lechatnoir

In a market the place rates of interest are at highs, there are loads of shares which might be in danger. Principal Avenue Capital (NYSE:MAIN) is one which has weathered the storm and shareholders at the moment are benefiting from a yield wherever from 7-10% relying on the supplemental dividends being paid out. Principal Avenue Capital has a powerful portfolio that results in sturdy revenue era due to administration investing in high quality companies at floating rates of interest. Whereas I do not assume there are a ton of capital positive factors available, I do assume Principal Avenue Capital is a purchase primarily based on the dividend alone. This can be a secure place to cover in a turbulent market.

What Is Principal Avenue Capital?

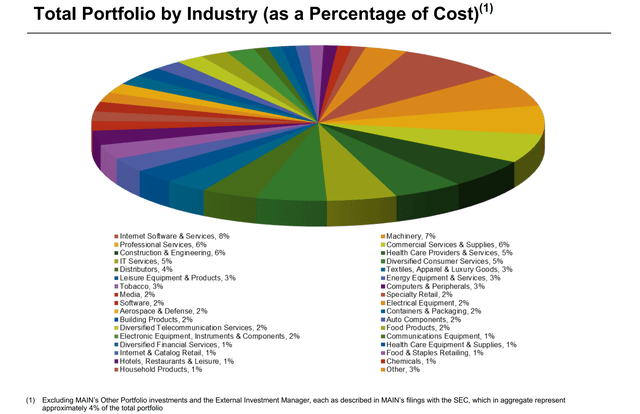

Principal Avenue Capital Company is a enterprise growth firm (BDC) that focuses on fairness capital to decrease center market firms. BDCs present capital wanted for initiatives, and in return, they obtain an possession place or a debt stake yielding above-average rates of interest. With respect to Principal Avenue Capital, they concentrate on companies with income between $10-150 million, and EBITDA of $3-20 million. They at the moment have over $6.8 billion in capital beneath administration. Trying under you possibly can see simply how various the portfolio is.

Principal Avenue Capital

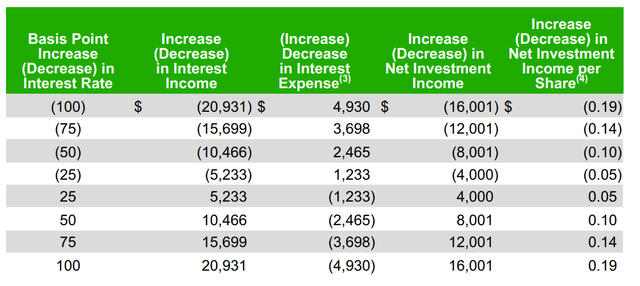

In case you are in search of an funding to fight rising rates of interest, look no additional. Principal Avenue Capital’s revenue solely will increase as charges go up. Which ends up in them paying a powerful dividend. Extra on that later. However, one of many belongings you need to see in dividend payers is reliable revenue. 75% of Principal Avenue Capitals’ excellent debt obligations have fastened rates of interest whereas 70% of Principal Avenue Capitals’ debt investments bear curiosity at floating charges. This helps hold prices down whereas permitting them to profit from the rising price atmosphere now we have seen within the final couple of years. An ideal mixture. Trying under, you will get an thought of how this works with respect to foundation level adjustments in rates of interest.

Principal Avenue Capital

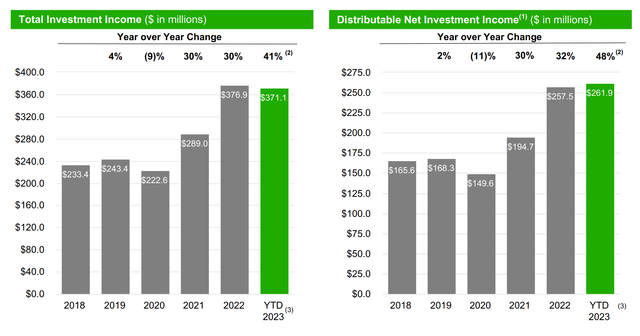

With respect to how this has mapped itself out over the previous few years, you possibly can see under simply how a lot of a surge there was in funding revenue as charges transfer up. YTD, they’ve generated 41% extra revenue. BDCs should meet sure necessities to maintain their particular standing and keep away from having to pay taxes on the company stage. One in every of these is that they need to distribute not less than 90% of their taxable revenue to shareholders yearly within the type of dividends. That’s the place Distributable Web Funding Revenue (DNII) is available in. The bigger the DNII, the better the payout should be to keep up its particular tax standing.

