Yijing Liu

Quick-term catalyst forward

Tencent Holdings (OTCPK:TCEHY), the world’s main recreation writer, is strategically positioning its esports division in anticipation of the Hangzhou Asian Video games scheduled for September 23 to October 8, 2023. Asian Video games, also called Asiad, is a continental multi-sport occasion held each fourth yr amongst athletes from throughout Asia.

This occasion represents a pivotal second for esports, with Tencent’s flagship cell video games, Honor of Kings and Recreation for Peace, prominently featured among the many seven official occasions. The opposite 5 occasions are League of Legends (developed by Riot Video games, owned by Tencent), FIFA 4 (owned by EA), Road Fighter (OTCPK:CCOEY), Dota 2 (owned by Valve), Dream Three Kingdoms. The importance lies within the potential to reshape public notion of cell video games and esports in China, elevating it to a mainstream type of leisure.

Tencent’s Honor of Kings, boasting 150 million Month-to-month Energetic Customers (MAU), and Recreation for Peace, rating third with 85 million MAU, are poised for elevated world publicity. This visibility surge might result in heightened person engagement and expanded income streams from in-game purchases and promoting. “The Asian Video games will make esports extra accessible, opening up new alternatives,” mentioned Hou Miao, who heads Tencent’s esports division. Foreseeable great amount of gaming content material will probably be proven or unfold throughout the web throughout the time. Tencent will probably be benefited from three facets:

Esports Development: Esports is a quickly rising {industry}, and Tencent has a robust presence in it via titles like “Honor of Kings,” “League of Legends,” and others. The Hangzhou Asian Video games might additional validate esports as a mainstream type of leisure, attracting extra gamers and sponsors to the {industry}, which may gain advantage Tencent. Quick-Time period Hype: Occasions just like the Hangzhou Asian Video games can generate short-term hype and pleasure across the firms concerned. This might result in elevated buying and selling quantity and short-term worth fluctuations in Tencent’s inventory. Lengthy-Time period Influence: Whereas occasions just like the Asian Video games can have short-term results, their long-term impression on an organization’s inventory worth is usually tied to how effectively the corporate capitalizes on the alternatives they provide. Tencent would wish to maintain and monetize the elevated curiosity in its video games and esports actions past the occasion to have a long-lasting impact on its inventory.

Lengthy-term prospect stays vivid

Tencent’s bold mission, Penguin Island (web metropolis), stands as certainly one of Shenzhen’s largest building ventures. Scheduled for completion in 2026, this mission has an estimated complete value of roughly $5 billion, which is equal to the price of Apple Park. It signifies Tencent’s forward-looking strategy. This transfer aligns with {industry} giants like Amazon (AMZN), Meta, Google, and Apple, which have traditionally expanded their workplace areas forward of headcount and income progress surges. Tencent’s geographic scaling technique is a pivotal qualitative facet to contemplate when analyzing its long-term prospects.

Moreover, this mission serves as a testomony to the Shenzhen authorities’s dedication, as they plan to assemble tunnels, bridges, and metro traces for handy entry to the island. This underscores the federal government’s recognition of the essential function performed by tech corporations in creating high-paying jobs and their proactive assist in constructing the mandatory infrastructure.

Addressing previous issues about authorities laws doubtlessly hindering the gaming {industry}’s progress, the assist for Tencent means that the regulatory limits could also be close to. Authorities backing is predicted to proceed, making certain a positive coverage setting for Tencent’s operations.

