Elena Bionysheva-Abramova

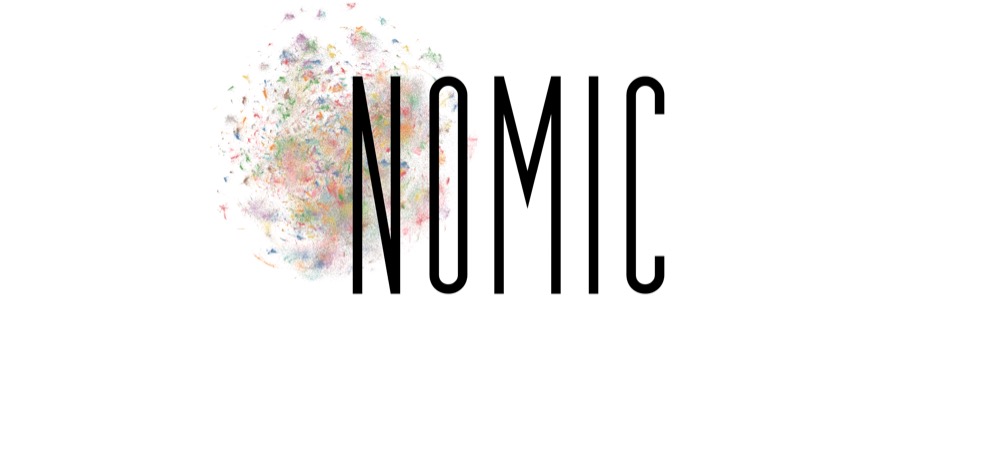

There may be lots of fanfare happening on the earth of shares proper now. Contemplate that the S&P 500 (SP500) is only a handful of proportion factors from a brand new all-time excessive, and up to date financial developments in Japan relating to the BoJ’s financial coverage have helped the Nikkei climb. Europe, in the meantime, has seen resilient worth motion amid a rising euro forex. Not a lot consideration is being paid to sturdy strikes in Latin American shares. The iShares Latin America 40 ETF (ILF) lately notched recent 5-year highs on a complete return foundation. One key cyclical firm gives buyers publicity to probably enhancing industrial exercise in that area.

I’m reiterating my purchase score on shares of Ternium S.A. (NYSE:TX). I proceed to seek out it engaging on valuation whereas its momentum has lately taken a tick larger. The inventory stories after the shut in the present day, August 1, and there are a number of key dangers to concentrate on.

Latin America Shares Climbing To Contemporary Multi-12 months Highs (Complete Return)

StockCharts.com

In keeping with Financial institution of America International Analysis, TX is the main flat metal producer in Latin America, with a crude metal capability of 12.4M tons. Its services are positioned in Mexico, Argentina, Brazil, Colombia, and the U.S. The corporate is managed by Techint Group, which immediately owns 63% of the overall capital, and the market free float is eighteen%. Ternium sells most of its merchandise in home markets, and the vast majority of shipments are flat metal merchandise.

The Luxembourg-based $8.8 billion market cap Metal business firm inside the Supplies sector trades at a low 6.4 trailing 12-month GAAP price-to-earnings ratio and pays a excessive 8.1% ahead dividend yield (I anticipate this yield to fall, which I’ll clarify later). Shares are anticipated to maneuver 5.6% after Q2 outcomes hit the tape tonight, August 1st, per the at-the-money straddle choices pricing, whereas the inventory’s quick curiosity is subsequent to nil at 0.8%.

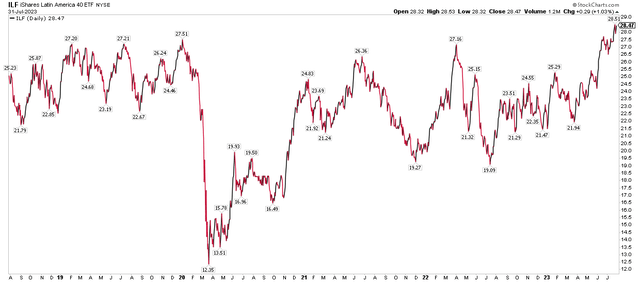

Again in April, TX reported a stable EPS beat. Per-share working earnings got here in at $1.91, handily topping estimates of simply $0.99. Income, nonetheless, missed analysts’ expectations. Gross sales have been down 16% year-on-year, nevertheless it was a tricky comp given sturdy metal costs towards the tail finish of the primary quarter of 2022, however a current dip in wholesale metal is a major danger. Maybe not surprisingly then, BofA downgraded the inventory amid smooth commodity costs two months in the past.

