Editor’s notice: Looking for Alpha is proud to welcome Investing In another way as a brand new contributing analyst. You possibly can turn out to be one too! Share your greatest funding thought by submitting your article for assessment to our editors. Get printed, earn cash, and unlock unique SA Premium entry. Click on right here to search out out extra »

Rafmaster

Funding Thesis

To start with, Jumia (NYSE: JMIA), an organization I regard as a juggernaut in its personal area, is just not at present in its greatest place. I consider the issues it’s going via could possibly be short-term offered it makes all the suitable selections. Macro-economic headwinds are the corporate’s largest issues and for my part are past its management. Primarily based on my evaluation, if the corporate can take main steps in direction of spreading past overreliance on a selected phase and market, its struggles generally is a factor of the previous. Due to this fact, Jumia (NYSE: JMIA) has a maintain score from me.

Introduction

Jumia is Africa’s main e-commerce platform with $244 million in income in 2023, and ~24 million lively clients; it operates within the following segments; on-line market, logistics and cost companies.

Jumia has managed to create a distinct segment marketplace for itself in Africa boldly dominating the area. With over half of the e-commerce market share, Nigeria is Jumia’s largest market and a big chunk of its operations are primarily based there, so is a big portion of its income from its operations there.

The case for Jumia

The factor with Jumia is that regardless of its juggernaut standing in Africa, it nonetheless has numerous issues it must work on. Having an e-commerce platform with solely 24 million lively customers- on tough estimate continues to be fairly low for an e-commerce platform. Although in Africa, as an investor at present on the continent, I do know that entry to the Web and onboarding of Expertise is an entire lot higher than that.

Not particularly reasonable for a comparability however I am going to use it anyway. Amazon has ~230 million clients in the USA, a rustic with entry to the Web of about 322 million as of March 2024. This represents about 71.4 p.c of the inhabitants with Web entry. Now, my case for Jumia and arguably so is that the variety of individuals with entry to the Web in Nigeria (one among its markets in Africa) is 154.8 million as of 2023, it has clearly grown as of now. Due to this fact, Jumia’s juggernaut standing in Africa accounts for under 15.5 p.c of the inhabitants of lively web customers in Nigeria (utilizing the estimated 24 million annual e-commerce platform clients), now this isn’t accounting for Africa as an entire.

I am not undermining its place because the main e-commerce platform within the continent, however I am simply highlighting that it has a possible wider and by far bigger market than it’s holding onto. I am going to blame this largely to the shortage of competitors within the area. Jumia must be much less comfy with being simply the biggest one and actually dominate the area.

Then there’s the foreign money problem

Nigeria is Jumia’s largest market. The nation’s proprietary foreign money the Naira has seen one of many worst devaluations amongst currencies prior to now yr. Highlighting longer time frames akin to throughout the previous 3 years and 5 years, the image appears to be like much more grim. Nonetheless, for the sake of my evaluation, I might be utilizing the previous yr.

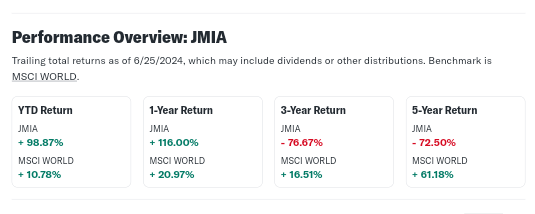

Jumia NYSE: JMIA efficiency report (Yahoo Finance – Inventory Market Reside, Quotes, Enterprise & Finance Information)

Whereas new holders (throughout the previous yr) of the inventory have their investments within the inexperienced. Traders who’ve owned the inventory for intervals of three to five years have seen close to abysmal losses across the -75% to -76% vary. Whereas I might partially consider that that will be broadly linked to the extraordinary devaluation of the Naira throughout the interval, however on the similar time, throughout the previous yr, it has seen a 116% improve, whereas the Nigerian Naira has decreased in worth by about 2.34 instances its former worth [using the Annual average exchange rate of one U.S dollar in Nigerian naira (NGN)]. Throughout the previous 3 and 5 years it has decreased ~3.78 instances and 4.61 instances its worth respectively.

Not being too intricate now, however other than the Nigerian Naira devaluation and the inflation within the nation’s financial system which is significantly worse prior to now yr, I consider its earlier poor efficiency must be linked to one thing else (that’s to say in context, it has been having a poor monetary efficiency over the previous yr, nonetheless, when the Nigerian financial system was considerably worse and witnessed its worst foreign money devaluation, Jumia managed to report a powerful inventory efficiency). This being stated, acknowledging that Nigeria is only one of its markets, although its largest.