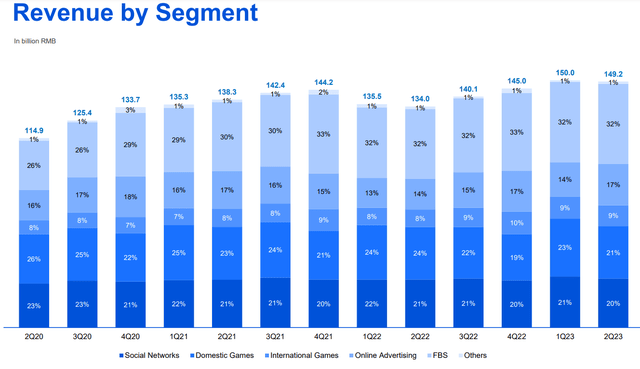

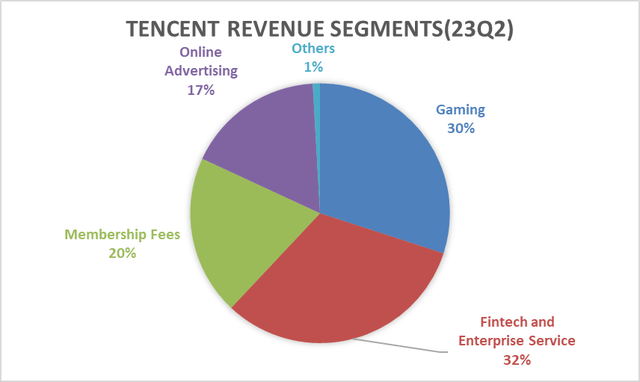

Diversification characterizes Tencent’s income construction, with gaming, fintech, enterprise providers (cloud), and promoting every contributing roughly one-third to its complete income. This balanced portfolio diminishes reliance on a single income supply, enhancing resilience towards financial fluctuations and industry-specific challenges.

Basic drivers are displaying strong progress. Elevated complete gaming time, enhanced promoting algorithms, and regular progress in fintech operations are noteworthy. In the latest quarter, promoting income surged by 34% YoY, whereas fintech and enterprise providers grew by 15% YoY. This resulted in a stable 11% YoY progress for the complete group, regardless of the gaming phase’s extra modest 5% YoY progress.

Determine 1: Tencent’s Income by Phase, as compared with Meta

Tencent’s investor presentation Tencent’s investor presentation Meta’s monetary disclosures

Supply: Tencent and Meta’s monetary disclosures

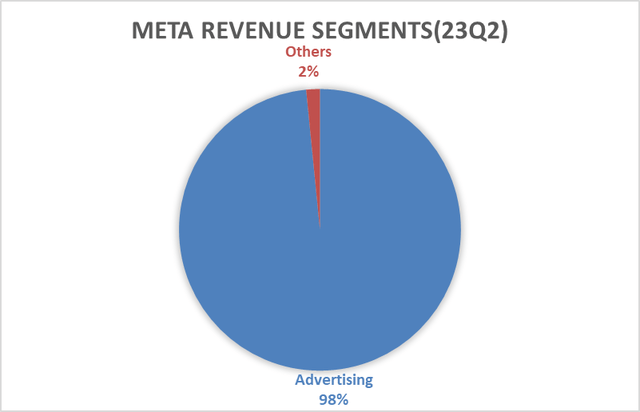

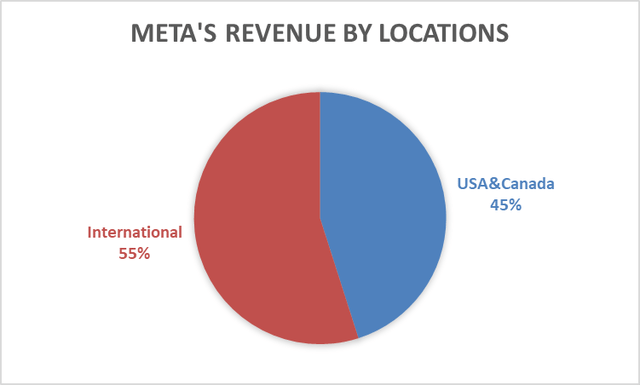

Taking a web page from Meta’s profitable progress drivers, which primarily revolved round algorithmic enchancment, advert density improve, and world growth. Tencent at the moment maintains a comparatively low advert density on its WeChat platform. Actually, private observations point out that Tencent’s advert load on WeChat is roughly half to one-third of what is usually discovered on Fb and Instagram. This implies important untapped potential for rising advert density. Moreover, Tencent’s worldwide presence is at the moment restricted. Because it seems forward, there’s ample room for Tencent to discover and increase its footprint abroad. As of right now, worldwide video games account for one-third of the whole video games income, and this proportion is on the rise.