Looking forward to the Q2 report tonight, the consensus requires $2.02 of EPS on $4.15 billion in income (one other YoY decline). BofA truly expects an honest quarter to be reported, with EBITDA progress having been sturdy, in line with a be aware printed in early July. Quarterly earnings comps flip simpler later this yr. Sanguine information hit on June 20 when the agency mentioned it could begin building on a brand new metal plant in Mexico.

Metal Costs Dipping As soon as Once more

TradingView

On valuation, it’s key to acknowledge that the agency’s revenue cycle is very depending on the metal business in North America and amongst some South American nations. Given some enhancing tendencies, akin to rising U.S. building spending, TX’s earnings ought to profit. Furthermore, the corporate’s sturdy stability sheet permits its administration staff to be versatile and pounce on new alternatives to broaden capability.

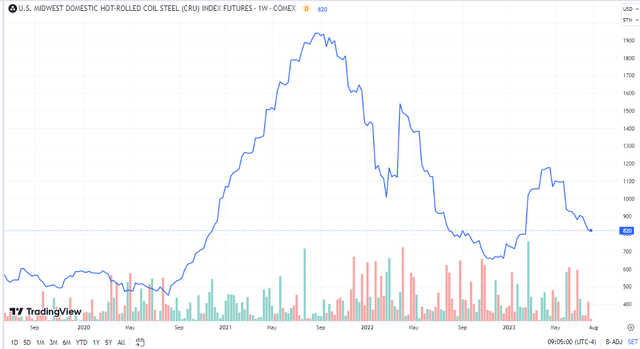

Earnings are anticipated to say no this yr following 2022’s sturdy yr for commodities, however per-share earnings are then anticipated to maintain close to $6 per share via the out yr. Dividends, in the meantime, are versatile with TX, so the distribution fee would possibly decline over the approaching quarters. However with a price-to-book ratio below 1 and P/Es deep into the one digits, shares stay compelling on valuation regardless of the worth rise since my preliminary report. A priority to me is its detrimental anticipated free money movement, regardless of sturdy profitability.

Ternium: EPS Seen Settling Close to $6 To $6.50

Looking for Alpha

If we assume a normalized EPS of $6.50 and apply the inventory’s 5-year common earnings a number of of seven.8, then shares ought to be within the low $50s. And that P/E could also be low given some troubles which have gone on within the industrial metals house over the previous few years in its important areas, however a danger is that if EPS falls below $6 by 2025. Furthermore, TX trades extraordinarily cheaply in comparison with Supplies’ sector median valuations.

