The “lengthy strangle squeeze” could conjure up a graphic picture nobody needs to be in.

However after seeing this commerce instance, many would have needed to be on this commerce.

Contents

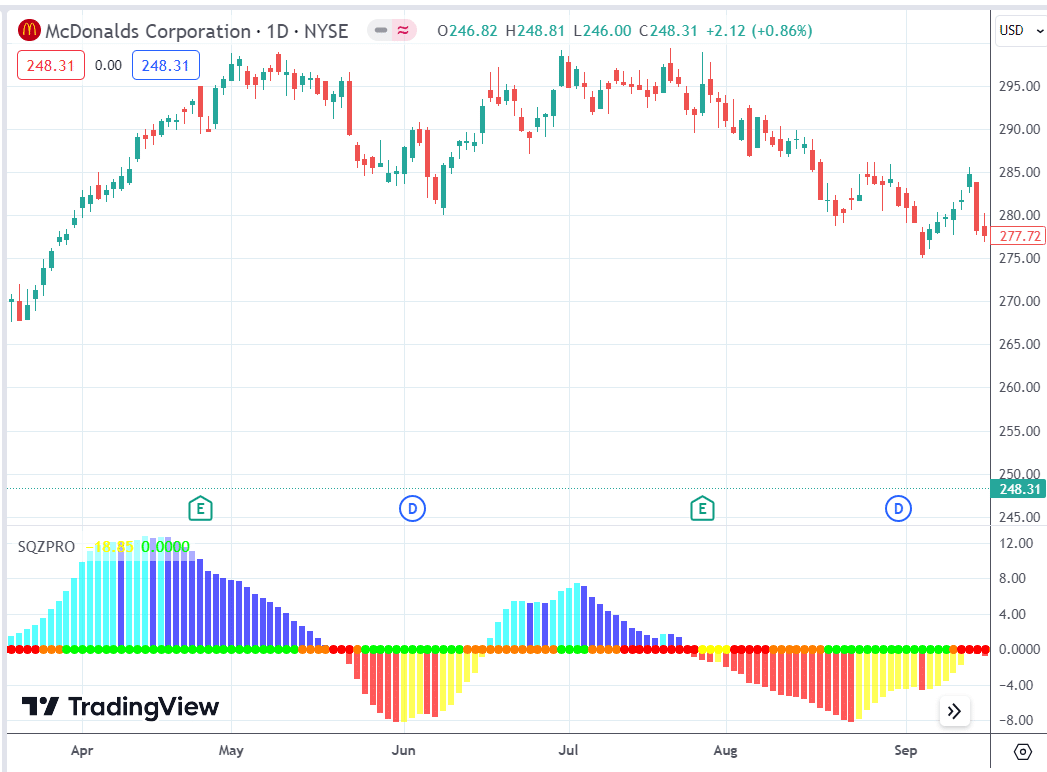

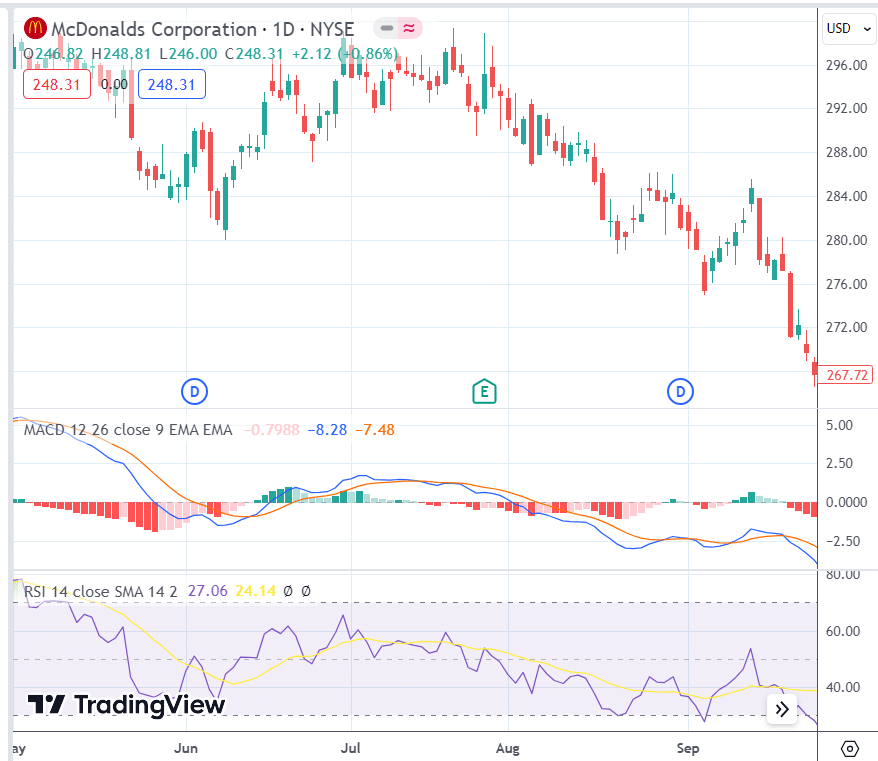

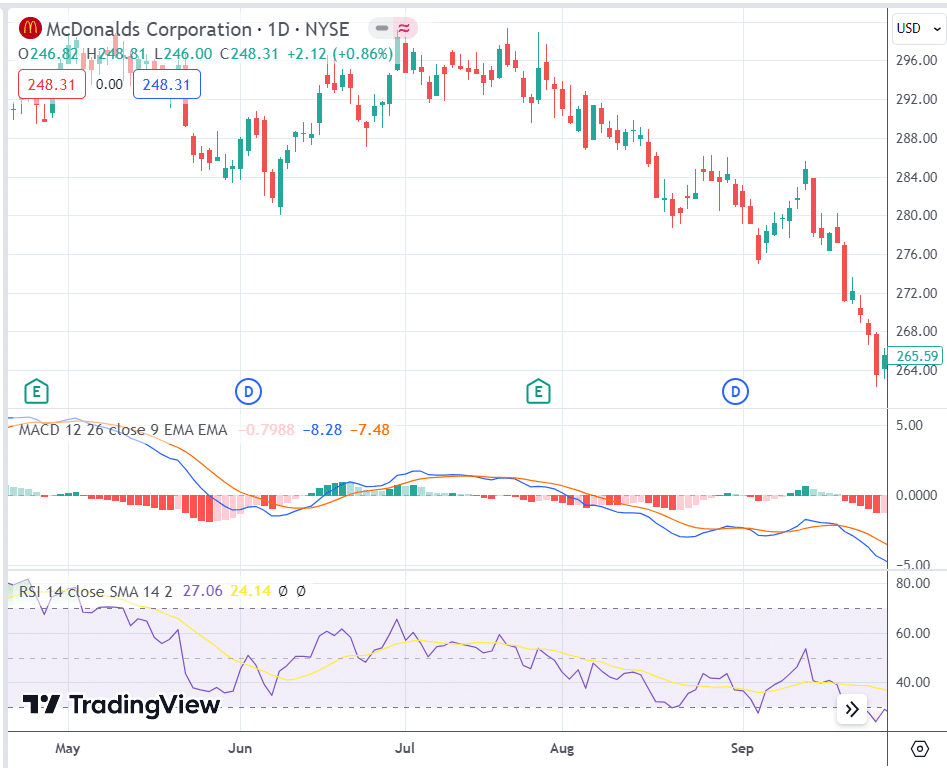

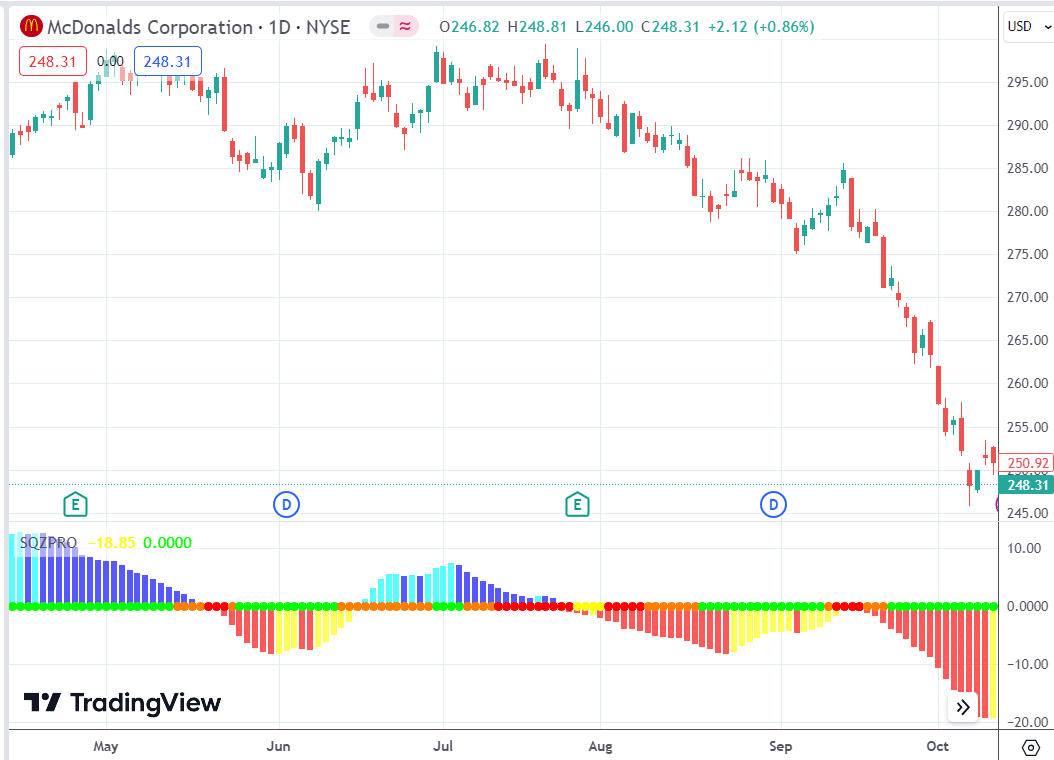

On September 18, 2023, we noticed three crimson dots within the Squeeze Professional indicator on McDonald’s chart.

See the FAQ under for the precise indicator proven right here in TradingView.

It’s good to attend for a minimum of two crimson dots earlier than contemplating it a sound “squeeze.”

A squeeze signifies that the value is in consolidation.

After a consolidation, the value will usually increase, transferring both up or right down to a brand new worth stage to consolidate.

