Yagi Studio

High quality is a phrase thrown round quite a bit in relation to choosing shares, however until you’ll be able to quantify what high quality means, it would not actually imply a lot. High quality does matter, however it must be rules-based in my opinion to actually have confidence in a portfolio that claims to make use of that as the first issue. That is why the JPMorgan U.S. High quality Issue ETF (NYSEARCA:JQUA) is fascinating to me.

JQUA is a passively managed funding car that tracks the JP Morgan US High quality Issue Index. This index represents a basket of Russell 1000 constituents acknowledged for his or her sturdy high quality, profitability, and steadiness sheet well being indicators. Incepted in November 2017, JQUA has since showcased its potential to be a stable performer within the ETF market, with a robust deal with delivering high quality publicity to its traders.

And whenever you look on the value ratio of JQLA to the iShares Russell 1000 ETF (IWB), it is clear that the fund has been a winner, notably in the course of the tough years of 2021 and 2022.

StockCharts.com

The fund has proven constant development since its inception. The fund’s expense ratio stands at 0.12%, which is competitively low, making JQUA an economical funding choice.

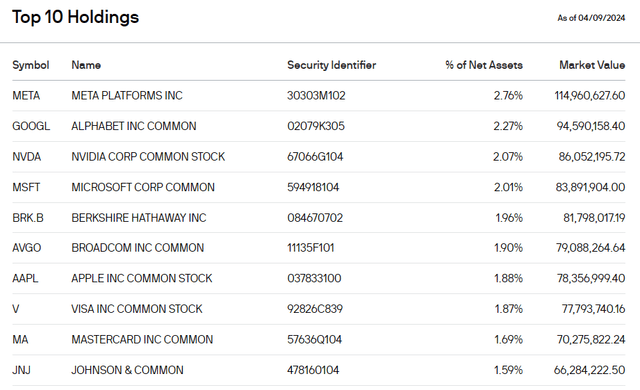

High Holdings: A Nearer Look

The JQUA portfolio consists of high-quality shares throughout varied sectors. These are all names you have to be accustomed to, however what’s most spectacular is that no inventory makes up greater than 2.76% of the portfolio. That is truly a really well-diversified repair, that appears totally different from the S&P 500 (SP500) and has carried out simply as effectively total.

jpmorgan.com

It is value noting that the fund has about 246 holdings, versus the Russell 1000 Index, which has 993. That is selective in what it is filtering for, which is what you need to see, particularly in relation to deciding on firms which have sturdy profitability. This issues in the next for longer rate of interest atmosphere to scale back the chance of firms being strained by increased curiosity expense by way of total debt administration.

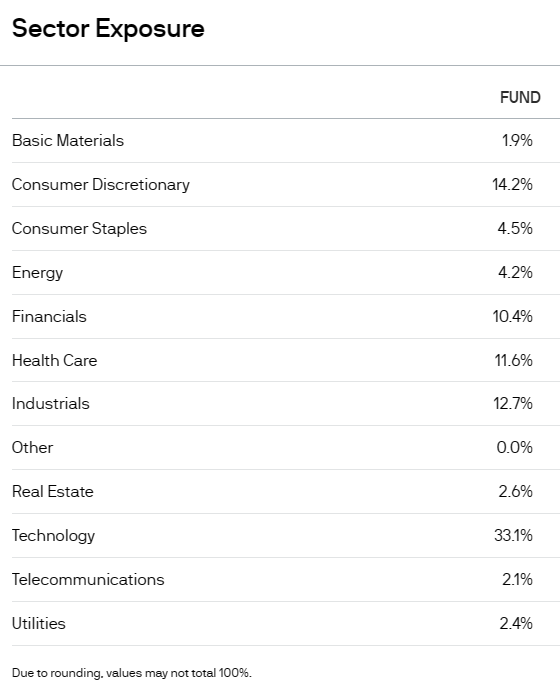

The one actual draw back, from my perspective, is that 33% of the fund is within the Know-how sector. I absolutely perceive many Tech shares could be categorized as high quality, however I nonetheless view this as a danger, simply given how outsized the efficiency of the sector has been. So, on the one hand, we have now a superb diversified mixture of particular person shares with managed safety weightings, however towards that also over-concentration sector-wise in Tech.

jpmorgan.com

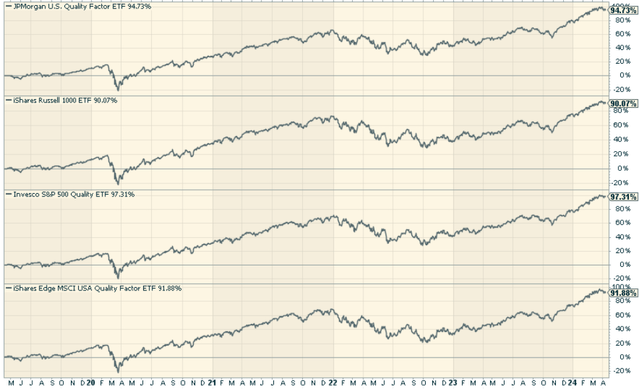

Peer Comparability: JQUA vs. the Rivals

Key rivals embrace the iShares Russell 1000 ETF (IWB), the Invesco S&P 500 High quality ETF (SPHQ), and the iShares MSCI USA High quality Issue ETF (QUAL). Total, these funds have accomplished effectively, with JQUA underperforming SPHQ and outperforming the others.

StockCharts.com

Professionals and Cons of Investing in JQUA

Professionals

Diversification: JQUA’s method ensures balanced publicity throughout varied shares, decreasing idiosyncratic dangers from firms in different market proxies that make up massive percentages of the general portfolio.

High quality Focus: The fund’s deal with high-quality, worthwhile firms enhances the potential for regular returns.

Low Expense Ratio: With an expense ratio of 0.12%, JQUA is an economical funding choice.

Cons

Market Volatility: Like all ETFs, JQUA is topic to market volatility, which may influence funding returns.

Potential Overvaluation: Given its deal with high-quality shares, there is a danger of overvaluation, which may influence future returns. It is not low-cost at a Worth-to-earnings ratio of 21.75.

Conclusion: Is JQUA a Worthy Funding?

Investing within the JPMorgan U.S. High quality Issue ETF presents a possibility to realize publicity to high-quality firms displaying sturdy profitability and sturdy steadiness sheet well being. With its diversified inventory combine, deal with high quality, and low expense ratio, JQUA stands out as a robust core fairness choice. Nonetheless, potential traders should think about market volatility and doable overvaluation dangers. Stable fund total, and I feel high quality will matter more and more within the years to return. At the very least this fund has a course of to outline that correctly.