patpitchaya

JPMorgan Fairness Premium Revenue ETF (NYSEARCA:JEPI) is designed primarily for income-focused buyers because it pays a month-to-month dividend. Based mostly on its comparatively enticing 8.3% payout, it is anticipated to be a core holding of earnings buyers trying to give attention to producing a sustainable month-to-month dividend.

Nevertheless, it is vital to contemplate that JEPI is not designed to duplicate the S&P 500 (SPX) (SPY). I imagine it is vital to contemplate this as JEPI is designed to supply a much less risky method over a “full market cycle” (three to 5 years) in comparison with the SPX. With its extra defensive portfolio choice, JEPI is predicted to underperform the S&P 500 in a bull market. Consequently, I assessed that JEPI is not the perfect automobile for whole return buyers trying to outperform the SPX constantly. I final up to date JEPI buyers in mid-September 2023, highlighting its uptrend restoration thesis. Though JEPI has underperformed the S&P 500 since then, the thesis has nonetheless panned out, because the market went on a rampaging run. Consequently, I imagine it is apt for me to offer an replace on JEPI, to assist buyers reassess whether or not the entry ranges are nonetheless well timed so as to add publicity, and whether or not they need to anticipate a pullback earlier than shopping for extra.

Observant buyers needs to be conscious that JEPI fund managers indicated in its prospectus that its income-driven, decrease volatility technique might “underperform in comparison with the S&P 500, significantly in bullish markets.” Buyers ought to know that JEPI executes its coated name technique by “focusing on 30-Delta OTM calls.” Consequently, it goals to “stability capturing some index upside whereas incomes possibility premiums.” Nevertheless, even with this method, it is nonetheless weak to substantial underperformance in bullish markets, as seen over the previous three months.

Accordingly, the S&P 500 posted a 3M whole return of 18.6%. In distinction, JEPI posted a 3M whole return of 10.1%. Consequently, the fund captured about 54% of SPX’s whole return over the identical interval. Zooming out over the previous 12 months, JEPI posted a complete return of 10.3% in comparison with SPX’s 22.3% over the identical interval. Regardless of the relative underperformance, it looks like JEPI has fallen in need of what the fund managers have meant to do, which is to “ship a good portion of the returns related to the S&P 500 Index however with diminished volatility.”

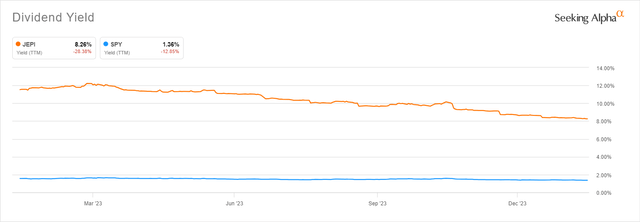

JEPI Vs. SPY TTM dividend yield (1Y) (Searching for Alpha)

Nonetheless, we might see that JEPI has nonetheless delivered a a lot larger dividend yield than SPX. Subsequently, it nonetheless fulfills one among JEPI’s worth propositions, recognized as a “key differentiator, providing common money move to buyers.”

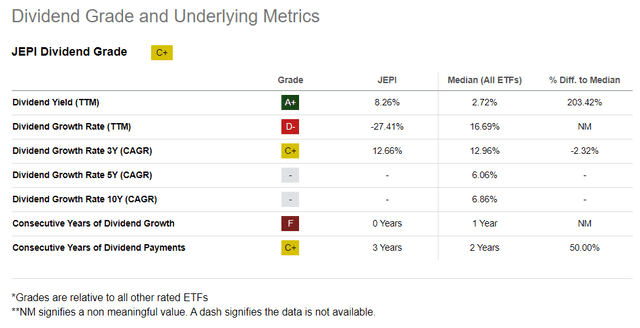

JEPI Dividend Grade metrics (Searching for Alpha)

As seen above, JEPI is assigned a comparatively impartial “C+” dividend grade by Searching for Alpha Quant. Its “A+” yield grade is taken into account best-in-class, though the expansion charges in its dividends haven’t been superior. Consequently, earnings buyers on the lookout for a extra constant and market-leading dividend progress alternative would possibly want to contemplate its much less interesting consistency of their evaluation.

Furthermore, JEPI is designed with a decrease portfolio focus than the SPX. Accordingly, the highest ten constituents in JEPI accounted for simply 15.5% of its whole internet property. In distinction, the S&P 500’s prime ten holdings accounted for practically 32% of its whole allocation. Subsequently, buyers on the lookout for a extra diversified portfolio ought to discover JEPI extra acceptable.

There’s little doubt that the Magnificent Seven have considerably influenced the S&P 500’s efficiency over the previous 12 months. The continued surge might additionally result in over-optimism dangers as most are not undervalued. In keeping with Morningstar’s valuation evaluation, solely Google (GOOGL) (GOOG) remains to be under its truthful valuation. With the tech sector accounting for about 31% of the S&P 500’s publicity, buyers making an attempt to chase alpha by going after its present upward momentum could possibly be struck by an unanticipated pullback. Consequently, I’ve confidence that JEPI’s extra defensive assemble might assist even whole return buyers mitigate these dangers by reallocating some publicity from the S&P 500.

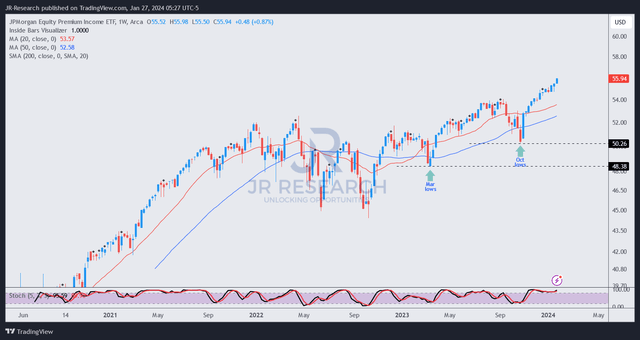

JEPI worth chart (weekly, adjusted for dividends) (TradingView)

As seen above, JEPI has regained its uptrend bias since October 2023 when adjusted for dividends. Consequently, I assessed that JEPI’s technique is working, however its relative underperformance to the S&P 500.

With the S&P 500 persevering with its rally after the latest consolidation, I do not count on the relative underperformance to reverse within the close to time period. Nevertheless, JEPI may gain advantage from a subsequent pullback and doubtlessly larger implied volatility, which has consolidated at its June 2023 lows.

As well as, JEPI ought to nonetheless obtain strong help from earnings buyers trying to capitalize on its comparatively enticing yields. Consequently, I see fewer causes to show extra cautious on JEPI, though it is not proof against potential market volatility resulting in a pullback.

In view of this, buyers can take into account the zone between the $50 to $52 ranges in the event that they anticipate a pullback within the broad market. Whereas JEPI’s coated name technique can doubtlessly mitigate draw back dangers, they do not present full safety. Consequently, steeper pullback within the broad market will seemingly nonetheless affect JEPI’s upward bias, affording buyers a extra enticing alternative to purchase weak spot.

Score: Preserve Purchase.

Necessary observe: Buyers are reminded to do their due diligence and never depend on the data supplied as monetary recommendation. Please all the time apply impartial considering and observe that the ranking is just not meant to time a particular entry/exit on the level of writing until in any other case specified.

I Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a vital hole in our view? Noticed one thing vital that we didn’t? Agree or disagree? Remark under with the intention of serving to everybody in the neighborhood to be taught higher!