Just_Super

By Blake Heimann

Because the launch of ChatGPT, mega-cap expertise corporations poised to revenue from AI-enhanced software program instruments or cloud AI-model coaching capabilities have seen a surge of their inventory costs. But, many have but to comprehend vital AI-driven income development, let alone a considerable impression on their backside traces. This has fashioned the idea for what Sequoia Capital calls AI’s $600B query—whether or not right now’s capital expenditures (CapEx) ranges can provide an estimated $600B in income generated from AI software program and providers to offer constructive return on funding (ROI), given the trade’s heavy funding in {hardware} infrastructure.

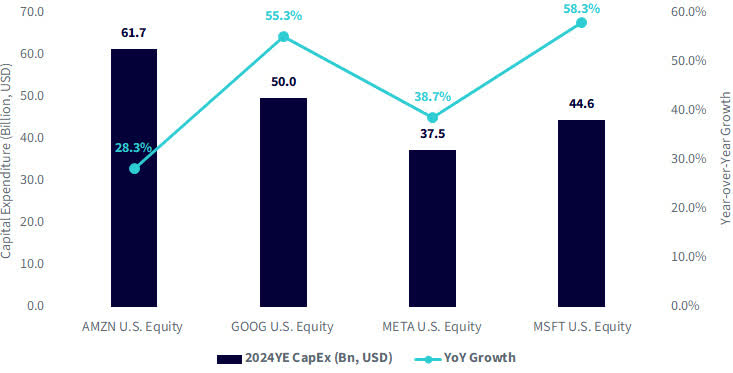

Determine 1: Mega-Cap Tech CapEx Estimates for Yr-Finish 2024

Supply: Koyfin, as of seven/29/24.

The apparent beneficiaries of this funding thus far have been Nvidia (NVDA) and its semiconductor friends, who’re experiencing exponential income development as a result of excessive demand for AI coaching chips. With vital capital expenditures being made to buy these chips and construct the subsequent wave of AI information facilities, a number of vital questions come up: Will finish customers and enterprises see sufficient worth to justify these prices? Will present investments in AI infrastructure ship constructive returns? And most significantly, are these corporations pretty valued?

On this weblog submit, we are going to deal with the query of valuation, inspecting whether or not the present inventory costs of those tech giants are justified given the modest impression of AI on their revenues thus far.

Valuation Traits and Market Sentiment

The narrative has at all times positioned AI as a software program revolution. Whereas semiconductors function important instruments, it’s the software program that would be the key differentiator as customers search probably the most superior, clever platforms. Consequently, mega-cap tech corporations have seen vital inventory value appreciation since ChatGPT’s launch, pushed by investor optimism about AI’s potential future earnings being concentrated amongst these outstanding gamers. Nevertheless, this enthusiasm has led to valuation a number of expansions, which many imagine might point out a bubble.

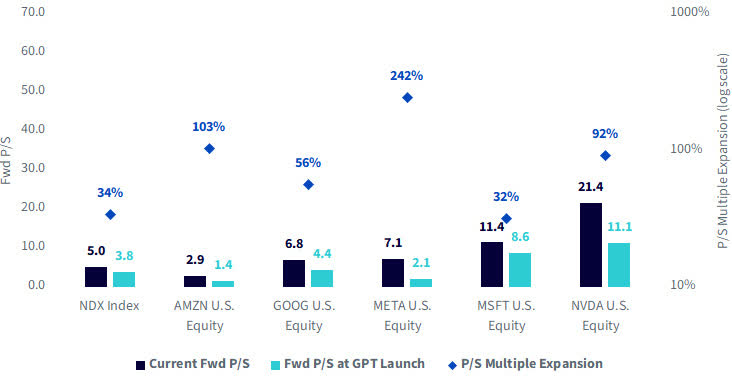

Inspecting the interval since ChatGPT’s launch, determine 2 reveals that the Nasdaq ahead price-to-sales (P/S) ratio expanded from 3.8 to five.0, a reasonable 34% improve. Nevertheless, Amazon (AMZN), Google (GOOG), Meta (META) and Nvidia all noticed expansions of greater than 50%, with some exceeding 100%. This might suggest that these shares are overvalued, or it’d point out that the market considers them pretty valued given the expectations of considerable future AI revenues and earnings potential past present ahead gross sales estimates.

Determine 2: Ahead Worth/Gross sales A number of Enlargement after Launch of ChatGPT

Supply: Bloomberg, 7/27/24. Interval begins when ChatGPT was launched on 11/30/22.

Extra not too long ago, Wall Road’s sentiment towards these corporations has shifted from constructive to damaging as traders query the potential ROI from massive capital expenditures and the timeline for realizing these returns. Current earnings experiences from main tech corporations revealed blended outcomes.

