CVaR is a metric present in some buying and selling platforms, notably the Tastytrade platform.

It stands for “Conditional Worth at Threat”.

The “a” for the preposition “at” is lowercase.

Contents

It’s a threat evaluation metric that helps merchants perceive the chance of maximum losses past a sure confidence stage.

A typical confidence stage could be the 95% or the 99% confidence stage.

For the reason that Tastytrade platform makes use of a confidence stage of 95% for its CVaR calculation [reference], we’ll use that in our instance.

A 95% confidence stage signifies that issues will end up okay (or at the very least survivable) 95% of the time.

Meaning the remaining 5% of the time is taken into account our “worst-case situations.”

This 5% is our “tail threat.”

When these worst-case situations do happen: Discover that I say “when” they happen.

I didn’t say “if” they happen.

Once you commerce lengthy sufficient, they’ll happen.

Statistically, they’ll happen as soon as out of twenty instances – that’s 5%.

So when these tail threat occasions happen, what would be the common loss incurred?

That’s CVaR – the common anticipated loss that may incur for occasions outdoors our confidence stage.

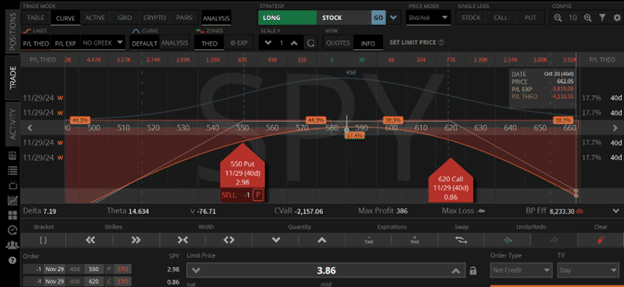

Beneath is a screenshot of strangle commerce on SPY within the Tastytrade platform with the CVaR metric proven.

Free Wheel Technique eBook

This strangle sells the 550 put and the 620 name at 40 days until expiration.

The credit score obtained is $386.

In order that might be our max revenue.

Our max loss is limitless as a result of strangles are undefined threat methods.

Because of this the max loss reveals the “infinity” image, indicating a theoretical potential for an infinite loss.

How can we outline our risk-to-reward ratio when there is no such thing as a quantity for our threat?

We can’t.

So, we use CVaR as a substitute.

Roughly talking, CVaR might be thought-about the common loss when the worst case occurs.

The instance screenshot reveals CVaR as -$2157.

The so-called “threat to reward ratio” of this strangle is then $2157 / $386 = 5.6.

It is very important keep in mind that that is solely an estimate on the 95% confidence stage.

This strangle can lose rather more than $2157.

In reality, nobody can inform you precisely how a lot this strangle can lose.

That’s the nature of undefined threat methods.

That’s not to say that strangles are a foul technique.

It’s Tom Sosnoff’s favourite technique.

How did I do know this?

He talked about that in a webinar with OptionsPlay.

Tom stated he had all the time been an choices vendor from the beginning.

About 75% of his trades are undefined threat trades, and 25% are outlined threat.

He takes about 100 trades every day, following the idea of buying and selling small and often.

Strangles are his bread-and-butter technique.

He likes to begin them at round 45 days until expiration and takes revenue at 25% of max revenue or exits at 21 days until expiration.

In his lengthy profession, Tom Sosnoff has performed many issues within the choices world.

It’s honest to say that he performed a significant position in growing the Tastytrade platform.

With strangles being his favourite technique, I’m not stunned that CVaR could be on the Tastytrade platform.

As a result of CVaR is the right metric to quantify the chance in a technique with undefined threat.

We hope you loved this text on the CVaR metric in choices buying and selling.

In case you have any questions, ship an e mail or go away a remark under.

Commerce secure!

Disclaimer: The data above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for buyers who are usually not conversant in alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.