Volvo EX90, full electrical SUV, exterior the official dealership. Luca Piccini Basile/iStock Editorial through Getty Photos

The newest buzz phrase to mesmerize the worldwide auto trade is the “software program outlined automotive,” a descriptor for automobiles which can be more and more electrified, containing options – some as soon as mechanical – that now are managed by computer systems and software program applications.

Volvo’s new EX90 three-row giant SUV exemplifies the development in the direction of automobiles filled with digital know-how, which has been gaining momentum and is proving to be a rising alternative for every kind of high-tech suppliers, from the makers of radars and cameras to the creators of code.

NVIDIA Company (NASDAQ:NVDA) dabbled within the automotive enterprise greater than a decade in the past, supplying graphics for automotive shows, a enterprise that quickly grew to become commoditized. As self-driving, connectivity, and energetic security options resembling computerized braking and over-the-air (OTA) updates grew to become extra frequent, vehicles required huge computing energy, opening the door to the designers of chipsets with supercomputing functionality.

Tesla, Inc. (TSLA), recognized primarily for its success with batteries, could also be credited with one other key automotive innovation: A single central pc that controls all of a car’s digital features, with extra chips for redundancy. Previous to Tesla’s single giant pc, digital options on a typical automotive resembling home windows, windshield wipers, infotainment and so forth had been wired to an digital management unit – ECU – and all had been networked and powered by the battery or generator.

All wired up

The wire harnesses connecting a car’s electrical elements and their ECUs had been heavy, cumbersome and carried solely a restricted quantity of information.

Till 2019, Tesla furnished its automobiles with Nvidia’s Drive PX computing platform, which managed superior driver help techniques (ADAS) – a precursor to autonomous driving. Tesla then switched to its in-house designed computing platforms. The automaker continues to buy Nvidia’s celebrated H100 chips for synthetic intelligence coaching functions.

Volvo’s choice to put in central computer systems utilizing Nvidia’s Drive Orin system on a chip for the primary time in considered one of its fashions was pushed by the rising use of cameras and sensors for superior energetic security and different options, which require extra capability and knowledge processing speeds that currently are measured in trillions of operations per second – TOPS. Drive Orin, the corporate says, is rated at 254 TOPS.

Nvidia Drive Orin (Nvidia)

The battery-powered EX90, beginning at about $81,000, will likely be outfitted with radars, lidar and cameras and be capable of create a 360-degree view across the automotive that may detect small objects a whole bunch of yards forward, nudge or alert a driver who’s distracted or drowsy; Pilot Help that adjusts pace, steering and braking; adjustment for the form and depth of headlights; and bidirectional charging for utilizing energy to gentle a house or switch energy to a different Volvo EV.

Extra knowledge quickly

Initially, Volvo’s lidar unit will be capable of join knowledge although it will not be built-in into the car’s features till some future date, which will likely be completed by OTA.

Volvo Lidar unit on roof of EX90 (Volvo)

EX90 connectivity tech additionally facilitates OTA in order that software program could also be repaired, enhanced and maintained and not using a dealership go to.

With automotive software program’s alternatives and enhancements can come pitfalls as effectively. Volvo’s EX30, a smaller battery-powered automotive imported from China that was launched within the U.S. earlier this yr and has been pulled from the market as a consequence of U.S. tariffs, has reportedly suffered a software program glitch affecting its speedometer.

As AI replaces crypto as the excitement of the second for fairness markets, Nvidia in the intervening time occupies a prime place among the many most watched shares. The corporate’s massively powered chips are wanted to “practice” AI algorithms. The keenness for AI’s potential to extend the productiveness of main industries is mirrored within the firm’s newest monetary outcomes, that are fairly dazzling.

Q1 income on a GAAP foundation for fiscal 2025 was up almost three-fold from a yr in the past, with internet earnings up almost five-fold. Gross margins are a hair beneath 79%, up from about 67% a yr in the past. The AI and supercomputing industries are actually begging for Nvidia chips and are keen to pay almost something to get them.

Spectacular numbers

For the second, automotive income and earnings represent a sliver of Nvidia’s enterprise. First quarter Automotive income was $329 million (of a complete income of $26 billion), up 17% from the earlier quarter and up 11% from a yr in the past.