We need to seize this transfer.

When this transfer occurs, we are saying the squeeze has fired, and the crimson dots flip inexperienced.

Whereas some merchants await the squeeze to fireside earlier than placing on the commerce, others want to be within the commerce earlier than it fires.

This squeeze firing would recommend that McDonald’s will make a “larger than anticipated transfer.”

Usually, if the inventory makes an “anticipated transfer,” then an extended name or an extended put would both breakeven or not make a lot cash as a result of the choice’s worth is already priced within the anticipated transfer.

As well as, any earnings from the lengthy name or lengthy put are being dragged down by the time worth decay of the lengthy choices.

Nevertheless, if the inventory makes a larger than anticipated transfer, shopping for choices may be worthwhile, particularly if the dealer buys the choices with expiration proper after an earnings announcement.

Though it was not confirmed then, McDonald’s reveals an earnings announcement on October 26 earlier than the market opens.

Due to this fact, the dealer buys the decision choice and the put choices, expiring on October 27 (after the earnings announcement), figuring that the choices will maintain their worth higher and never decay as quick.

Name choices and places choices expiring proper after an earnings date are in larger demand as a result of buyers need them for defense or hypothesis of the incomes occasion worth transfer.

Traders holding these choices won’t seemingly need to promote them till after the earnings announcement, once we would already be out of the commerce.

We don’t need to maintain the commerce via the earnings date.