Principal Avenue Capital

Due to this, I do assume we’ll proceed to see sturdy dividend development out of the corporate. It will result in elevated revenue for shareholders with minimal draw back danger. To not say there aren’t any dangers, however within the meantime, let’s discover simply how good this dividend is.

How About That Dividend?

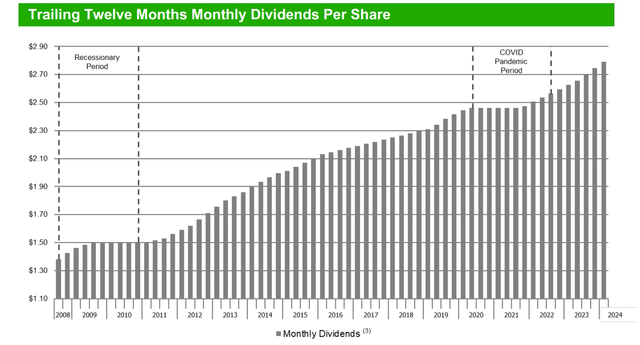

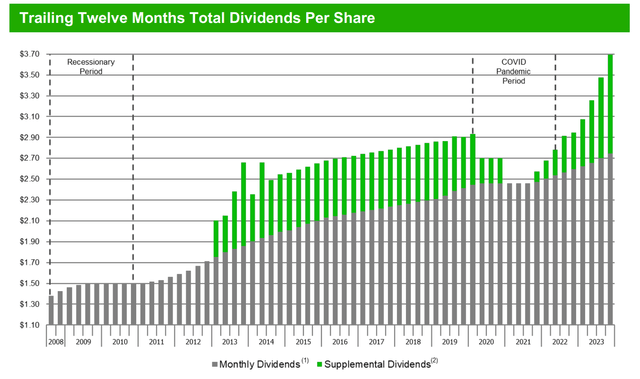

In case you are in search of a inventory to hook you up with capital positive factors, transfer alongside. Principal Avenue Capital isn’t for you. In case you are in search of regular, dependable revenue. Welcome dwelling. At the moment yielding 7.0%, Principal Avenue Capital is amongst the most effective choices on the market. The inventory pays a month-to-month dividend of $0.24 per share after the rise introduced on November 1st. This takes impact in Q1 (Jan, Feb, Mar) and represents a 6.7% improve from Q1 23. That is additionally the fifth improve within the final 6 quarters. Fairly spectacular monitor document.

Trying under, we are able to see the annual payout during the last handful of years. They’ve by no means minimize the bottom dividend, and it has elevated 118% since IPO in late 2007. Granted some systematic financial downfall, we’ll set a brand new all-time excessive dividend of $2.88 in 2024. However, I do anticipate the will increase to proceed which means we’ll possible see much more than $2.88 paid out in 2024.

Principal Avenue Capital

Oh, what’s that? Particular or “supplemental” dividends you say? Why sure! Typically forgotten about is the wealthy historical past Principal Avenue Capital has with supplemental dividends. The corporate has paid or declared, together with supplemental dividends, since IPO, by the primary quarter of 2024 equal $39.54 per share. To place that in perspective, the inventory is at the moment buying and selling at simply over $40.00 per share. Fairly unbelievable stuff. The latest supplemental dividend for December ends in an extra 35% paid out to shareholders during the last 12 months. This brings the precise yield nearer to 10%, which is tough to seek out wherever. Even higher information? It is already anticipated that they are going to be handing out one other supplemental dividend in Q1 24.

Principal Avenue Capital

How safe is the dividend? Nicely, if paying out extra money to shareholders serves as any indication, it’s totally secure. Principal Avenue Capital makes use of distributable internet funding revenue (DNII) to find out how a lot it may afford to pay out. In Q3, DNII exceeded the month-to-month dividends by $0.35 per share, or 51% and the overall dividends by 8%. It’s due to the constructive outlook on DNII going ahead that the corporate can already anticipate additional supplemental payouts. Even once we noticed DNII fall within the Covid years, the corporate didn’t minimize the bottom dividend, and as you possibly can see above, shortly reinstated supplemental dividends. That is certainly one of many causes you possibly can sleep nicely with Principal Avenue Capital in your portfolio.

What Are The Dangers?