Amazon’s inventory declined on account of a cautious income outlook and disappointing gross sales, compounded by rising prices to develop Amazon Internet Companies. Microsoft (MSFT) reported slowing development in its Azure cloud-computing arm and plans to proceed substantial investments in information facilities. In distinction, Meta posted sturdy earnings, appeasing traders and shopping for time for its AI investments to bear fruit. In the meantime, Alphabet’s shares fell after the corporate shocked Wall Road with sharply greater prices, overshadowing its better-than-expected gross sales. The impression of a weaker-than-expected jobs report on the finish of the week additional exacerbated declines in these shares, prompting traders to reassess their positions amid a slowing economic system. Because of this, there have been vital a number of contractions as traders promote shares and reposition themselves. The valuation premium beforehand afforded to those shares has diminished as considerations develop that the AI hype might not meet expectations.

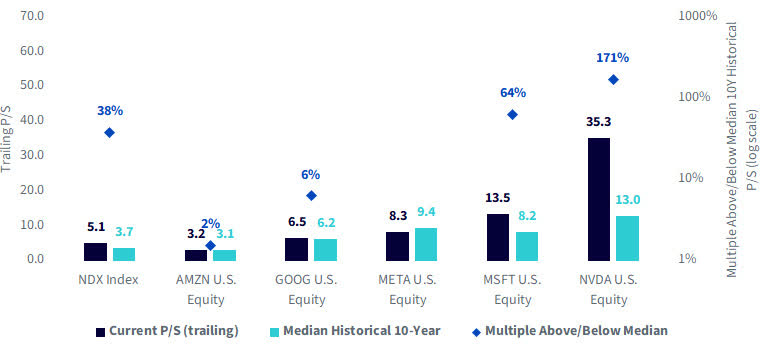

Inspecting present P/S ratios within the context of historic traits can present beneficial insights into whether or not valuations have change into stretched in comparison with the previous. Determine 3 sheds gentle on whether or not the current pullbacks in inventory costs are justified.

Determine 3: Present Worth/Gross sales vs. 10-Yr Historical past

Supply: Bloomberg, 7/24/24. Meta’s P/S A number of Above/Under Median 10-year historic P/S isn’t proven on account of axis limits, at a worth of -12%.

Nvidia and Microsoft stand out as notable outliers, with present P/S ratios considerably greater than their historic 10-year medians. This might counsel that the market expects truthful worth for very sturdy development forward, or it might point out overvaluation. By piecing collectively ahead and historic ratios, we see that Amazon, Google and Meta have recovered from comparatively low valuation ratios not too long ago. With vital a number of expansions post-GPT launch, they’ve returned to valuations which are in step with their historic numbers. Nevertheless, the story could also be completely different for Microsoft and Nvidia, as each have skilled vital a number of expansions past what’s seen within the broader Nasdaq Index, materially exceeding historic norms.

AI’s potential as a game-changer for mega-cap tech corporations would possibly justify greater valuations now and into the longer term. Traditionally, investing in these corporations 5 or extra years in the past would have been extremely worthwhile, no matter valuation. Nevertheless, the present valuations of some point out a major “valuation premium” in comparison with the previous, which possible explains why traders are actually extra cautious. This warning has contributed to current value pullbacks, even amid constructive earnings experiences.

Historic Views on Valuations

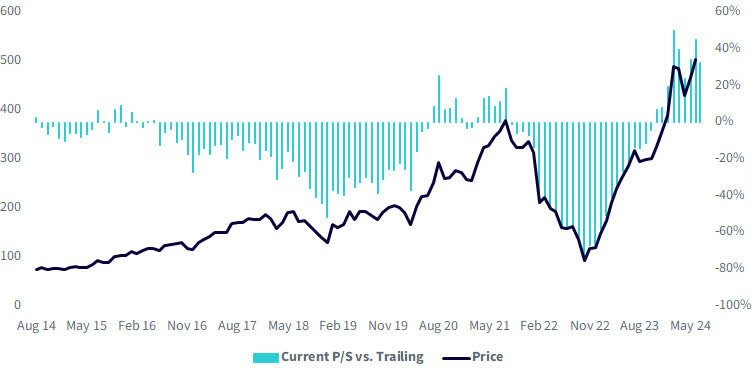

Investing in exponential applied sciences like AI can profit portfolios, however it’s important to handle focus threat and market timing. By being conscious of valuation traits, traders can strategically trim positions when overvalued and add when undervalued – following the basic “purchase low, promote excessive” adage. A ten-year chart of Meta illustrates how trimming positions throughout overvaluation durations and accumulating throughout undervaluation relative to historic norms might have been helpful.