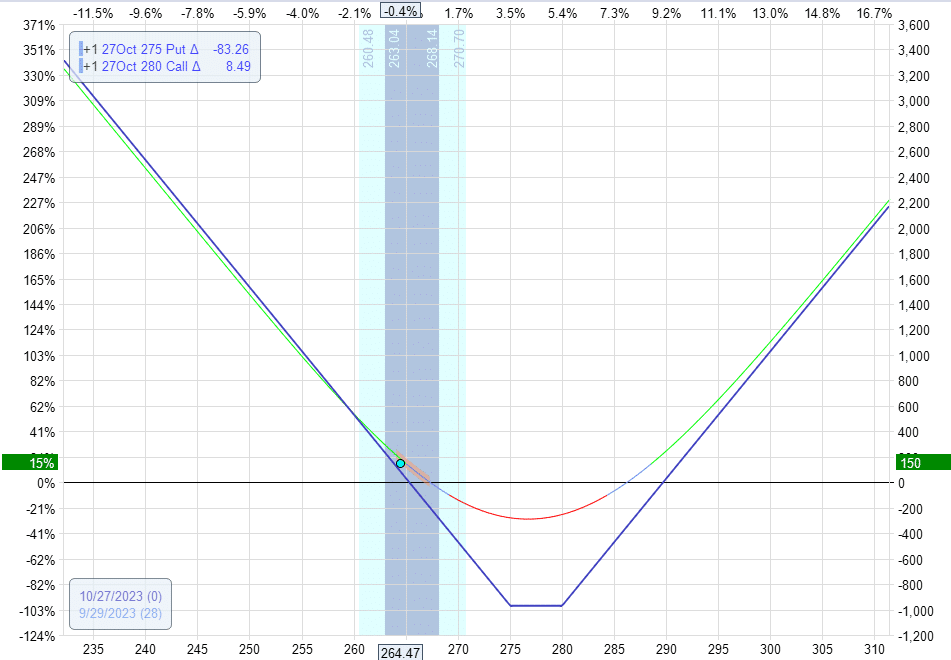

So let’s purchase a name and put choice on September 18 with expirations on October 27.

This selection construction is named a strangle. It is named a lengthy strangle as a result of we purchase the choices as an alternative of promoting them.

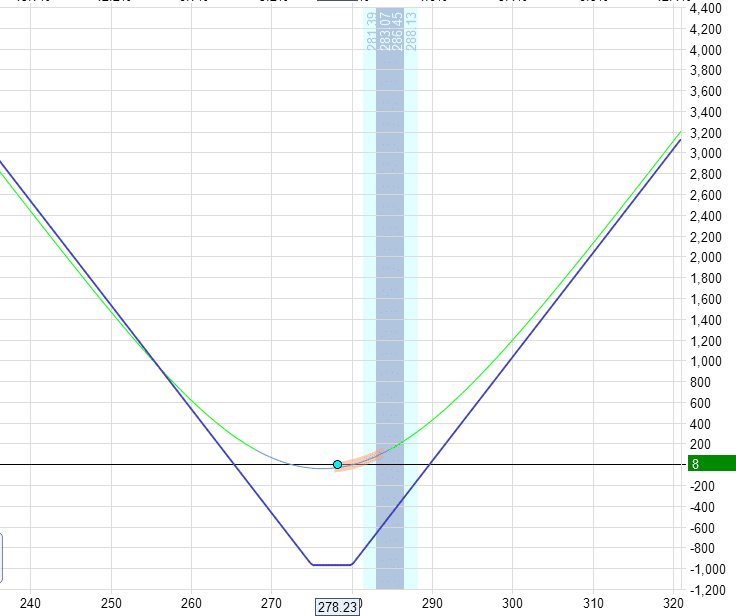

Date: September 18, 2023

Value: MCD @ $278

Purchase one October 27 MCD $280 name @ $3.70Buy one October 27 MCD $275 put @ $6.00

Web debit: -$970

The max danger on this commerce is the debit paid -$970.