Among the many giant variety of automotive corporations that purchase Nvidia chips are Mercedes-Benz (infotainment), Jaguar Land Rover, SAIC, Rivian, Hyundai, Lucid, Polestar, Zoox, and Cruise. In 2023, Chinese language automakers BYD, XPeng, Li Auto and NIO introduced that they might be utilizing high-speed Nvidia DRIVE Orin platforms of their automobiles. The worldwide marketplace for gentle automobiles is rebounding, having reached 88.8 million in 2023 – increasingly more will likely be outfitted with high-tech options that require superior pc processing.

The long run is not fully shiny. Since 2022 Nvidia has confronted U.S. authorities export restrictions on its chips to China, primarily for knowledge facilities, primarily based on nationwide safety issues. How chip shipments will likely be affected is unclear primarily based on a wide range of components together with how in depth the White Home needs to restrict exports and the actions of different international locations which may be exporting Nvidia chips to China.

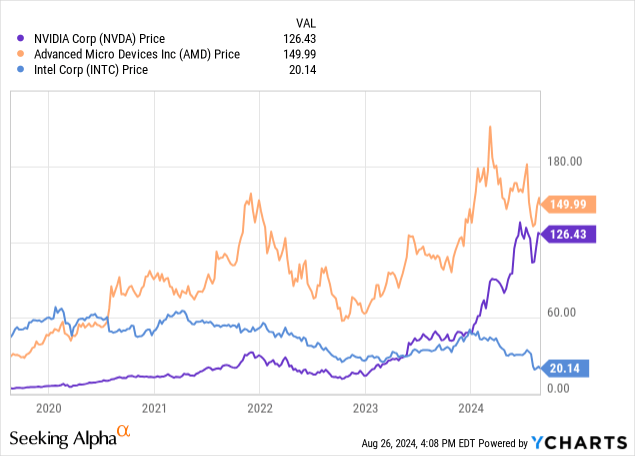

Volvo’s EX90 is one car that seems to be resistant to the hazard of export controls disrupting its manufacturing. The long run might be very shiny for Nvidia’s automotive enterprise so long as automotive corporations proceed to change to digital architectures – as they seem like doing – and that Nvidia stays a prime competitor amongst chipmakers, which embody Superior Micro Units, Inc. (AMD) and Intel Company (INTC). Alphabet Inc. (GOOG) (GOOGL), Microsoft Company (MSFT), and Amazon.com, Inc. (AMZN) – essential Nvidia prospects – are designing their very own chips for inner use.

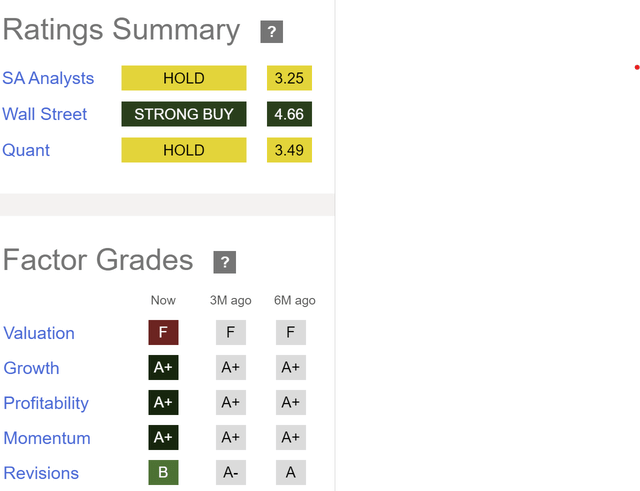

In search of Alpha’s analysts and its Quant Ranking currently have grown extra bearish on NVDA shares, probably due to their F grade for valuation. But, the Quant’s Progress, Profitability, and Momentum grades stay fairly sturdy. A brand new Nvidia Blackwell chip has been delayed, main currently to some hesitation amongst some analysts.

In search of Alpha scores on Nvidia (In search of Alpha)

Generative AI – machine studying that makes use of language and different knowledge to create new content material resembling texts, video, music, audio, and, sure, driving directions – seems to this analyst like a area whose progress is simply starting and is more likely to be exponential.

Nvidia – which dominates its class by dint of early mover benefit and an infinite market capitalization – will expertise ups and downs as opponents come up. Nonetheless, the corporate’s longer-term development seems to be fairly constructive and can profit these holders with a long-term funding perspective.