL.

The primary commerce to the left is a breakout commerce to the upside.

Worth pierces the earlier excessive, the quantity greater than the previous couple of intervals and is skewed in the direction of the path of the commerce, and at last, the momentum indicator is optimistic and growing.

Three alerts, all probably confirming a breakout.

The second instance is a promote that flashed all the identical alerts in the wrong way.

There was greater promoting quantity as the worth pierced the underside band, and the momentum indicator was destructive, signaling destructive momentum.

So far as threat administration is anxious, that’s as much as the dealer on a breakout commerce.

Some merchants use the Midline as their exit as a result of it follows up with worth, making it dynamic because the commerce strikes.

Others select the fastened threat/reward ratios or a flat share of their account.

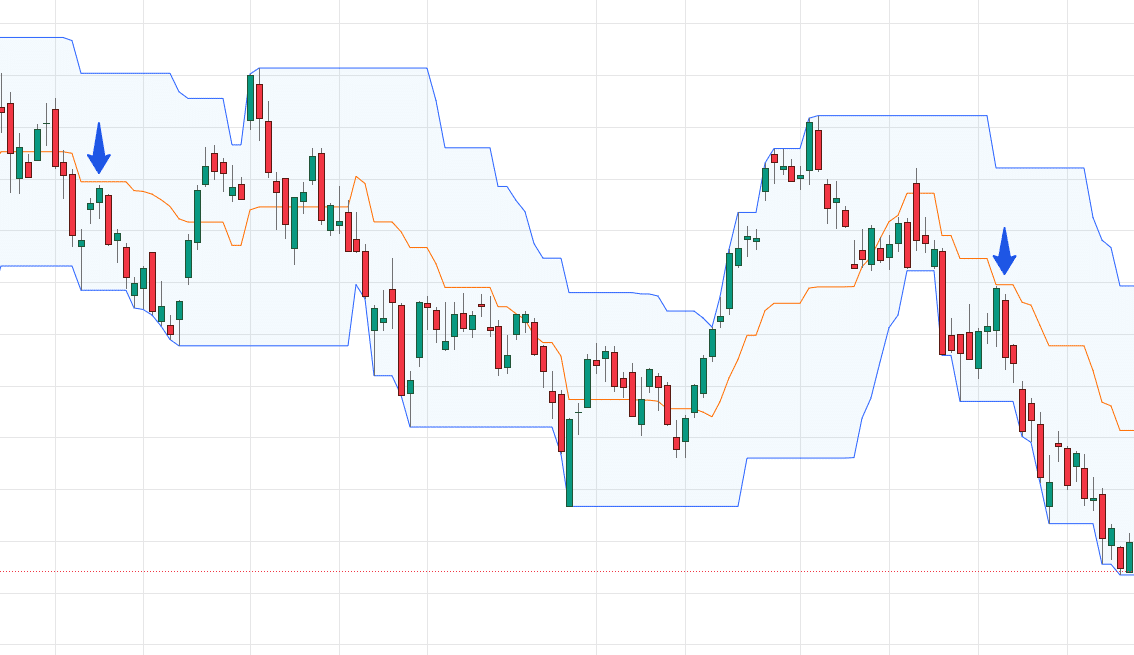

Return to the Mid Commerce

The return to the mid-trade is solely a imply reversion commerce. It’s easy in idea however not all the time straightforward to see in real-time.

The commerce is when the worth bounces or pierces one of many outer channels however then rapidly reverses and heads again to the Midline.

The entry on this commerce could be the candle after the bounce.

There’s a lengthy instance and a brief instance beneath. Within the lengthy instance in mid-June, the entry would occur across the opening of that lengthy inexperienced candle above the arrow.

The commerce would have chopped round for a number of days however ultimately would have taken you to the Midline for a revenue.

The second commerce is a brief in mid-August.

That is after a breakout commerce; there’s a Doji that pushes barely greater, after which the small crimson candle would have been the entry candle on this commerce.

These trades would have had comparatively tight cease losses by placing them on the opposite aspect of the bands.

Get Your Free Put Promoting Calculator

A significant a part of all indicators and techniques is optimizing them to the merchants’ specific model.

Whereas many individuals discover that the default settings work effectively with their buying and selling, experimenting and backtesting another settings might improve their effectiveness.

One other essential a part of optimizing the Donchian Channels is seeing the right way to use them with different indicators.

There are a number of examples of a momentum indicator above, however in the end, it comes all the way down to what suits a dealer’s eye greatest.

Another widespread indicators you need to use with the Donchian Channels are the ATR, MACD, RSI, and Quantity.

Donchian Channels can show to be a really highly effective software when used at the side of different indicators.

On this information, we’ve got checked out a fundamental understanding of how they work, the right way to calculate them, how merchants can use them, and three fundamental buying and selling methods.

This isn’t all they can be utilized for, although different makes use of embody day by day ranges, trailing cease losses, and stock-specific volatility.

Finally, how they find yourself getting used is as much as the dealer, however one factor is for certain: the Donchian Channels ought to be a software in each dealer’s toolbox.

We hope you loved this text on utilizing donchian channels.

When you’ve got any questions, please ship an e-mail or go away a remark beneath.

Commerce protected!

Disclaimer: The data above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for buyers who will not be acquainted with alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.