We’ve a pre-determined psychological cease lack of 25% of our funding.

So once we test in on our commerce every day, if we see our P&L drop under -$240, we’ll exit the commerce to chop our loss.

We plan to exit the commerce on October 25 or earlier than the earnings announcement.

Since this isn’t an earnings commerce, we don’t need to maintain the commerce via the earnings announcement.

Whereas it might appear good to carry the commerce via earnings to see if the inventory makes a big transfer that can profit the commerce.

The danger is that implied volatility drops proper after the announcement, drastically lowering the worth of our lengthy name and lengthy put choices.

This drop is named a volatility crush and should impression our commerce extra negatively than the inventory’s post-earnings transfer.

It’s a simple alternative if we’ve got a constructive P&L earlier than the announcement.

Simply exit the commerce as an alternative of risking the earnings.

In any other case, you possibly can take the gamble on the earnings announcement.

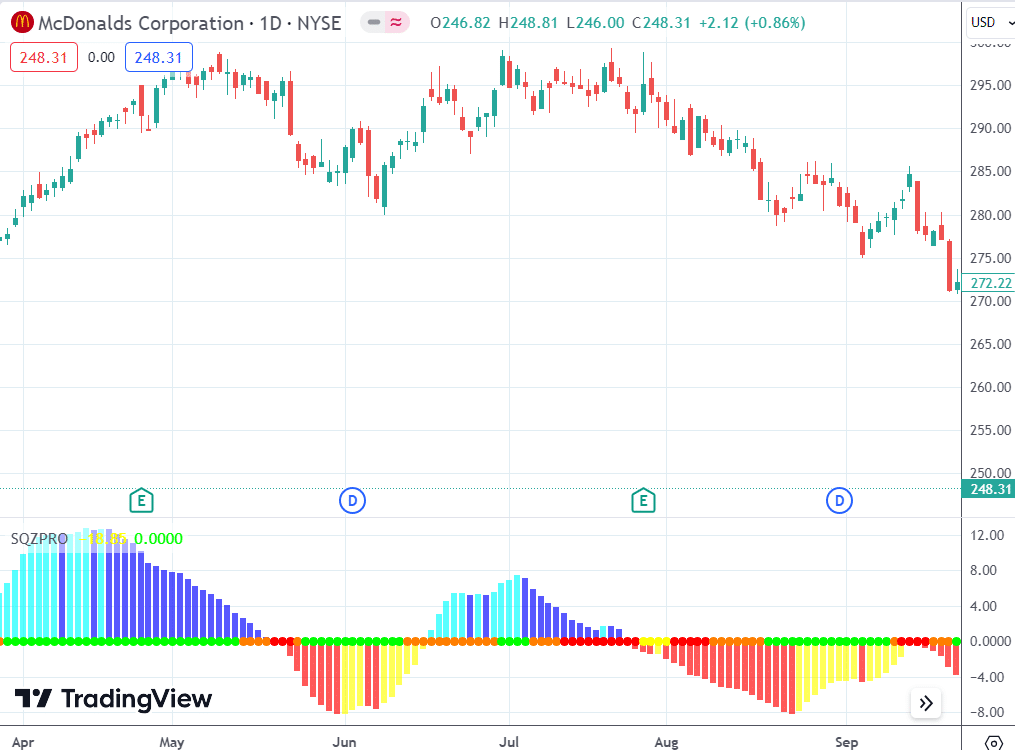

We see a inexperienced dot on the finish of the week on September 22.

The squeeze has fired.

The inventory is beginning to transfer (which is what we would like in an extended strangle).