Determine 4: Meta Worth and Worth/Gross sales Historical past (Present vs. Trailing Median)

Supply: Bloomberg, as of seven/24/24.

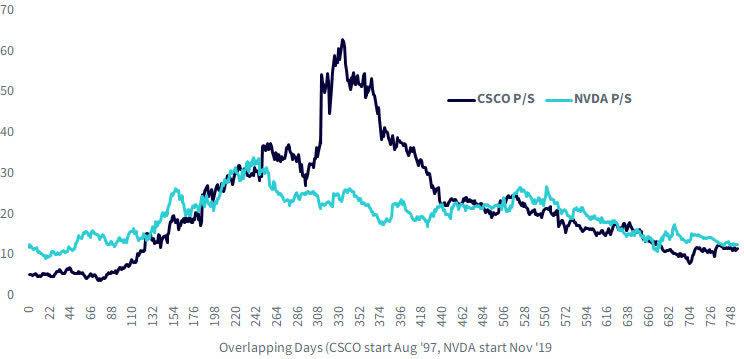

Reflecting on previous market bubbles, corresponding to Cisco (CSCO) through the dot-com period, can present beneficial context for remaining valuation-sensitive when investing in expertise equities. Cisco’s P/S ratio soared to 60 earlier than the inventory value collapsed by greater than 80% within the early 2000s. Comparatively, Nvidia’s present P/S of roughly 35 isn’t at dot-com bubble ranges, indicating a much less excessive valuation.

Determine 5: Nvidia vs. Cisco Worth/Gross sales

Sources: WisdomTree, Bloomberg, as of seven/24/24.

This historic perspective helps handle the query, “How far is simply too far?” when valuations appear stretched. Whereas mega-cap tech agency P/S ratios have expanded considerably for the reason that onset of the AI wave, they continue to be properly under the extremes seen through the dot-com bubble. This implies that though valuation multiples have elevated since ChatGPT’s launch, we aren’t witnessing a bubble akin to the early 2000s.

Conclusion

Whereas investing in AI and exponential applied sciences is thrilling, a valuation-aware strategy is essential. Fairly than avoiding these investments solely, traders ought to alter their publicity as valuations fluctuate, making certain they keep away from over-concentration at peak valuations and preserve a diversified portfolio.

At WisdomTree, we search to take this strategy in our WisdomTree Synthetic Intelligence and Innovation Fund (WTAI), which invests in your complete AI ecosystem and worth chain. With exposures in software program and semiconductors, in addition to different essential {hardware} key to the worth chain, the Fund stays diversified by taking a modified equal weighting strategy, with the pliability to rebalance allocations the place dislocations could also be by trimming positions that will have been “too far stretched” whereas including to these that could be “underappreciated,” giving traders the advantage of flexibility inside a extremely dynamic market atmosphere.

Vital Dangers Associated to this Article

There are dangers related to investing, together with the attainable lack of principal. The Fund invests in corporations primarily concerned within the funding theme of synthetic intelligence and innovation. Corporations engaged in AI usually face intense competitors and probably fast product obsolescence. These corporations are additionally closely depending on mental property rights and could also be adversely affected by loss or impairment of these rights. Moreover, AI corporations usually make investments vital quantities of spending on analysis and improvement, and there’s no assure that the services or products produced by these corporations will likely be profitable. Corporations which are capitalizing on innovation and growing applied sciences to displace older applied sciences or create new markets is probably not profitable. The Fund invests within the securities included in, or consultant of, its Index no matter their funding benefit, and the Fund doesn’t try and outperform its Index or take defensive positions in declining markets. The composition of the Index is ruled by an Index Committee, and the Index might not carry out as meant. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

Blake Heimann, Senior Affiliate, Quantitative Analysis

Blake Heimann is a Senior Affiliate on the Quantitative Analysis & Multi Asset Options workforce at WisdomTree, based mostly in Europe. He initially joined WisdomTree in 2020 as an Analyst on the Analysis workforce within the U.S. In his present position, he’s accountable for supporting the creation, upkeep, and reconstitution of fairness and digital asset indices.

Blake’s finance profession started in 2017 at TD Ameritrade, the place he began as an Analyst earlier than transitioning to a task as a Quantitative Analyst. Throughout this time, he centered on analysis and improvement of machine studying functions in finance. Blake holds bachelor’s levels in Arithmetic and Economics from Iowa State College, and he has accomplished his Grasp’s in Laptop Science with a specialization in Machine Studying at Georgia Tech.

Unique Put up