Investing.com– U.S. inventory index futures moved little in night offers on Tuesday, steadying after a rally in Tesla and inspiring feedback from Federal Reserve Chair Jerome Powell spurred file highs on Wall Avenue.

Buying and selling volumes have been slim, with markets set for a shortened buying and selling day on Wednesday and the Independence Day vacation on Thursday.

fell 0.1% to five,564.50 factors, whereas edged decrease to twenty,248.50 factors by 19:13 ET (23:13 GMT). fell barely to 39,670.0 factors.

Fed minutes, nonfarm payrolls awaited

Markets have been now awaiting the of the Fed’s June assembly, that are due on Wednesday.

The central financial institution had stored charges regular in the course of the assembly, and had slashed its forecast for rate of interest cuts in 2024, citing issues over the sticky inflation.

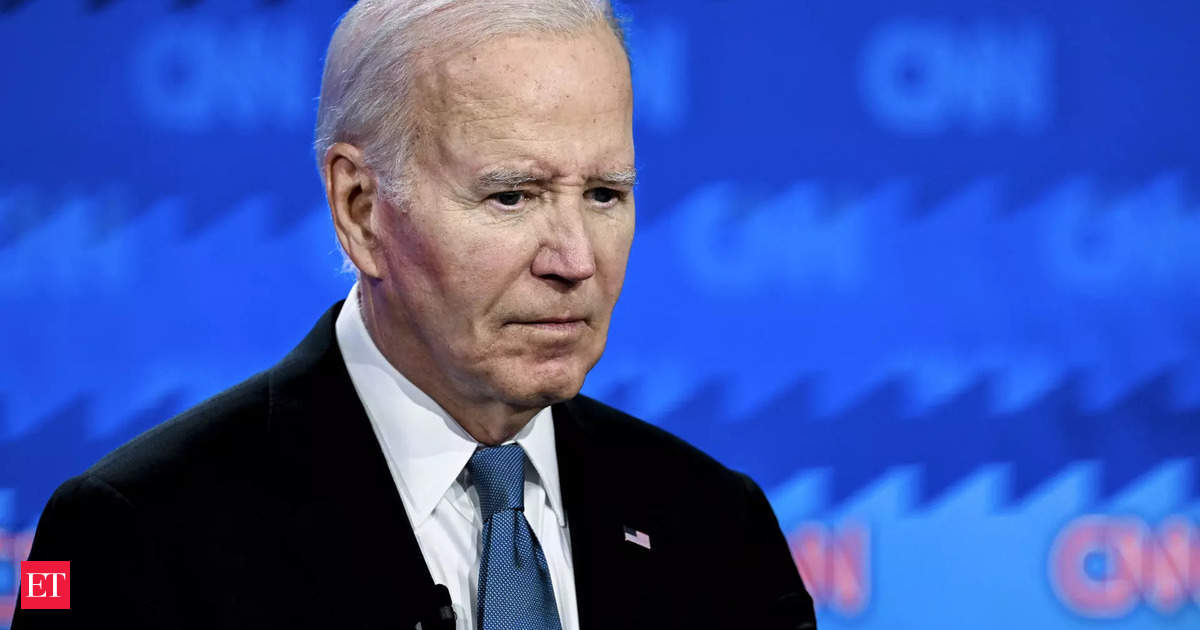

The minutes come only a day after Fed Chair Jerome Powell flagged some progress in bringing down inflation, though he warned that the Fed nonetheless wanted rather more confidence to start reducing rates of interest.

Different Fed officers are additionally set to talk, with talking afterward Wednesday.

Market focus this week can also be on a slew of key labor market readings- most significantly information on Friday. However earlier than that, information is due on Wednesday, whereas information launched on Tuesday learn hotter than anticipated.

Energy within the labor market is one other key consideration for the Fed in reducing rates of interest.

Wall St scales file highs on megacap rally, Powell feedback

Wall Avenue indexes surged to file highs on Tuesday, after Powell flagged some progress in cooling inflation, which noticed traders largely look previous the recent job openings information.

Positive factors have been pushed mainly by heavyweight development shares, with electrical automobile maker Tesla Inc (NASDAQ:) rallying over 10% after it clocked a smaller-than-expected decline in its quarterly deliveries.

Afterhours movers: Paramount surges, First Basis plummets

Amongst main aftermarket movers, Paramount World (NASDAQ:) jumped round 7% after a number of experiences mentioned that the agency’s controlling shareholder, Nationwide Amusements, had entered a preliminary merger cope with Skydance Media.

First Basis Inc (NYSE:) slid over 20% after the agency obtained a $228 million fairness funding from associates of Fortress Funding Group, Canyon Companions, Strategic Worth Financial institution Companions, North Reef Capital and others, who will purchase closely discounted shares within the agency. The Wall Avenue Journal additionally reported that the financial institution had heavy publicity to industrial actual property.