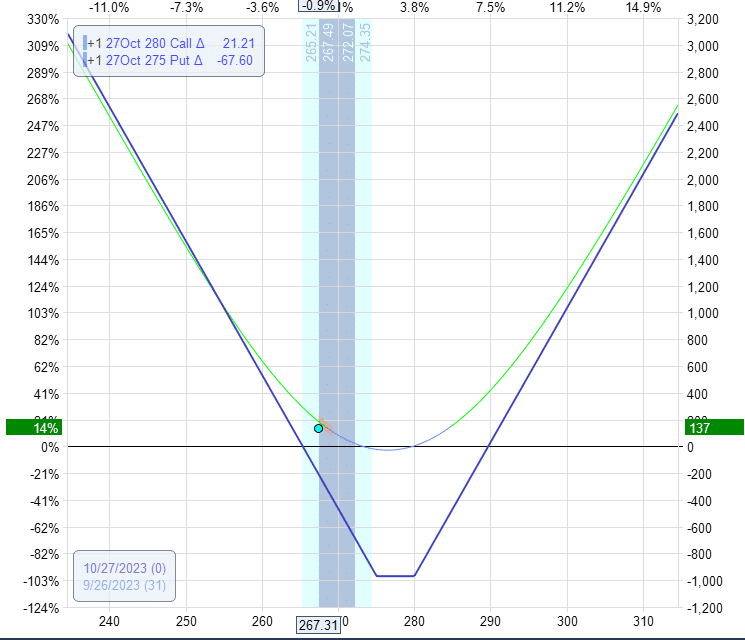

On September 26, the MCD strangle may be bought at $1108, giving the dealer a $138 revenue or a 14% return on capital in danger.

Except one is excellent at technical evaluation, it isn’t simple to know when the down transfer ends and to take off the commerce.

Some merchants could resolve to take the place off based mostly on the earnings achieved.

Others could resolve based mostly on worth motion and technicals.

That is what the candlesticks regarded like on September 26:

Right here, we see that RSI (with default settings) had dipped into the oversold situation, which could have been what prompted a technical dealer to take off the commerce and lock within the earnings.

Merchants who’ve purchased a number of strangles might have scaled out of the place with out exiting all contracts.

Better of Choices Buying and selling IQ

Different merchants could search for a flip again up on the MACD histogram; this occurred on September 28:

See how the MACD histogram went from shiny crimson to pink.

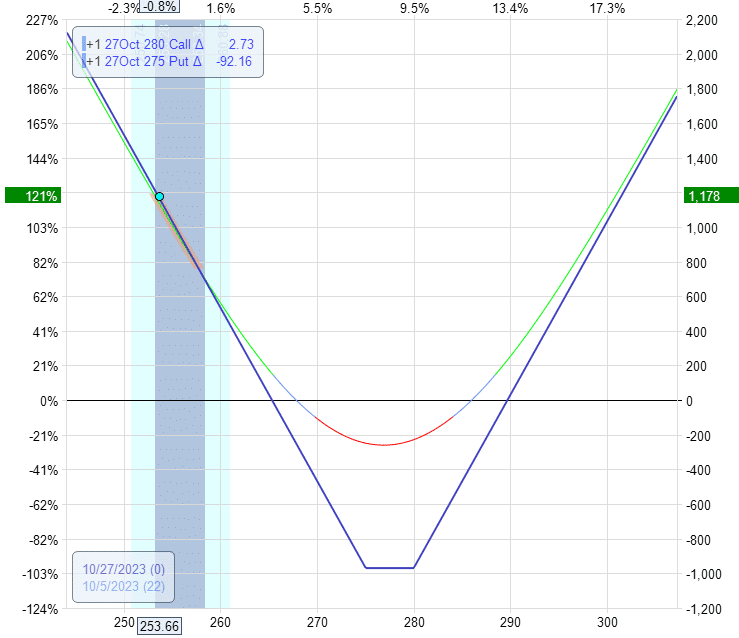

A dealer promoting the strangle the following day, on September 29, after seeing this could reap a revenue of $150, or 15%.