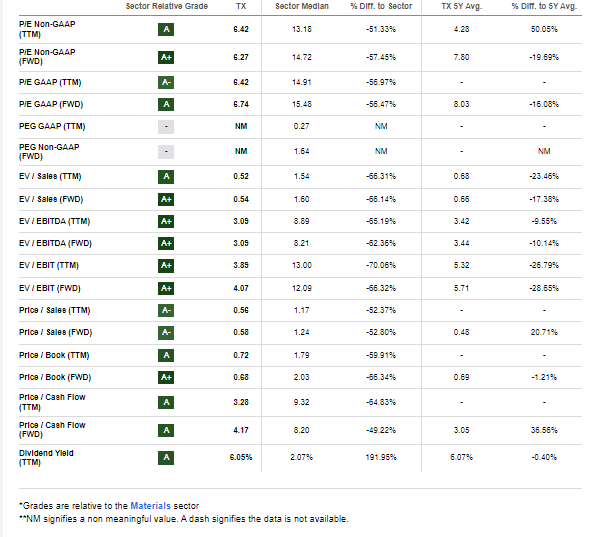

TX: Compelling Valuation Metrics

Looking for Alpha

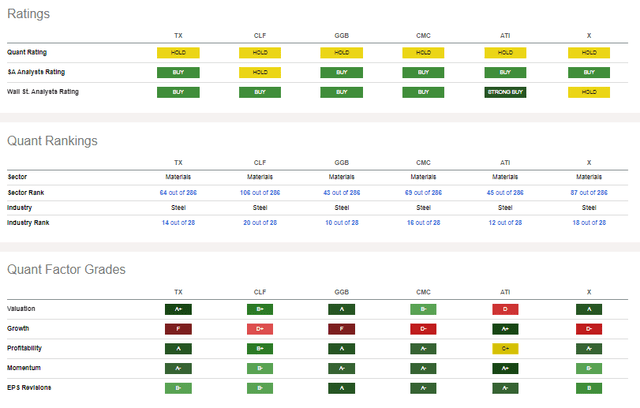

TX & Peer Comparability

Looking for Alpha

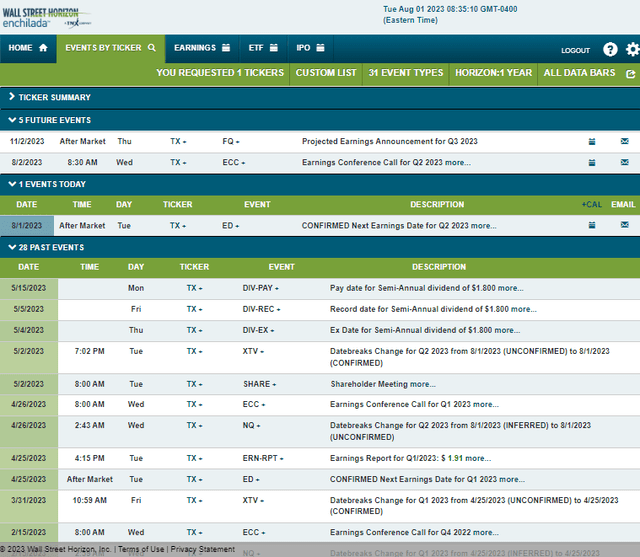

Trying forward, company occasion knowledge offered by Wall Road Horizon exhibits a confirmed Q2 2023 earnings date of Tuesday, August 1, after market shut with a convention name the next morning. You possibly can pay attention dwell right here. No different volatility catalysts are seen within the coming months.

Company Occasion Danger Calendar

Wall Road Horizon

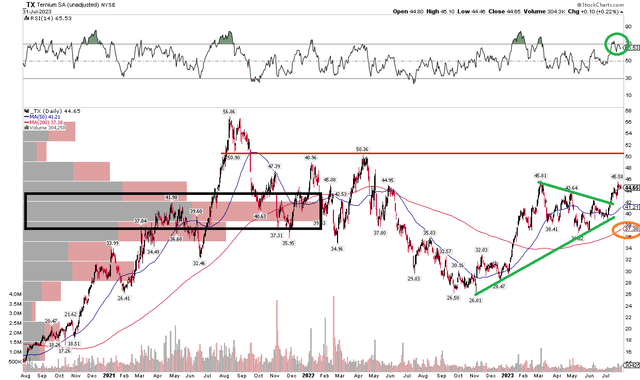

The Technical Take

Again in April, I famous {that a} bearish head and shoulders sample seemed to be negated care of a inventory worth rally via the low $40s. Whereas shares dipped at occasions over the following weeks, a broader rally has certainly taken form. As we speak, I spot additional upside potential. Discover within the chart beneath that TX broke out from a symmetrical triangle sample. I see resistance coming into play within the low $50s – about matching the place I see truthful worth.

The multi-year excessive of $57 could possibly be a goal if momentum runs sturdy. Talking of momentum, the RSI (14) indicator on the high of the graph has confirmed the upside thrust to the inventory worth. Additionally, the long-term 200-day shifting common is now positively sloped, which tells me that the bulls are in cost. On the draw back, assist ought to be seen within the $37 to $39 zone – the vary lows from February via late June.

General, the chart stays constructive for my part, and I wish to see a leap via the $46 near-term peak post-earnings.

TX: Bullish Breakout, Eyeing A Check Of The Low $50s

StockCharts.com

The Backside Line

I reiterate my purchase score on Ternium. The valuation is engaging whereas technical momentum is stable forward of earnings tonight.