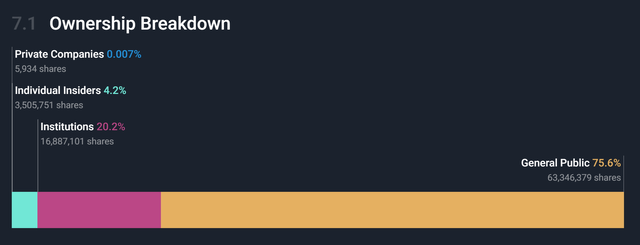

I see two potential dangers. The primary being the possession of the inventory. Trying under, you possibly can see that most of the people owns 75.6% of the float. Whereas lots of which might be going to carry for all times and simply gather the dividend, there’s a chance that there’s an irrational rush for the exit ought to the economic system take a flip for the more severe. Sure, this potential exists if it is closely institutional, however traditionally most of the people acts extra primarily based on crowd considering than having a look on the fundamentals. Simply one thing to pay attention to.

Simplywall.st

The second danger is when the economic system finally improves, and rates of interest begin to come again down. Whereas I do not assume we’ll see 2% charges once more anytime quickly, any change does have an effect on the underside line. As talked about earlier with respect to normal sensitivity, their debt is fastened whereas their revenue is floating, so this could solely damage the underside line. I do anticipate to see charges begin to slowly come down in 2024.

That mentioned, I do assume the portfolio is various sufficient that the influence is minimal and long-term, Principal Avenue Capital will come by any price adjustments and proceed to reward shareholders with a really wholesome dividend.

What Does The Value Say?

When you have learn my work earlier than, that is the half within the article the place I discuss concerning the technical facet and simply how a lot upside or draw back I anticipate. Nonetheless, with a inventory like Principal Avenue Capital, you might be actually simply shopping for for the dividend. I do not actually see any big strikes coming with respect to capital positive factors. This inventory is a gradual engine and is targeted on producing revenue for its shareholders.

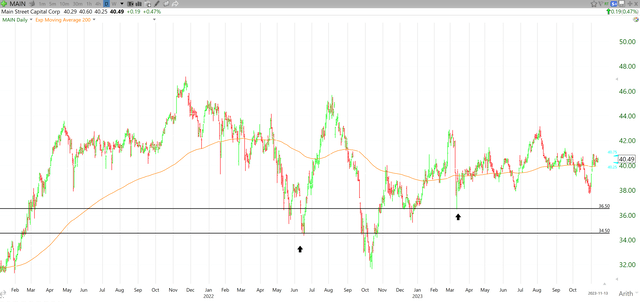

That mentioned, I need to make sure that buyers nonetheless have stops in place. Though the dividend wasn’t minimize in 2020, the inventory nonetheless dropped ~70% with every thing else in sight.

TC2000.com

Trying above, we are able to see that the inventory has typically been pretty secure outdoors of some remoted peaks and valleys. The 200-day shifting common has been a reasonably good level of help and resistance, and we are able to see the inventory is browsing proper alongside that stage at the moment. With respect to stops, I might have them in at $36.50 & $34.50. This offers you the choice to keep up a smaller place ought to your first cease get triggered whereas ready to see what course we go from there.

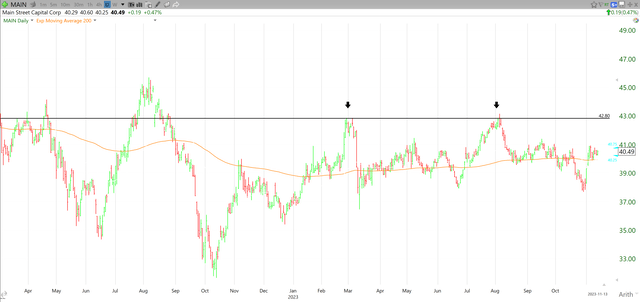

With respect to the upside, we have to see one other check of $42.80. That is solely 6% from present ranges. A breakthrough right here can lead us to $45.00 and past. Having examined $42.80 twice this yr and having fairly fierce rejections means a breakthrough ought to type fairly heavy help there. One thing to regulate for positive.

TC2000.com

That mentioned, nobody is shopping for Principal Avenue Capital for short-term capital positive factors. In case you are shopping for, you might be shopping for to gather the dividend for the long run. I nonetheless assume you will need to have stops in place attributable to how fragile the economic system appears to be, however you possibly can sleep nicely at evening letting the dividend pile up.

Wrap-Up

As you possibly can see, this can be a inventory that many personal merely for the dividend, and I might advocate including it to any revenue portfolio. Many are on the hunt for yield, and this can be a nice possibility that ought to maintain sturdy within the present market. I consider you possibly can relaxation simple figuring out that you just’re gathering a well-covered dividend over the subsequent couple of years. Principal Avenue Capital is nicely diversified and can fly by any form of rate of interest turbulence easily.