da-kuk

On January eleventh, 2024, spot Bitcoin (BTC-USD) ETFs began buying and selling in US markets for the primary time. This is a gigantic optimistic step for the cryptocurrency business and for Bitcoin particularly as an investable asset. Frankly, since Grayscale received its lawsuit with the SEC final yr, the approval of those ETFs has been a considerably anticipated formality. There are a lot of implications from these approvals.

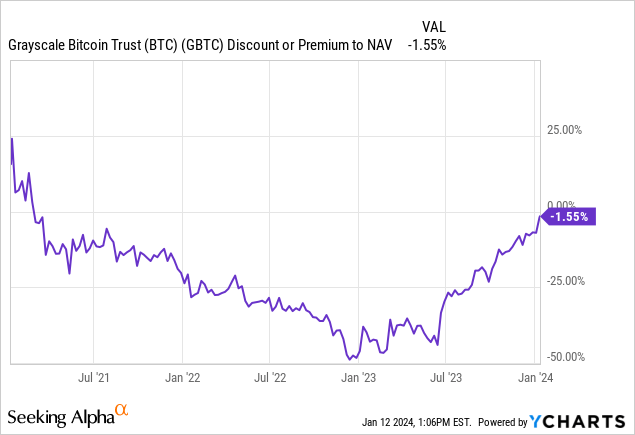

In anticipation of this resolution, the NAV low cost arbitrage window within the Grayscale Bitcoin Belief (GBTC) has successfully come to an in depth following the fund’s profitable conversion to an ETF. That low cost fee at the moment sits at 1.55%. It has been an exceptional commerce from a 50% low cost up to what’s basically honest worth now and I am glad to have been on the precise aspect of that decision over the final yr. For my part, that is the place the NAV fee will possible stay going ahead.

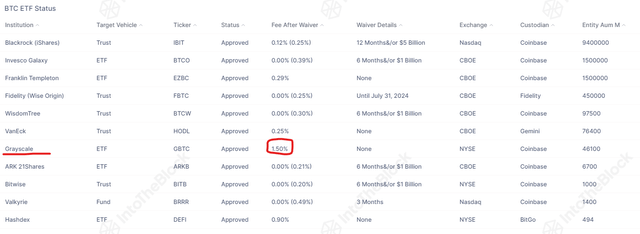

Bitcoin ETFs (IntoTheBlock)

Now that traders have almost a dozen extra spot Bitcoin ETFs to select from, charges have develop into a race to the underside and Grayscale’s 1.5% payment is not aggressive. That payment is probably going being baked into the NAV low cost. The purpose is, I do not foresee an excessive amount of variance for the low cost fee in GBTC any longer. For arbitrage merchants with a digital asset-lean, that does not depart many choices:

Grayscale Fund NAV Charges (Writer’s Desk/Calculations)

We nonetheless have 13 extra single-asset Grayscale trusts that commerce at vital premiums and reductions. As I famous with my protection of the Grayscale Litecoin Belief (OTCQX:LTCN) late final yr, I do not assume it is clever to mess with these funds after they’re buying and selling a number of multiples above NAV. Shorting them might be too harmful given the character of the market and the quickness with which digital belongings can transfer.

However if you happen to’re in search of low cost arbitrage in a market that’s lastly being allowed to mature, your single asset Grayscale choices are actually restricted to the Grayscale Ethereum Belief (OTCQX:ETHE) and the Grayscale Ethereum Basic Belief (ETCG). The Bitcoin pure play arb is gone.

The Osprey Alternative

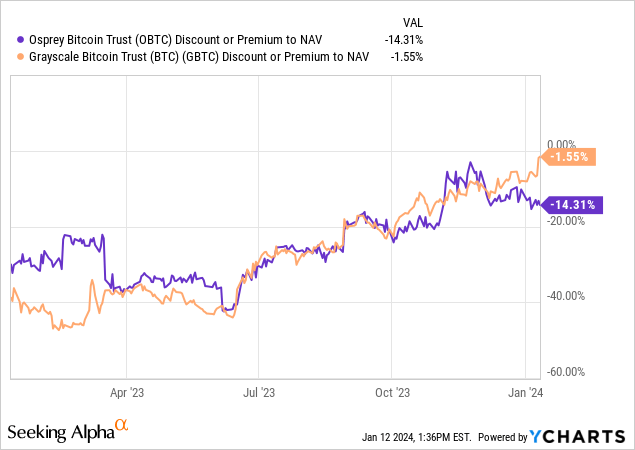

Fortuitously, there’s nonetheless one other alternative to purchase Bitcoin at a sizeable low cost to internet asset worth. The a lot lesser recognized Osprey Bitcoin Belief (OTCPK:OBTC) nonetheless trades with a double determine NAV low cost:

With a 14% intraday NAV low cost on January twelfth when this text is being submitted, OBTC is buying and selling close to its steepest low cost since early November. The low cost fee in OBTC largely held tight with the speed in GBTC between late June and early October. The fund then began to fluctuate a bit extra. It lagged GBTC’s low cost transfer in October after which over-corrected in November. Since then, it has completely diverged from GBTC and presents fairly a little bit of potential upside if the value of BTC stays the identical.

Fund AUM Price BTC per Share OBTC $109m 0.49% 0.000329 GBTC $28.6b 1.5% 0.000894 Click on to enlarge

Supply: Grayscales, Osprey

Whereas OBTC’s payment is definitely nonetheless far lower than Grayscale’s GBTC payment, Osprey has not but filed to transform the fund to a spot ETF, regardless of Osprey CEO and founder Greg King stating it as a purpose in a late 2022 weblog submit. It seems that as an alternative of going the ETF route within the quick time period, seemingly in an effort to alleviate the NAV hole for OBTC traders, Osprey just lately disclosed a young provide to purchase as much as 20% of the fund’s excellent shares on the NAV.

The provide is sweet till February ninth, however Osprey indicated within the submitting that this could possibly be prolonged. Given the timing of the tender provide being on the identical day because the launch of the spot ETFs, the market response seems to be considerably detached to this announcement. However I view this as a attainable alternative for arbitrage merchants who’re in search of one other Bitcoin horse to journey now that the GBTC arb is successfully over. Even within the occasion that Osprey would not file to transform to an ETF, OBTC’s payment is pretty aggressive with the post-waiver charges of most of those funds, and positively nonetheless cheaper than GBTC.

Dangers

The main threat right here is that the value of the underlying asset continues to go down. Arb trades are dangerous, may end up in losses even when the low cost window closes. For instance, if an investor purchases OBTC at a ten% low cost and the speed closed to 0% whereas Bitcoin declined in worth by 15%, OBTC shareholders can be proper on the arb however mistaken on the return. The early indications from the rapid classes following ETF approvals has been that it is a “promote the information occasion:”

BTC Day by day Chart (TradingView)

After briefly touching $49k on January eleventh, Bitcoin has gone down 12% just about in a straight line to a bit over $43k. Technically talking, I really feel this has been a much-needed pullback after what was a relentless 3-month rally for BTC. One other threat to think about is that the tender provide is probably not sufficient to maneuver the needle on the NAV low cost. In that occasion, the fund’s low cost fee might proceed to wrestle in opposition to the spot ETFs from an investor curiosity standpoint and even probably transfer decrease.

Abstract

I would not go too heavy on this one as a result of it is a smaller fund that does not have a lot visibility in comparison with the a lot bigger companies that now provide competing merchandise. That stated, if you happen to like arbitrage trades and do not significantly care to have Ethereum (ETH-USD) publicity, OBTC could also be a fund to check out.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.