Segments Assessment

Jumia’s operations are primarily based on the next segments;

On-line Market (e-commerce) enterprise

Logistics enterprise

Cost companies

On-line Market (e-commerce) enterprise

Jumia’s on-line market, which has principally been addressed earlier on this evaluation, is the largest of its segments. A majority of its clients are primarily based in a single market- Nigeria.

Nigeria is at present in a not so nice financial state of affairs, which in keeping with the enterprise is affecting its e-commerce enterprise.

Its opponents within the e-commerce (on-line market) area contains; jiji and Konga (see statista’s e-commerce analysis). On a much bigger scope (in Africa), its dominance continues to be unequalled with its buyer base being over double its nearest competitor.

Logistics enterprise

Jumia’s Logistics enterprise (Jumia com)

Its logistics enterprise, although considered a phase, is majorly depending on its e-commerce enterprise. This service principally offers with supply of products bought on its e-commerce platform. Additional, it would not have the monopoly of this as each clients and sellers on the platform can go for different supply strategies. I see this as a purple flag because it broadly limits the potential of the phase, making it unimaginable to face alone. Low gross sales in its e-commerce enterprise will inevitably have an effect on the logistics enterprise. Working in an business with the dimensions of ~US$10 billion (in Nigeria) opens up a window of intense alternatives. Nonetheless, Jumia appears to be struggling on this regard because it lately suspended its ‘logistics as a service’ enterprise, shedding the potential of tapping into this massive market.

Cost service enterprise

Jumia’s cost service (Jumia.com)

Valued at over $22 billion in 2022, the Nigerian cost companies business positions as one other potential marketplace for Jumia. Within the 2023 monetary yr, its proprietary cost service JumiaPay dealt with transactions to the tune of $192.2 million {dollars} (this covers all its operations in all its markets), exhibiting its means to successfully deal with giant quantities and volumes of funds. Nonetheless, quoting instantly from its 2023 monetary stories,

“JumiaPay Transactions corresponds to the whole variety of orders for services on our market for which JumiaPay was used, no matter cancellations or returns, for the related interval.”

Indicating that outdoors the Jumia e-commerce market, this phase is equally lower than its full potential as a majority of its transactions are associated to its e-commerce enterprise (nonetheless, it additionally handles different types of funds outdoors its e-commerce enterprise). I personally assume that that is unhappy seeing that primarily based on the quantity of transactions it handles, there is not any main assertion of its relevance outdoors the e-commerce area. Once more to notice that regardless of strides, if the e-commerce enterprise suffers, this phase suffers additionally. Ought to the corporate plan to dive totally into the market, main opponents could be Opay, Palmpay, Flutterwave, Paystack, and so on, with considerably greater market share.

This goes with out saying, I consider that each its logistics enterprise and cost service enterprise ought to evolve to be unbiased from its e-commerce enterprise. It has operated within the African area lengthy sufficient to at the least try to correctly market the thought to its giant buyer base.

Financials

Its earnings per share of the previous 12 months (EPS TTM) is -1.09, that is not good wanting ahead as an investor, despite the fact that I do know that projecting previous efficiency ahead is just not essentially the most logical funding evaluation, I consider it usually offers an image of the corporate. I imply what is the level of historical past if we can’t at the least attempt to study from it (although projecting previous efficiency ahead won’t give an correct image of the corporate’s future efficiency, it’s going to positively assist in seeing its present standing and would additionally assist to create an outlook to work with).

So, it had a income of $186 million prior to now fiscal yr, that is darkened by its working lack of $78 million (~42% of whole income). It has been in a position to handle the lower in its liquidity, a superb one from that finish.

Chatting with its shareholders in its report for 2023, it acknowledged the above highlighted financial points I predicted.

“Upheavals on the worldwide stage have had a big influence on African economies and its individuals. Excessive inflation charges and foreign money depreciation have led to a shortage of provide and have adversely impacted the buying energy of shoppers. These have been difficult instances for tech and retail companies throughout the continent. Towards that unsettling backdrop, we launched into a elementary transformation of our firm with a purpose to quickly enhance our financials and set up a stronger basis for our e-commerce enterprise. This transformation clearly got here with a painful short-term influence, as we discontinued actions with poor progress prospects, stopped costly advertising practices, and radically streamlined our group…”

Additional, highlighted its dedication to axe off enterprise actions and segments which might be inflicting the ship to sink.

“We consider that Jumia is now a a lot leaner, extra agile and extra centered firm. We’ve reevaluated our portfolio and made robust selections concerning enterprise actions that didn’t carry the suitable worth. Lately, we discontinued our meals supply operations as we concluded that the expansion prospects didn’t justify the complexity it created. We consider our focus and sources might be higher invested in our bodily items enterprise, the place we see extra alternative for income progress and better margins.”