Determine 2: Tencent’s income by geographic places, as compared with Meta

Tencent’s monetary disclosures Meta’s monetary disclosures

Supply: Tencent and Meta’s monetary disclosures

Determine 3: Tencent’s $5 Billion Funding in New Headquarters – Penguin Island (web metropolis) in Shenzhen

Baidu map

Not Absolutely Valued as of Now

Tencent boasts a sturdy monetary place, that includes substantial free money movement of $11 billion within the first half of 2023, equal to three% of its complete market capitalization. Moreover, Tencent has roughly $100 billion in investments, with 55% allotted to public firms.

From a valuation perspective, Tencent trades at a P/E of 13 and a PEG of 0.38, markedly decrease than comparable friends like Google (GOOG), Meta (META), and MercadoLibre (MELI), and Digital Arts. Moreover, its Free Money Move (FCF) yield stands at 6.6%, considerably larger than Google and Meta.

Determine 5: Tencent’s Comparable Valuation

Market Cap($b)

P/E

23Q2 Income Development

23Q2 Incomes’s progress

P/E/G

Tencent

399

13

11%

34%

0.38

1720

29

7%

15%

1.93

Meta

770

35

11%

16%

2.19

Mercado Libre

72

96

31.5%

113%

0.85

Digital Arts

33

37.4

9%

29%

1.3

Click on to enlarge

Share worth

FCF per share

(TTM)

FCF yield

Tencent

$40.29

$2.66

6.6%

$136.38

$5.40

4%

Meta

$297.8

$9.18

3.1%

Mercado Libre

$1428

$25.38

1.8%

Click on to enlarge

Supply: firm financials and GuruFocus

Dangers

A possible danger arises from international fairness holders, with PROSUS N.V. being the biggest shareholder at 25.42%. PROSUS N.V. has signaled its intention to steadily cut back its possession by 2% to three% yearly, concentrating on an possession degree of 24% to 25% by the conclusion of 2023. It introduces two unfavourable facets:

Promoting strain: This impression might trigger promoting strain, because it might put downward strain on Tencent’s inventory worth if there is not ample demand from different traders to soak up the shares being bought. Tencent mitigated this by repurchasing shares, accounting to Tencent’s fillings, Tencent bought 81.5 million shares or 0.9% of complete shares excellent year-to-date in 2023. In Might of this yr, Tencent commenced its share repurchase plan that might buy as much as 10% of complete shares. Contemplating Tencent’s Free Money Move (FCF) yield of 6.6%, it’s probably that Tencent can handle this 2%-3% possession sell-off by itself. Market Notion: Traders and the market could interpret PROSUS N.V.’s determination to cut back its possession stake as a insecurity in Tencent’s future prospects. Nonetheless, this can be influenced by elements equivalent to Tencent’s sustained progress and efficiency, doubtlessly mitigating the notion of decreased confidence.

A gradual discount in possession might result in a extra diversified shareholder base and fewer dependence on a single main shareholder in the long run. Tencent holds a $100 billion funding portfolio, so the results of PROSUS N.V.’s actions might be offset by different elements, together with the potential sale of partial investments to purchase again shares. Traders and analysts might monitor developments and assess the implications for Tencent’s future efficiency and technique.

Determine 6: PROSUS N.V. possession in Tencent

Quantity Offered (mm) Promoting Value (in HKD) Quantity Left (mm) Possession Proportion 8/24/2023 58.4 345 2429 25.42% 4/25/2023 87.6 292 2488 25.99% 1/3/2023 13.4 292 2575 26.93% 12/13/2022 103.3 292 2589 26.99% 09/08/2022 76.8 292 2692 27.99% 4/08/2022 191.9 595 2769 28.86% Click on to enlarge

In conclusion, Tencent’s strategic positioning for the Hangzhou Asian Video games (ASIAD), its bold infrastructure mission, diversified income streams, engaging valuation, and investor sentiment dynamics collectively underscore its promising outlook in each the quick and long run.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.