StrideUp has lowered its charges on all five-year mounted merchandise by 80 foundation factors.

The specialist lender is concentrated on debtors not served by the excessive road, together with overseas nationals, consumers reliant on monetary assist from household, the self-employed and contractors.

Charges now begin at 6.09% for these with a 40% deposit.

StrideUp considers debtors who don’t but have the everlasting proper to reside within the UK as long as they’ve a 12 months left on their visa.

The lender makes use of the latest 12 months’s revenue for self-employed clients, serving to to maximise affordability.

StrideUp merchandise are structured as sharia-compliant house buy plans, that are appropriate for folks of Muslim religion because of the absence of curiosity funds.

Intermediaries who’ve FCA house buy plan (HPP) permissions can advise and submit enterprise on to StrideUp, nevertheless for these intermediaries who are usually not HPP authorised, the client might be referred to StrideUp who will present the recommendation to the client.

Procuration charges are paid on all accomplished circumstances whether or not the middleman offers the recommendation or refers the client on.

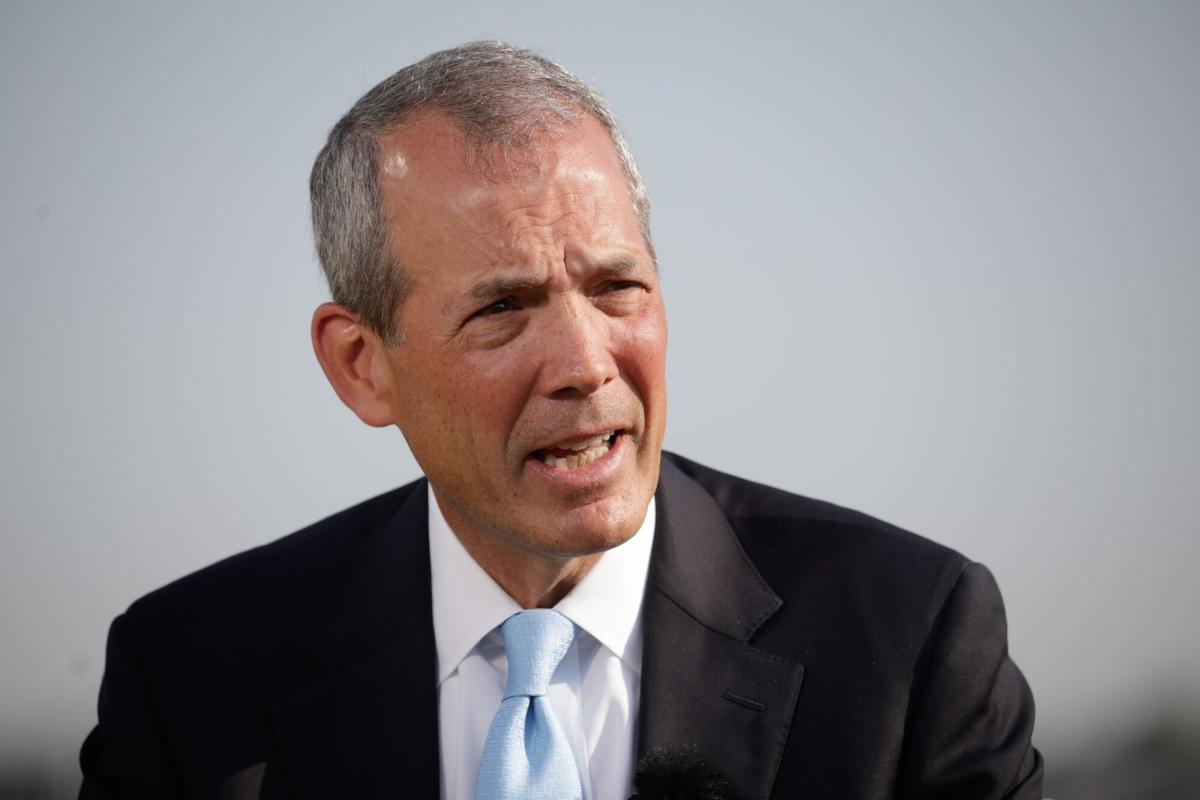

Chief government Sakeeb Zaman says: “At StrideUp, our mission is to assist extra folks obtain their monetary and homeownership aspirations, and we’re continuously evaluating the best steps to additional this mission.

“These pricing and standards modifications will make our proposition extra accessible to a good higher variety of folks and assist extra brokers present a greater diversity of choices for individuals who are underserved by the normal lenders.”