Nonetheless, no matter its commitments and encouragement to shareholders, I see its financials in a large number, its property to liabilities ratio exhibits liabilities is about 64.2%, this can be a excessive threat particularly since its main issues primarily based on my evaluation and in addition confirmed by itself is majorly macro-economic, as such it is rather a lot our of its management.

By way of a holistic evaluation

Whereas there are double digits income will increase in fixed foreign money, there occurs to be a decline within the reported foreign money (USD). Additional, its discount in working prices, enhancements in gross income offers it a optimistic outlook transferring ahead. Nonetheless, it additionally wants to handle its lowering liquidity and lowering money flows. A lot of the negativity, I attribute to the devaluation of the Naira in its foremost market, reflecting how harmful it’s as it will probably make optimistic steps ahead appear to be steps in the other way. General, the corporate’s financials present a optimistic signal of enchancment as regards its operational metrics and a extra sustainable value construction. These are among the explanation why it’s nonetheless value holding.

A few of the tendencies I’ve seen within the firm’s efficiency is firstly, the shortage of curiosity in diversifying past its overreliance on a selected phase – e-commerce. Whereas this has most likely helped it construct its management standing within the business, I strongly consider it might obtain extra if it steps out of its consolation zone.

Additional on a macroeconomic stage, the devaluation of the Nigerian Naira has been a serious problem for the nation, with its Apex Financial institution (the Central Financial institution of Nigeria – CBN) working around the clock to handle. Points the CBN highlighted and goals to handle is the speculative holding of the US greenback and different foreign exchange in anticipation of a wider improve of their worth and consequently a lower within the worth of the Naira, heightened curiosity in Cryptocurrencies, heavy reliance on imports resulting in commerce deficits, elevated demand for foreign exchange, Inflation, and so on, mixed with its Debt Servicing Prices creates a multifaceted financial problem. My assertion is that at this level Jumia can solely react to it, take selections to safeguard itself, other than these it can’t actually do something about it.

Alternatives

Throughout the previous couple of months earlier in 2024, the Nigerian Naira witnessed a powerful surge in worth, changing into the most effective performing foreign money throughout the timeframe of a pair months. If such an occasion repeats itself, and the financial system of the nation stabilizes in such a state, the story could be completely totally different as Jumia wouldn’t solely routinely be on an extremely worthwhile aspect, however its e-commerce engagements in addition to different segments would primarily profit in no small manner. This could additionally make me change my score to a purchase.

Additionally, a transfer to make different segments unbiased would for my part be a optimistic recreation changer for the inventory as its efficiency will not be tied to a sure phase.

Additional, its standing topping the leaderboard of the e-commerce area in Africa would set it up for advantages ought to the business on the continent witness a optimistic improve.

Dangers

The financial system of its main market might additional deteriorate, whereas I do not see this occurring because it appears to have stabilized. I acknowledge that it’s nonetheless a really legitimate threat. Additional, any main points with its e-commerce platform would adversely have an effect on different segments seeing they’re so intently hooked up.

I failed to hold out a comparability to different pairs within the e-commerce area in Nigeria, due to its market share and the truth that none of its opponents are listed in a US inventory change, I felt no correct comparability is obtainable. JUMIA is uniquely in a category of its personal. Additionally, the evaluation to this point is majorly primarily based on its highest grossing phase by income – e-commerce, plus I consider you will need to notice that different segments: cost companies and logistics is using on its e-commerce enterprise, outdoors of its e-commerce platform, the opposite segments are negligible as they do not stand on their very own in any important manner, thus, the success or failure of the e-commerce enterprise would inform on each different segments.

Concluding ideas

The financial points in Nigeria, although legitimate as an excuse for underperformance, would buttress why I consider an organization’s operation shouldn’t be too chubby on an financial system, significantly on one popularly considered unstable.

Seeing that JMIA’s points are principally macro-economic, thus majorly out of its management. It might solely react to or at greatest be proactive to remain afloat.

My score on JMIA is HOLD, it appears to be taking some main steps which for my part is in the suitable route. Its YTD and 1 yr inventory assessment exhibits a optimistic uptrend additional, it’s fixated on the suitable issues.

Though I am not too impressed that it did not spotlight a call and steps to quickly and aggressively develop operations particularly out of its main stronghold- Nigeria. Now, I consider Nigeria, one among Africa’s largest economies continues to be a plus for the corporate, in spite of everything it has a inhabitants of lively web customers which is considerably greater than all the inhabitants of different African nations. Saying this, I additionally consider that worthy of notice is {that a} main optimistic improve within the Nation’s foreign money and financial system would immediately skyrocket Jumia’s income and progress. I assert additionally, that engaged on the independence of its cost service and logistics companies could be very useful for its stability transferring ahead.

Nonetheless, additional outlook not simply at Jumia however the nation’s financial system is crucial to make funding selections transferring ahead with a possible to vary my present score.