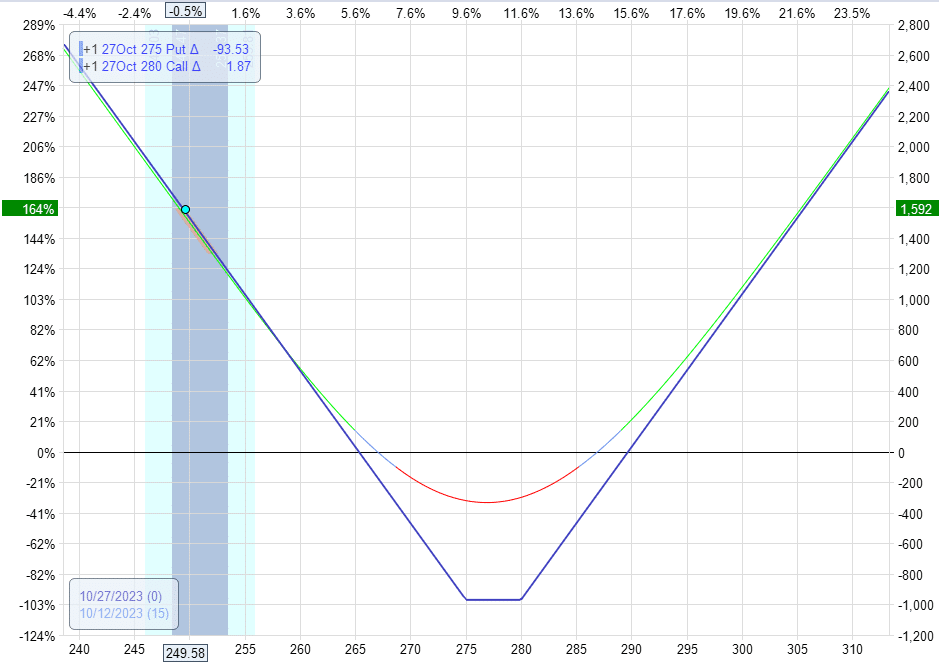

On October 5, the earnings would have exceeded the $1000 mark and would have given the dealer a 100% return on funding:

One other alternative to take earnings.

On this case, the down transfer remains to be not completed.

Because the Squeeze indicator acquired us into the commerce, why not use the identical indicator to inform us when to exit? Good thought.

On October 11, we lastly noticed that squeeze indicator histogram flip up.

That’s when the histogram coloration goes from crimson to yellow.

And if the dealer exits the following day after seeing that, the earnings could be $1591, or 164% return on the capital in danger.

With solely 15 days left to expiration, this concludes our instance.

When an earnings date is unconfirmed, the date can change. Throughout this commerce, McDonald’s modified its earnings date from October 26 to the confirmed date of October 30.

That signifies that the worth of the choice contracts with an expiration of October 27 would now not be held up by the earnings date of October 30.

In any case, this commerce labored out primarily due to the squeeze and the massive worth transfer by McDonald’s.

Hooking our choices with the earnings date solely has a minor secondary impact.

The place can we see the confirmed earnings date?

There are numerous sources. One is EarningWhipsers.

It has a checkmark subsequent to the earnings date, that means it’s confirmed.

In case you hover over the checkmark, it tells you when it was confirmed.

It was confirmed after we had positioned the commerce.

Supply: earningswhipsers.com

Might the commerce be exited when the RSI comes out of oversold situation as an alternative of when it goes into oversold situation?

Definitely, and a few merchants would await that.

There are execs and cons.

Typically, a inventory can keep in oversold situation for a really very long time; generally, a inventory will contact oversold and are available out instantly.

Troublesome to know prematurely.

It’s as much as the person dealer to resolve when to exit the place.

What’s the distinction between a straddle and a strangle?

A straddle is when the strike worth of the put choice and the decision choice are the identical.

A strangle is when they’re at totally different strikes.

This commerce might have been executed as a straddle.

Nevertheless, we went with strangle since MCD was buying and selling at $278 proper between two main strikes of $275 and $280.

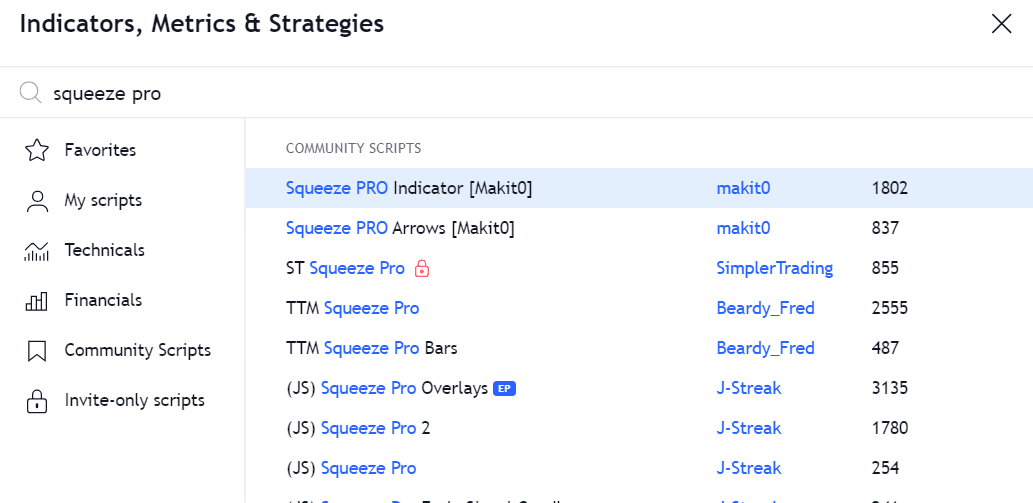

Is the squeeze indicator free?

Though the “Squeeze Professional” is a paid indicator by SimplerTrading, the older model, “TTM Squeeze,” is free on many platforms, resembling ThinkOrSwim and barchart.com.

Nevertheless, they could not give the identical alerts attributable to implementation and configuration variations.

In TradingView, there are freely accessible neighborhood scripts. One known as “Squeeze PRO Indicator” by Makit, which is used on this instance.

It’s based mostly on SimplerTrading’s Squeeze Professional. However it’s NOT the official SimplerTrading Squeeze Professional, which is proven under as “ST Squeeze Professional” with a lock icon subsequent to it.

It has a locked icon as a result of it will likely be accessible so that you can use on TradingView if you are going to buy the indicator from SimplerTrading.

What do the orange and yellow dots within the indicator imply?

The crimson dot is the conventional compression, and the orange dot is a lesser compression.

The yellow dot is a better compression or squeeze.

Mcdonald’s, with a beta of 0.65, is taken into account a slow-moving inventory.

Nevertheless, when squeezed, it will possibly nonetheless transfer.

A squeeze suggests a larger than anticipated transfer the place the anticipated transfer is a statistical calculation based mostly on choice costs.

The magnitude of the transfer and the potential returns on the commerce are additionally troublesome to know prematurely.

And the squeeze won’t at all times work out as properly on this instance.

The lengthy strangle construction has limitless upside potential.

Therefore, the returns may be anyplace from 10% to greater than 100% return on capital.

After all, it may be a loss, too.

If the transfer doesn’t materialize or the inventory strikes too little, the time decay will eat up all of the earnings till the strangle worth goes to zero at expiration, and the dealer loses 100% of the capital invested.

This is the reason merchants would hardly ever maintain this commerce to expiration.

A squeeze doesn’t recommend a path.

Due to this fact, the dealer should have a look at different components like worth motion or different indicators.

If a path is obvious, the dealer could make a directional commerce by both shopping for a name or a put or utilizing directional spreads.

If the path is unclear, the dealer can wait till the path is obvious.

Or purchase in each instructions, as in our instance.

The time decay of the lengthy choice could also be decreased if one buys choices related to earnings.

Lastly, the lengthy strangle or lengthy straddle can act as a black swan hedge.

Had the market crashed whereas within the lengthy strangle/straddle, we’d not have been anxious as a result of the massive down transfer would have made the lengthy strangle/straddle worthwhile.

We hope you loved this text on the lengthy strangle squeeze.

If in case you have any questions, please ship an electronic mail or depart a remark under.

Commerce secure!

Disclaimer: The data above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for buyers who should not accustomed to trade traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.